The Lucrative Business of SAT Test Prep Is About to Get Disrupted

For years, critics of the SAT have claimed that wealthy students who can afford expensive, private test prep courses have a leg up on poorer students without access to such classes.

That just changed. Starting yesterday, all students can access free, high-quality online test prep via a new partnership between the College Board, which administers the test, and online course powerhouse Khan Academy, a nonprofit supported by the Bill and Melinda Gates Foundation and Ann and John Doerr among others. The online program will include quizzes, video lessons and personalized lessons.

The Official SAT Practice will focus on the recently redesigned SAT, with questions created by the tests’ authors.

Related: SAT Tests: Another Drain on the Family Budget

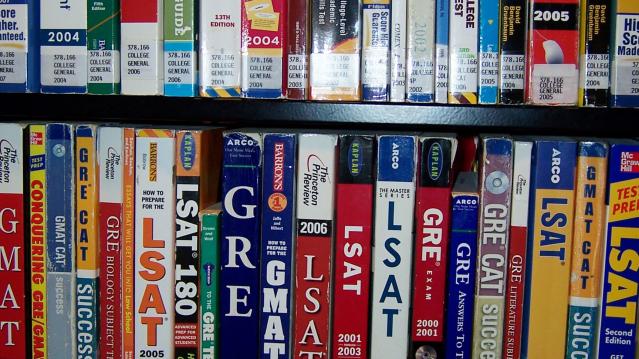

College test preparation is a $4.5 billion business. Private SAT tutors charge in excess of $100 per hour and classes from companies like Kaplan or Princeton Review run about $1,000. And those classes may help. Students from the wealthiest families have average test scores that are more than 300 points higher than students from the poorest families on average, according to the College Board.

In recent years, more colleges have moved away from the SAT and its competitor, the ACT, as a backlash against the tests have grown.

More than 850 schools have made the tests optional for admission, according to advocacy group FairTest, choosing instead to focus on class grades and other factors. A study released last year of undergrads at those schools found no difference in either the GPAs or the graduation rates of students who took the SATs versus those that skipped it.

Small Business Owners Say They’re Raising Worker Pay

A record percentage of small business owners say they are raising pay for their workers, according to the latest monthly jobs report from the National Federation of Independent Business, based on a survey of 10,000 of the group’s members. A seasonally adjusted net 35 percent of small businesses say they are increasing compensation. “They are increasing compensation at record levels and are continuing to hire,” NFIB President and CEO Juanita Duggan said in a statement accompanying the report. “Post tax reform, concerns about taxes and regulations are taking a backseat to their worries over filling open positions and finding qualified candidates.”

The US Is Running Short on More Than 200 Drugs

The U.S. is officially running short on 202 drugs, including some medical staples like epinephrine, morphine and saline solution. “The medications most vulnerable to running short have a few things in common: They are generic, high-volume, and low-margin for their makers—not the cutting-edge specialty drugs that pad pharmaceutical companies’ bottom lines,” Fortune’s Erika Fry reports. “Companies have little incentive to make the workhorse drugs we use most.” And much of the problem — “The situation is an emergency waiting to be a disaster,” one pharmacist says — can be tied to one company: Pfizer. Read the full story here.

Chart of the Day: Could You Handle a Sudden $400 Expense?

More Americans say they are living comfortably or at least “doing okay” financially, according to the Federal Reserve’s Report on the Economic Well-Being of U.S. Households in 2017. At the same time, four in 10 adults say that, if faced with an unexpected expense of $400, they would not be able to cover it or would cover it by selling something or borrowing money. That represents an improvement from 2013, when half of all adults said they would have trouble handling such an expense, but suggests that many Americans are still close to the edge when it comes to their personal finances.

Kevin Brady Introduces Welfare Reform Bill

The Tax Policy Center’s Daily Deduction reports that Rep. Kevin Brady (R-TX), chair of the House Ways and Means Committee on Friday introduced The Jobs and Opportunity with Benefits and Services (JOBS) for Success Act (H.R. 5861). “The bill would rename the Temporary Assistance for Needy Families (TANF) program and target benefits to the lowest-income households. Although the House GOP leadership promised to include an expansion of the Earned Income Tax Credit as part of an upcoming welfare reform bill, this measure does not appear to include any EITC provisions.” The committee will mark up the bill on Wednesday.