In his State of the Union speech last week, President Obama put the focus squarely on the middle class, pushing policies that he promised would rescue the broad middle of U.S. society, which has seen little of the benefits of the economic recovery. However, an analysis of his proposal to increase taxes on the wealthy in order to cut taxes on everyone else shows the Obama plan doesn’t do much at all for families in the middle income bracket.

WHY THIS MATTERS

Obama has been championing the middle class, in part to build support for a potential Democratic successor in 2016. But when plans that are meant to benefit the “middle class” actually do nothing for those in the middle income distribution, how long will the public will keep buying his claims?

“We break people up into income quintiles, and for people in the middle quintile, it’s pretty much, ‘No story here. Move on,’” said Howard Gleckman, a resident fellow at the Urban Institute and the editor of the Tax Policy Center’s TaxVox blog. “There are winners and losers, but on average the tax change for people in that middle quintile are very small one way or the other.”

Related: Why Health Care Could Get More Expensive for 5 Million People

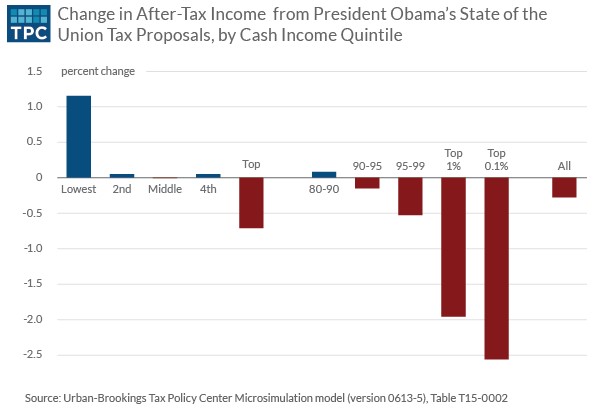

The losers? That’s very plainly the very wealthy. Under the proposal, the top one percent would see a nearly 2 percent decline in cash income, while the top 0.1 percent would see income fall by over 2.5 percent.

The winners are earners in the bottom 20 percent of the income distribution, who would see an increase of about 1.2 percent, or about $175 per year, Gleckman found. For everyone above the bottom quintile up to the 90th percentile, the changes would be trivial — amounting to perhaps one-tenth of one percent.

For those in the middle quintile – identified by Gleckman as those earning between $49,000 and $84,000 per year – the net change would actually be a decline in after-tax income of $7.

“Both critics and supporters describe the Obama plan as a major redistribution of income through the tax code,” Gleckman writes. “In reality, it would significantly boost taxes on the rich and only modestly cut them for many low income households, though for some, especially those with young children, the boost in after-tax income would be substantial. For most of the rest of us, the net impact would be relatively small, though some people would enjoy hefty tax cuts and others would face big tax hikes.”

Related: Obama’s About-Face on 529 Plans Could Save the Middle Class a Bundle

Gleckman also warned of the trade-offs that go with such a plan.

Much of the tax increase on the wealthy comes from an increase in the capital gains tax, triggered when an investment is sold for a profit. People wishing to avoid a high capital gains tax might avoid selling assets that they would otherwise prefer to invest somewhere else – meaning that capital that might be more productive somewhere else is effectively locked up.

Update: Leonard Burman, director of the Tax Policy Center writes in an email: “Not sure I agree on your lock-in point...It’s true that the higher capital gains tax rate would tend to increase lock-in, but taxing capital gains at death would vastly reduce the incentive to hold. I can’t say with certainty how the package would affect lock-in, but I’d guess that on balance, lock-in would be reduced.”

Top Reads from The Fiscal Times: