Republican presidential candidate Jeb Bush released 33 years of tax records on Tuesday showing that his net worth of between $19 million and $22 million has been amassed largely through investments and speaking fees that have been as high as $75,000 per engagement.

In a show of transparency expected to pressure his rivals to bare their tax records, Bush revealed that since the end of his tenure as Florida governor in 2007, his annual income has risen sharply to nearly $7.4 million in 2013 from $260,580 in 2006.

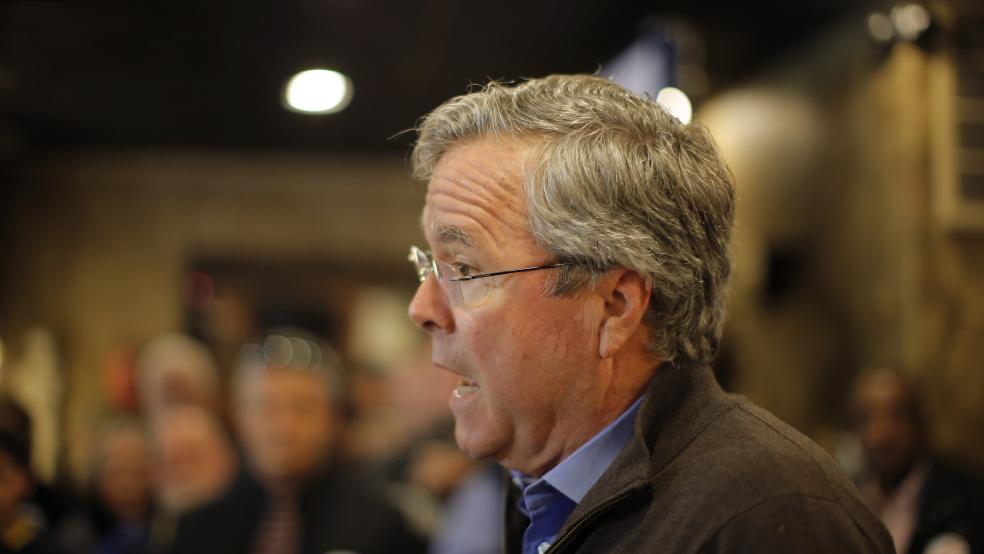

Talking to a handful of reporters in Washington about the 1,150 pages of returns made public, Bush, 62, said his hope was to "give people a sense of who I am."

He said, "It's not a life that has been scripted to run for president. I’ve led a life with ups and downs," said Bush, who comes from a family of means and whose father George H.W. Bush and brother George W. Bush were elected president.

In his quest for the Republican nomination in a crowded field of 14 candidates, Bush has increasingly sought to contrast himself with rivals in his own party, and Hillary Clinton, the front runner for the Democratic nomination in the November 2016 election.

Clinton and her husband, Bill, the former president, earned more than $25 million for delivering 104 speeches since the beginning of 2014, her organization said in May.

"I made less than Chelsea Clinton," Bush said, referring to the reported $65,000 speaking fee of the Clintons' daughter, Chelsea.

The tax records released covered nearly his entire business career, including his long-time involvement in Miami real estate.

Using a common tax burden measure, Bush and his wife Columba paid an effective tax rate, based on their taxable income, in 2013 of 40.5 percent. Based on adjusted gross income, before itemized deductions, their effective tax rate was 40.3 percent.

While that rate is high, compared to some other wealthy politicians such as Mitt Romney, it is worth noting that Bush has written off substantial pre-tax business expenses from 2007 to 2013, reducing the income used in calculating effective tax rate.

"He's revealing in this that he's going to be transparent," said Rick Wilson, a Florida Republican strategist. "It's an invitation to the Clintons to open the books."

Speaking Fees

In each of 2011, 2012 and 2013, Bush has written off more than $1 million each in business expenses. Over the seven year period, he has deducted roughly 20 percent of his business income in expenses. Had those expenses all been considered part of his taxable income, his effective tax rates would be lower.

Bush's tax records show that speaking fees have been a major part of his income. He said his fees have ranged from $40,000 in the United States to up to $75,000 per speech abroad.

From 2007 through 2013, he grossed $24.6 million in fees and used that business to write off $6.7 million in expenses, including contributions of $2.4 million to his own pension and profit sharing funds.

Over those years, he became a successful investor and a savvy tax filer. He and his tax preparer were aggressive about capturing investment losses through the credit crisis and thereafter. For example, in 2009, the market bottom following the crisis, he claimed $97,079 in capital losses that have allowed him to reduce his taxes that year and subsequent years.

Bush’s investments in so-called passive activity, such as real estate and investment partnerships has grown substantially. In 2008, he declared $590 in income in real estate and partnerships; in 2013, he claimed $679,526 in real estate and partnership income.

Bush has earned most of his money since 2007 through Jeb Bush & Associates, a consulting firm, and by forming, with three partners, a company called Britton Hills, which has focused on a few growth-capital investments.

Bush made an average of $1.3 million per year over two years in working as a consultant for Lehman Brothers before the firm went bankrupt during the 2008 financial crisis. His brother was president at the time.

For the past several years, Bush has held shares in private funds founded – and in some cases managed – by relatives. As early as 2001, Bush was earning money from investments in the Winston Capital Fund, managed by his brother Marvin Bush.

More recently, beginning in 2007, Jeb Bush bought shares in several funds issued by a Texas-based real estate investment company co-founded by his son George P. Bush that is now known as Pennybacker Capital which buys office buildings, retail properties and apartments that are in disrepair and renovates them to increase their potential returns through higher rents.

George P. Bush left the company to become Texas Land Commissioner, a position to which he was elected in 2014.

(Additional reporting by Emily Flitter in New York and Alex Wilts in Washington and Howard Schneider; Editing by Kevin Drawbaugh, Doina Chiacu, Grant McCool.)