The Lucrative Business of SAT Test Prep Is About to Get Disrupted

For years, critics of the SAT have claimed that wealthy students who can afford expensive, private test prep courses have a leg up on poorer students without access to such classes.

That just changed. Starting yesterday, all students can access free, high-quality online test prep via a new partnership between the College Board, which administers the test, and online course powerhouse Khan Academy, a nonprofit supported by the Bill and Melinda Gates Foundation and Ann and John Doerr among others. The online program will include quizzes, video lessons and personalized lessons.

The Official SAT Practice will focus on the recently redesigned SAT, with questions created by the tests’ authors.

Related: SAT Tests: Another Drain on the Family Budget

College test preparation is a $4.5 billion business. Private SAT tutors charge in excess of $100 per hour and classes from companies like Kaplan or Princeton Review run about $1,000. And those classes may help. Students from the wealthiest families have average test scores that are more than 300 points higher than students from the poorest families on average, according to the College Board.

In recent years, more colleges have moved away from the SAT and its competitor, the ACT, as a backlash against the tests have grown.

More than 850 schools have made the tests optional for admission, according to advocacy group FairTest, choosing instead to focus on class grades and other factors. A study released last year of undergrads at those schools found no difference in either the GPAs or the graduation rates of students who took the SATs versus those that skipped it.

GOP Tax Cuts Getting Less Popular, Poll Finds

Friday marked the six-month anniversary of President Trump’s signing the Republican tax overhaul into law, and public opinion of the law is moving in the wrong direction for the GOP. A Monmouth University survey conducted earlier this month found that 34 percent of the public approves of the tax reform passed by Republicans late last year, while 41 percent disapprove. Approval has fallen by 6 points since late April and disapproval has slipped 3 points. The percentage of people who aren’t sure how they feel about the plan has risen from 16 percent in April to 24 percent this month.

Other findings from the poll of 806 U.S. adults:

- 19 percent approve of the job Congress is doing; 67 percent disapprove

- 40 percent say the country is heading in the right direction, up from 33 percent in April

- Democrats hold a 7-point edge in a generic House ballot

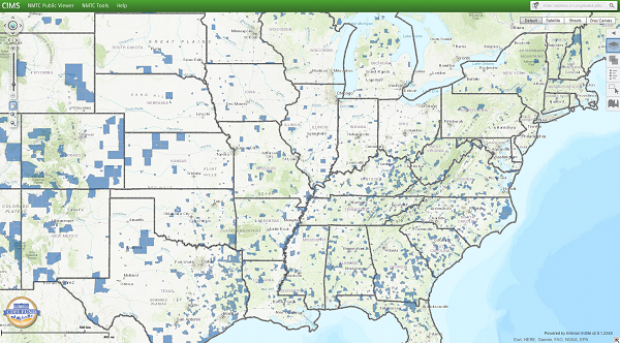

Special Tax Break Zones Defined for All 50 States

The U.S. Treasury has approved the final group of opportunity zones, which offer tax incentives for investments made in low-income areas. The zones were created by the tax law signed in December.

Bill Lucia of Route Fifty has some details: “Treasury says that nearly 35 million people live in the designated zones and that census tracts in the zones have an average poverty rate of about 32 percent based on figures from 2011 to 2015, compared to a rate of 17 percent for the average U.S. census tract.”

Click here to explore the dynamic map of the zones on the U.S. Treasury website.

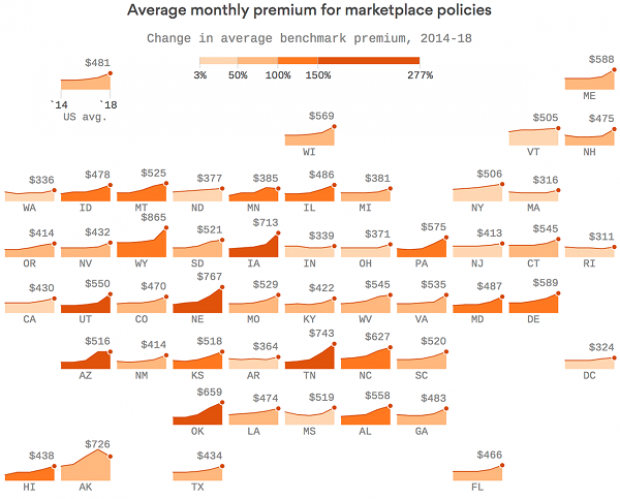

Map of the Day: Affordable Care Act Premiums Since 2014

Axios breaks down how monthly premiums on benchmark Affordable Care Act policies have risen state by state since 2014. The average increase: $481.

Obamacare Repeal Would Lead to 17.1 Million More Uninsured in 2019: Study

A new analysis by the Urban Institute finds that if the Affordable Care Act were eliminated entirely, the number of uninsured would rise by 17.1 million — or 50 percent — in 2019. The study also found that federal spending would be reduced by almost $147 billion next year if the ACA were fully repealed.

Your Tax Dollars at Work

Mick Mulvaney has been running the Consumer Financial Protection Bureau since last November, and by all accounts the South Carolina conservative is none too happy with the agency charged with protecting citizens from fraud in the financial industry. The Hill recently wrote up “five ways Mulvaney is cracking down on his own agency,” and they include dropping cases against payday lenders, dismissing three advisory boards and an effort to rebrand the operation as the Bureau of Consumer Financial Protection — a move critics say is intended to deemphasize the consumer part of the agency’s mission.

Mulvaney recently scored a small victory on the last point, changing the sign in the agency’s building to the new initials. “The Consumer Financial Protection Bureau does not exist,” Mulvaney told Congress in April, and now he’s proven the point, at least when it comes to the sign in his lobby (h/t to Vox and thanks to Alan Zibel of Public Citizen for the photo, via Twitter).