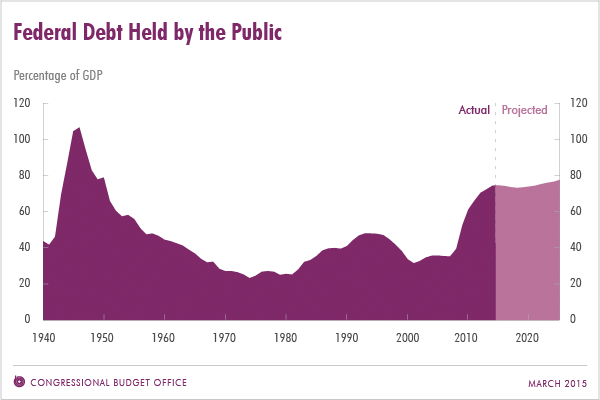

Absent any dramatic change in spending or tax policy, the publicly held federal debt will amount to roughly 74 percent of the economy over the next several years – or more than in any previous year since 1950, according to a new budget analysis by the non-partisan Congressional Budget Office.

The Obama administration and many Democrats have hailed the government’s success in narrowing the annual gap between spending and revenues after a prolonged period of huge deficits that once exceeded $1 trillion annually. But that good news will only last a few more years before annual deficits and the cumulative national debt begin to increase dramatically, both in absolute dollars and as a percentage of the gross domestic product.

Related: McConnell Vows to Avoid Another Debt Ceiling Crisis

After accounting for all of the government’s borrowing needs, CBO projects that, under current law, debt held by the public will rise from $13.4 trillion at the end of 2015 to $21.2 trillion at the end of 2025 – or 77 percent of GDP.

Debt held by the public consists mostly of securities that the U.S. Treasury issues to raise cash to fund the federal government’s activities and to pay off its maturing liabilities. The remainder of the debt results from intra-governmental transfers and holdings.

While many economists differ on the importance and economic impact of a rising public debt, the CBO was adamant in its latest report that that such high and rising debt would have “serious negative consequences for the nation” in the coming decade – when interest rates begin to rise again and more and more of the budget must be dedicated to paying off interest on borrowing.

“When interest rates [return] to more typical, higher levels, federal spending on interest payments would increase substantially,” the CBO report states. “Moreover, because federal borrowing reduces national saving over time, the nation’s capital stock would ultimately be smaller and productivity and total wages would be lower than they would be if the debt was smaller.”

Related: CBO Warns of Looming Fiscal Crisis as Debt Soars

Lawmakers saddled with rising public debt would have less flexibility than otherwise to use tax and spending policies to respond to unexpected challenges, the report contends. “Finally, a large debt increases the risk of a fiscal crisis, during which investors would lose so much confidence in the government’s ability to manage its budget that the government would be unable to borrow at affordable rates,” according to CBO.

The gross national debt -- currently about $18.1 trillion -- skyrocketed during the Bush and Obama administrations, largely because of the staggering unpaid cost of the wars in Afghanistan and Iraq and the impact of the worst financial crisis and recession in modern history.

Controversy over the debt was rekindled last week when Treasury Secretary Jack Lew announced that the U.S. will officially hit its statutory debt limit on March 16. That set the stage for another potential showdown between lawmakers and the White House over spending and Obama administration policies later this fall, when the Treasury will likely exhaust its current borrowing authority and face the possibility of a first-ever default on its borrowing.

Related: U.S. begins measures to buy time under debt limit

The Treasury secretary emphasized in a letter to congressional leaders last week, "Increasing the debt limit does not authorize new spending commitments," but instead "simply allows the government to pay for expenditures Congress has already approved." Debates over raising the debt ceiling historically have been a proxy for political differences over budget and tax policy.

The CBO’s latest updated budget projections for 2015 to 2025 represent one of the final documents that will be issued under the leadership Doug Elmendorf, the outgoing director. He will be succeeded by Keith Hall, a former government economist who was the choice of Senate and House Republicans leaders.

In late January, CBO reported that with a relatively strong wind at the back of the economy and continued restraints on government spending, the budget deficit this year and next will be at its lowest levels since 2007, or roughly $468 billion a year.

However, the latest report bumped up the 2015 projected deficit by $18 billion – mostly because the agency has increased estimated outlays for student loans, Medicare and Medicaid.

Top Reads from The Fiscal Times: