Most retirement advice focuses on how to save enough money for your later years and how to make the best use of your pension (if you’re lucky enough to have one). For many Americans, however, the most confusing part of retirement planning is their Social Security benefits.

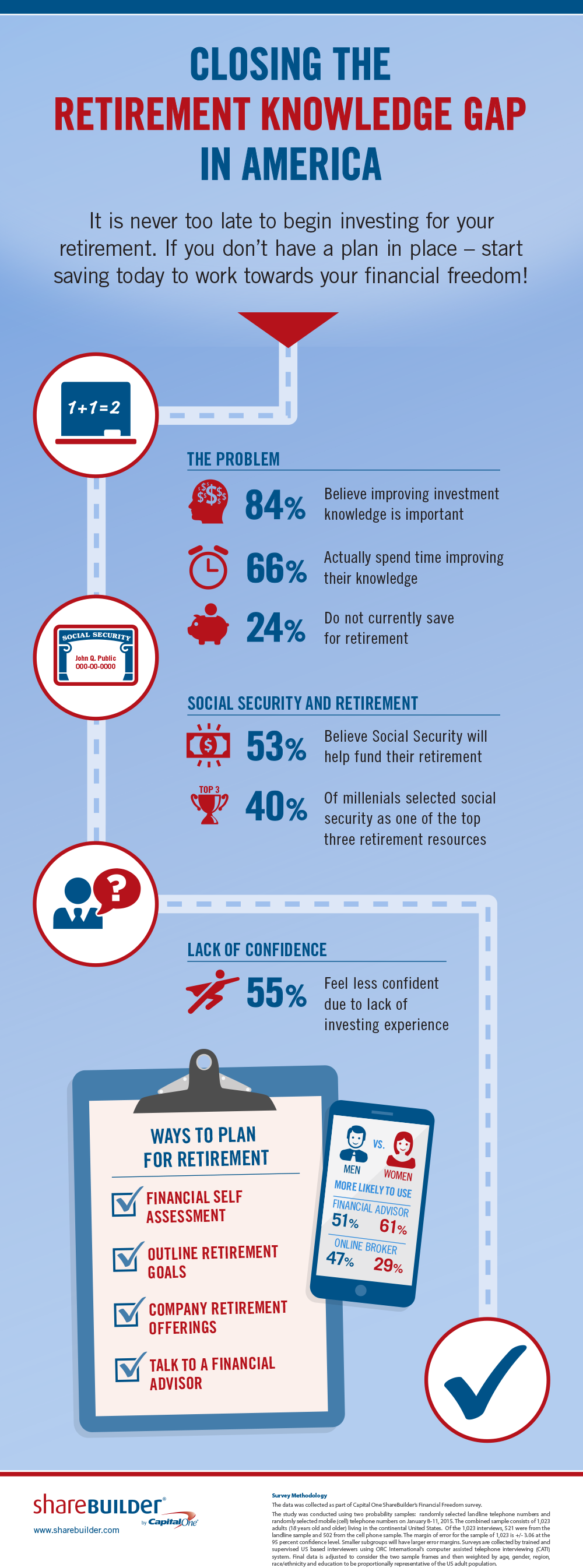

When it comes to Social Security, Americans certainly plan on tapping it. More than half of Americans intend to fund their retirement with their Social Security payments – making this government entitlement program more popular as a funding source than 401(k)s, pensions or investment portfolios, according to a recent survey by ShareBuilder by Capital One.

Related: The Right Time to Take Social Security: A Go-To Guide

Taking Social Security benefits at the right time – which will vary for people depending on their situation – can be worth hundreds of thousands of dollars throughout a lifetime. For many people, it’s the only retirement income stream designed to increase with inflation.

Still, misperceptions about the benefits persist. Here’s the truth about six common Social Security myths:

MYTH #1: The Social Security Administration will guide you through the process.

While most Social Security workers will do their best to help you, the decision to claim the benefit is notoriously complicated and there’s no one-size-fits-all solution. “Many people inside the Social Security Administration do not understand their own rules, do not understand all the benefit choices and often give people incomplete or wrong advice,” says Philip Moeller, co-author of Get What’s Yours: The Secrets to Maxing Out Your Social Security.

To make the right move, you’ll need to do your own research and potentially hire a financial planner or consultant who specializes in helping individuals and couples craft a Social Security plan.

Related: The Debt That’s Robbing Seniors of Their Social Security

MYTH #2: You should enroll in Social Security as soon as you’re eligible.

You can start receiving retirement benefits as early as age 62, but financial planners say doing so is usually a big mistake. Every year that you wait through age 70 will make your monthly checks worth more. A worker retiring this year at full retirement age, for example, would be eligible for a maximum monthly benefit of $2,663 – while a 62-year-old taking benefits this year would only receive $1,997 per month.

Continuing to delay collecting Social Security until after your full retirement age will net you 8 percent more a year. That’s a guaranteed return you’re not likely to find anywhere else. On average, a man reaching age 65 today can expect to live until 84, according to the Social Security Administration, while one in every four 65-year-olds will live past age 90.

Of course, waiting until age 70 to take benefits is not right for everyone. If you can’t live without the cash or if you have a health problem or family history of dying young, you may want to take benefits earlier, since you may not live long enough to realize that 8 percent return.

MYTH #3: You can’t get Social Security if you haven’t worked outside the home.

Even if you never once paid into the Social Security system, you can still get benefits equal to half your spouse’s benefits. You’re eligible for spousal benefits even if you’re currently divorced, as long as you were married for 10 years and haven’t remarried.

Related: 10 Social Security Rules You Won’t Believe

MYTH #4: You can spend your entire Social Security check.

Even in your golden years you can’t escape Uncle Sam. If your annual income is above $34,000 (if you file taxes individually) or $44,000 if you are married and filing jointly, you’ll owe taxes on 85 percent of your provisional income, which includes income from tax-free municipal bonds. There are also a handful of states that impose a tax on Social Security benefits.

MYTH #5: Social Security will fully fund your retirement.

Social Security was always meant to supplement Americans’ retirement income – and even at current levels it’s not nearly enough to sustain a pre-retirement lifestyle. The average monthly benefit in January was about $1,260, amounting to just over $15,000 annually. That’s just higher than the poverty level of about $12,000 per year.

MYTH #6: There won’t be any Social Security money left by the time millennials retire.

Given the funding problems with Social Security, it’s easy for workers, especially younger millennials, to write off the system entirely. Most experts, however, say that some form of Social Security payment will always be there, even if it’s a smaller check that arrives at a later age. “There’s no politician out there that’s going to look at the camera and say ‘I’m going to cut Social Security benefits entirely,’” says Anthony LoCascio, a certified financial planner and tax specialist in Clinton, N.J.

Top Reads from The Fiscal Times: