Five States Account for 31% of Underwater Mortgages

Here’s another sign that the housing market keeps getting healthier: More than 250,000 formerly underwater homes regained equity in the first quarter of 2015, according to CoreLogic, meaning that the value of the homes rose above the value of the mortgages on them.

Borrower equity grew more by $694 billion in the quarter, and more than 90 percent of mortgaged American homes now have equity. Such a surge in homeowner wealth has historically led to increased consumer spending and investment.

“Many homeowners are emerging from the negative equity trap, which bodes well for a continued recovery in the housing market,” Anand Nallathambi, president and CEO of CoreLogic said in a statement. “With the economy improving and homeowners building equity, albeit slowly, the potential exists for an increase in housing stock available for sale, which would ease the current imbalance in supply and demand.”

Related: 9 Real Estate Trends to Watch in 2015

Still, 5.1 million mortgaged homes remain underwater, representing 10.2 percent of all mortgaged properties. Five states — Nevada, Florida, Illinois, Arizona and Rhode Island — account for nearly a third of all properties with negative equity. As of the end of the fourth quarter, 10.8 percent of homes — or about 5.4 million properties — were underwater.

The number of underwater homes has decreased year-over-year by 1.2 million and the aggregate value of negative equity has fallen 13 percent to $337.4 billion.

Texas was the state with the fewest underwater properties; 98 percent of homeowners there with a mortgage have equity in their homes.

Just under 20 percent of homes with a mortgage are considered “under-equitied,” meaning that they have less than 20 percent equity and would likely have trouble refinancing their property or obtaining new financing to sell their home and buy another.

A 5 percent increase in home values nationwide would bring another million homeowners into positive equity territory, CoreLogic economists predict.

Deficit Hits $738.6 Billion in First 8 Months of Fiscal Year

The U.S. budget deficit grew to $738.6 billion in the first eight months of the current fiscal year – an increase of $206 billion, or 38.8%, over the deficit recorded during the same period a year earlier. Bloomberg’s Sarah McGregor notes that the big increase occurred despite a jump in tariff revenues, which have nearly doubled to $44.9 billion so far this fiscal year. But that increase, which contributed to an overall increase in revenues of 2.3%, was not enough to make up for the reduced revenues from the Republican tax cuts and a 9.3% increase in government spending.

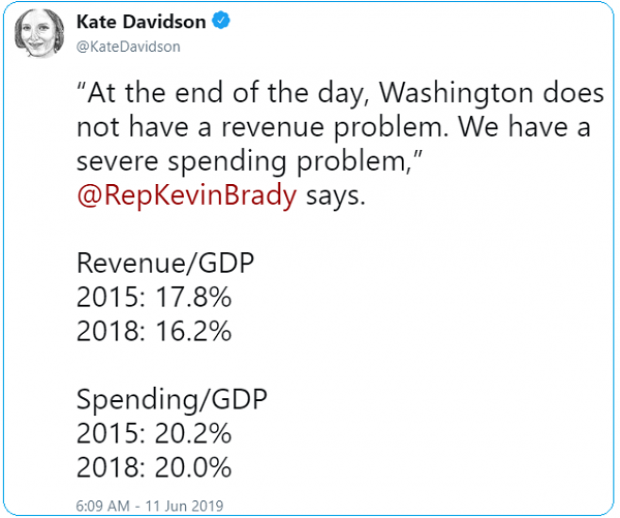

Tweet of the Day: Revenues or Spending?

Rep. Kevin Brady (R-TX), ranking member of the House Ways and Means Committee and one of the authors of the 2017 Republican tax overhaul, told The Washington Post’s Heather Long Tuesday that the budget deficit is driven by excess spending, not a shortfall in revenues in the wake of the tax cuts. The Wall Street Journal’s Kate Davidson provided some inconvenient facts for Brady’s claim in a tweet, pointing out that government revenues as a share of GDP have fallen significantly since 2015, while spending has remained more or less constant.

Chart of the Day: The Decline in IRS Audits

Reviewing the recent annual report on tax statistics from the IRS, Robert Weinberger of the Tax Policy Center says it “tells a story of shrinking staff, fewer audits, and less customer service.” The agency had 22% fewer personnel in 2018 than it did in 2010, and its enforcement budget has fallen by nearly $1 billion, Weinberger writes. One obvious effect of the budget cuts has been a sharp reduction in the number of audits the agency has performed annually, which you can see in the chart below.

Number of the Day: $102 Million

President Trump’s golf playing has cost taxpayers $102 million in extra travel and security expenses, according to an analysis by the left-leaning HuffPost news site.

“The $102 million total to date spent on Trump’s presidential golfing represents 255 times the annual presidential salary he volunteered not to take. It is more than three times the cost of special counsel Robert Mueller’s investigation that Trump continually complains about. It would fund for six years the Special Olympics program that Trump’s proposed budget had originally cut to save money,” HuffPost’s S.V. Date writes.

Date says the White House did not respond to HuffPost’s requests for comment.

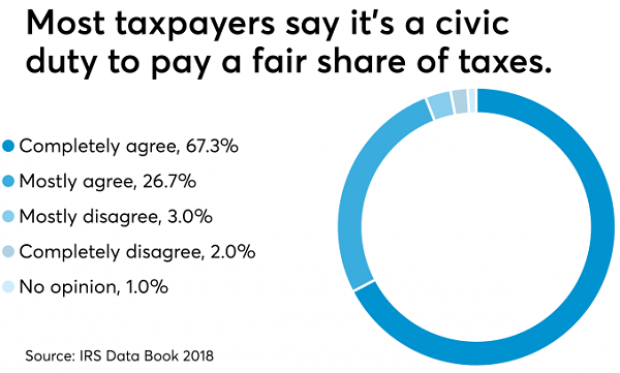

Americans See Tax-Paying as a Duty

The IRS may not be conducting audits like it used to, but according to the agency’s Data Book for 2018, most Americans still believe it’s not acceptable to cheat on your taxes. About 67% of respondents to an IRS opinion survey “completely agree” that it’s a civic duty to pay “a fair share of taxes,” and another 26% “mostly agree,” bringing the total in agreement to over 90%. Accounting Today says that attitude has been pretty consistent over the last decade.