Why You Should Shop Around for Car Insurance Right Now

If you haven’t shopped for auto insurance recently, you might want to spend an hour or so checking out other deals. It pays to review your policy and check what’s out there.

A new survey from insuranceQuotes.com shows that 66 percent of policyholders never or only rarely check to see if they could get the same or better coverage at a better price. The average American driver has been with the same auto insurance company for 12 years, and some have stayed with the same insurer for two to three decades, or longer.

Related: 5 Ways to Lower Your Car Insurance—Right Now

Millennials age 18 to 29 and senior citizens number among those least likely to shop around for auto insurance. At least six in 10 millennials with auto insurance assume you have to wait until your renewal date to switch insurance companies. And they’re not alone: 46 percent of Americans do not know that you can switch your auto insurance company at any time.

One of the reasons auto insurance may not be a priority for consumers? Auto pay options, while convenient, could be keeping car insurance payments and rates out of sight—and out of mind. Human nature and procrastination is another. “People think that it’s a task that might be difficult and time-consuming,” says senior analyst Laura Adams, “but it could be as simple as going to a website like insurancequotes.com, putting your information in for a free quote, and getting multiple quotes back. There’s no financial risk in looking for a new rate.”

Just spending an hour once a year to compare quotes from three different companies could potentially save you hundreds or thousands of dollars.

Related: A Quick Way to Save Big on Your Insurance

Experts suggest checking your car insurance rates the same way you would remember to change the oil in your car or swap the air filters in your home. Here are some tips to get started:

- Ask your current insurer if there are any company discounts you might be eligible for but don’t know about, such as the good-student discount. For college and grad students who have a B-average or better (or their parents) that could result in a significant discount.

- If you find a better deal, tell your current insurance company that you’re thinking of switching unless they can match the new offer or exceed it.

- If your current insurer refuses to negotiate, sign up for the new policy first—and then cancel the old one. “You always want to make sure you’re covered,” says Evans. “Insurance companies do not like to see a gap in coverage, and your rates could rise.”

- To get a wider variety of quotes, get online quotes from insurance company websites, consult with an independent agent, and look into companies that don’t use independent agents as well.

“Being married can cause your rate to decrease,” says Evan. “Marriage, getting good grades--these are all things that you have to self-report, which is why I recommend revisiting auto insurance at least once a year, as your life situation could change.”

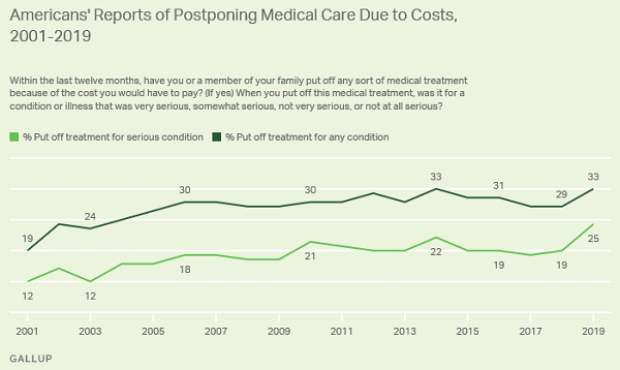

Increasing Number of Americans Delay Medical Care Due to Cost: Gallup

From Gallup: “A record 25% of Americans say they or a family member put off treatment for a serious medical condition in the past year because of the cost, up from 19% a year ago and the highest in Gallup's trend. Another 8% said they or a family member put off treatment for a less serious condition, bringing the total percentage of households delaying care due to costs to 33%, tying the high from 2014.”

Number of the Day: $213 Million

That’s how much the private debt collection program at the IRS collected in the 2019 fiscal year. In the black for the second year in a row, the program cleared nearly $148 million after commissions and administrative costs.

The controversial program, which empowers private firms to go after delinquent taxpayers, began in 2004 and ran for five years before the IRS ended it following a review. It was restarted in 2015 and ran at a loss for the next two years.

Senate Finance Chairman Chuck Grassley (R-IA), who played a central role in establishing the program, said Monday that the net proceeds are currently being used to hire 200 special compliance personnel at the IRS.

US Deficit Up 12% to $342 Billion for First Two Months of Fiscal 2020: CBO

The federal budget deficit for October and November was $342 billion, up $36 billion or 12% from the same period last year, the Congressional Budget Office estimated on Monday. Revenues were up 3% while outlays rose by 6%, CBO said.

Hospitals Sue to Protect Secret Prices

As expected, groups representing hospitals sued the Trump administration Wednesday to stop a new regulation would require them to make public the prices for services they negotiate with insurers. Claiming the rule “is unlawful, several times over,” the industry groups, which include the American Hospital Association, say the rule violates their First Amendment rights, among other issues.

"The burden of compliance with the rule is enormous, and way out of line with any projected benefits associated with the rule," the suit says. In response, a spokesperson for the Department of Health and Human Services said that hospitals “should be ashamed that they aren’t willing to provide American patients the cost of a service before they purchase it.”

See the lawsuit here, or read more at The New York Times.

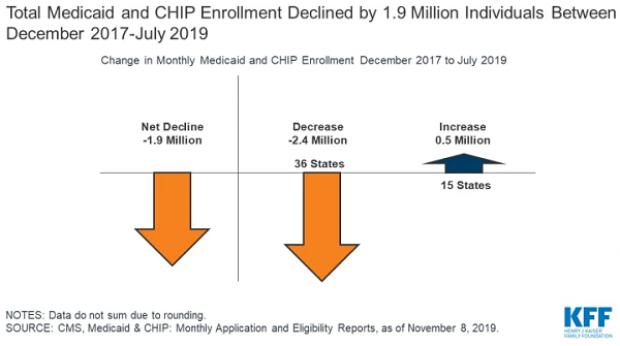

A Decline in Medicaid and CHIP Enrollment

Between December 2017 and July 2019, enrollment in Medicaid and the Children's Health Insurance Program (CHIP) fell by 1.9 million, or 2.6%. The Kaiser Family Foundation provided an analysis of that drop Monday, saying that while some of it was likely caused by enrollees finding jobs that offer private insurance, a significant portion is related to enrollees losing health insurance of any kind. “Experiences in some states suggest that some eligible people may be losing coverage due to barriers maintaining coverage associated with renewal processes and periodic eligibility checks,” Kaiser said.