Five States Account for 31% of Underwater Mortgages

Here’s another sign that the housing market keeps getting healthier: More than 250,000 formerly underwater homes regained equity in the first quarter of 2015, according to CoreLogic, meaning that the value of the homes rose above the value of the mortgages on them.

Borrower equity grew more by $694 billion in the quarter, and more than 90 percent of mortgaged American homes now have equity. Such a surge in homeowner wealth has historically led to increased consumer spending and investment.

“Many homeowners are emerging from the negative equity trap, which bodes well for a continued recovery in the housing market,” Anand Nallathambi, president and CEO of CoreLogic said in a statement. “With the economy improving and homeowners building equity, albeit slowly, the potential exists for an increase in housing stock available for sale, which would ease the current imbalance in supply and demand.”

Related: 9 Real Estate Trends to Watch in 2015

Still, 5.1 million mortgaged homes remain underwater, representing 10.2 percent of all mortgaged properties. Five states — Nevada, Florida, Illinois, Arizona and Rhode Island — account for nearly a third of all properties with negative equity. As of the end of the fourth quarter, 10.8 percent of homes — or about 5.4 million properties — were underwater.

The number of underwater homes has decreased year-over-year by 1.2 million and the aggregate value of negative equity has fallen 13 percent to $337.4 billion.

Texas was the state with the fewest underwater properties; 98 percent of homeowners there with a mortgage have equity in their homes.

Just under 20 percent of homes with a mortgage are considered “under-equitied,” meaning that they have less than 20 percent equity and would likely have trouble refinancing their property or obtaining new financing to sell their home and buy another.

A 5 percent increase in home values nationwide would bring another million homeowners into positive equity territory, CoreLogic economists predict.

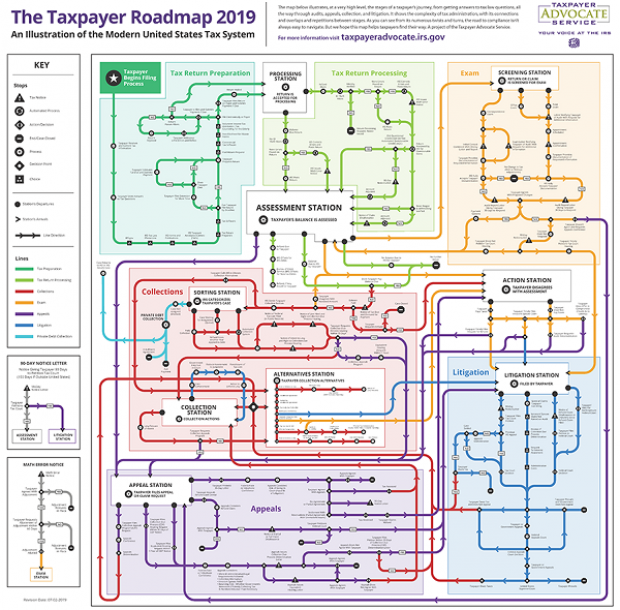

Map of the Day: Navigating the IRS

The Taxpayer Advocate Service – an independent organization within the IRS whose roughly 1,800 employees both assist taxpayers in resolving problems with the tax collection agency and recommend changes aimed at improving the system – released a “subway map” that shows the “the stages of a taxpayer’s journey.” The colorful diagram includes the steps a typical taxpayer takes to prepare and file their tax forms, as well as the many “stations” a tax return can pass through, including processing, audits, appeals and litigation. Not surprisingly, the map is quite complicated. Click here to review a larger version on the taxpayer advocate’s site.

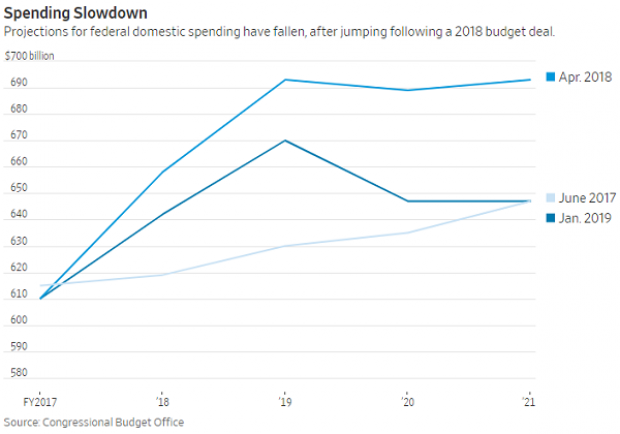

A Surprise Government Spending Slowdown

Economists expected federal spending to boost growth in 2019, but some of the fiscal stimulus provided by the 2018 budget deal has failed to show up this year, according to Kate Davidson of The Wall Street Journal.

Defense spending has come in as expected, but nondefense spending has lagged, and it’s unlikely to catch up to projections even if it accelerates in the coming months. Lower spending on disaster relief, the government shutdown earlier this year, and federal agencies spending less than they have been given by Congress all appear to be playing a role in the spending slowdown, Davidson said.

Number of the Day: $203,500

The Wall Street Journal’s Catherine Lucey reports that acting White House Chief of Staff Mick Mulvaney is making a bit more than his predecessors: “The latest annual report to Congress on White House personnel shows that President Trump’s third chief of staff is getting an annual salary of $203,500, compared with Reince Priebus and John Kelly, each of whom earned $179,700.” The difference is the result of Mulvaney still technically occupying the role of director of the White House Office of Management and Budget, where his salary level is set by law.

The White House told the Journal that if Mulvaney is made permanent chief of staff his salary would be adjusted to the current salary for an assistant to the president, $183,000.

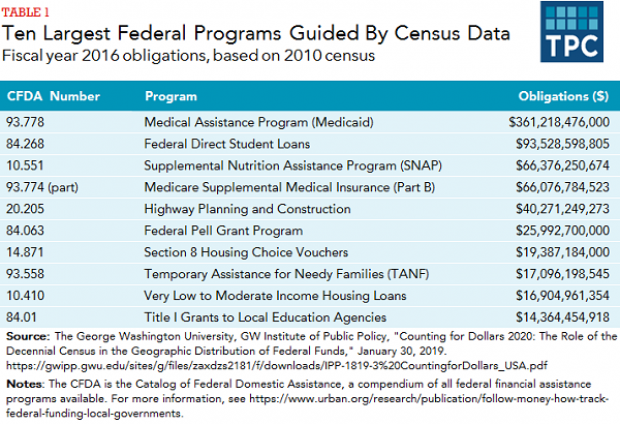

The Census Affects Nearly $1 Trillion in Spending

The 2020 census faces possible delay as the Supreme Court sorts out the legality of a controversial citizenship question added by the Trump administration. Tracy Gordon of the Tax Policy Center notes that in addition to the basic issue of political representation, the decennial population count affects roughly $900 billion in federal spending, ranging from Medicaid assistance funds to Section 8 housing vouchers. Here’s a look at the top 10 programs affected by the census:

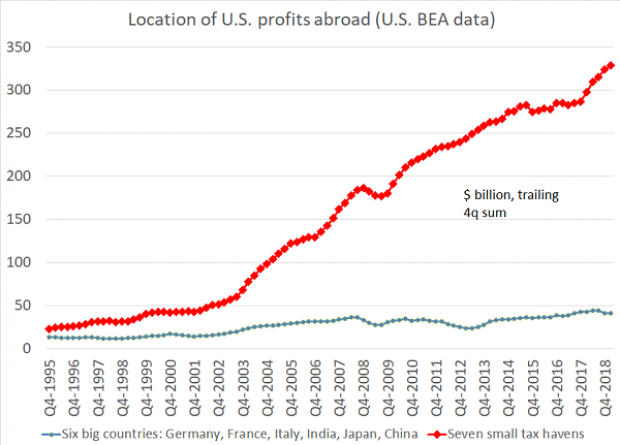

Chart of the Day: Offshore Profits Continue to Rise

Brad Setser, a former U.S. Treasury economist now with the Council on Foreign Relations, added another detail to his assessment of the foreign provisions of the Tax Cuts and Jobs Act: “A bit more evidence that Trump's tax reform didn't change incentives to offshore profits: the enormous profits that U.S. firms report in low tax jurisdictions continues to rise,” Setser wrote. “In fact, there was a bit of a jump up over the course of 2018.”