Largely under the radar screen, lawmakers are toying with ideas that could add as much as $1.5 trillion to the national debt in the coming decade.

Washington is transfixed on President Obama’s new immigration reform executive action and the ultimate fate of the Keystone XL pipeline. But lurking in the background are proposals by lawmakers in the House and Senate that would use deficit financing to extend a slew of costly expiring tax provisions and compensate for overspending by Medicare.

Related: The Ignored Congressional Crisis That Could Raise Your Taxes

More than 50 tax provisions are typically renewed by Congress every two years or so without offsetting spending cuts or revenue hikes. These so-called “tax extenders” gradually add to the debt – but don’t get much attention.

WHY THIS MATTERS

If Congress goes ahead with proposals to use deficit financing to expand and extend costly tax provisions, it would wipe out all the new revenue that was generated by the 2013 “fiscal cliff” deal. It would also fail to offset the Medicare Sustainable Growth Rate reprieve

Some lawmakers, however, are considering breaking with tradition by expanding and permanently extending several of the biggest tax breaks. These include the highly popular Research & Experimentation Tax Credit – commonly known as the R&D Tax Credit – which allows companies to write off some of their spending on research, and refundable tax credits like the Child Tax Credit and the American Opportunity Tax Credit.

On top of that, the deal would temporarily extend dozens of other tax provisions at their current levels for another two years.

The maximum overall cost of that approach: nearly $1.2 trillion over ten years, including related interest costs. As the Committee for a Responsible Federal Budget (CRFB) points out, that would be five times more expensive than extending all the provisions for two years.

Related: CBO Says Budget Deficit Dipped to $486 Billion in 2014

Another enormously expensive idea under discussion is to permanently replace the Medicare Sustainable Growth Rate (SGR) formula – designed to control the rate of growth of the health care program for seniors. The SGR was created to make sure that yearly increases in expenses per Medicare beneficiaries do not exceed the growth of the overall economy. Whenever expenditures do exceed that level, Congress must reduce funding to reimburse physicians by a corresponding amount the following year.

Congress in the past has come up with the money to spare doctors those cuts – the so-called “Doc Fix” – to prevent many from abandoning Medicare treatment. But if lawmakers decide this time to simply add the cost to the nation’s credit card, it would add $144 billion to the debt.

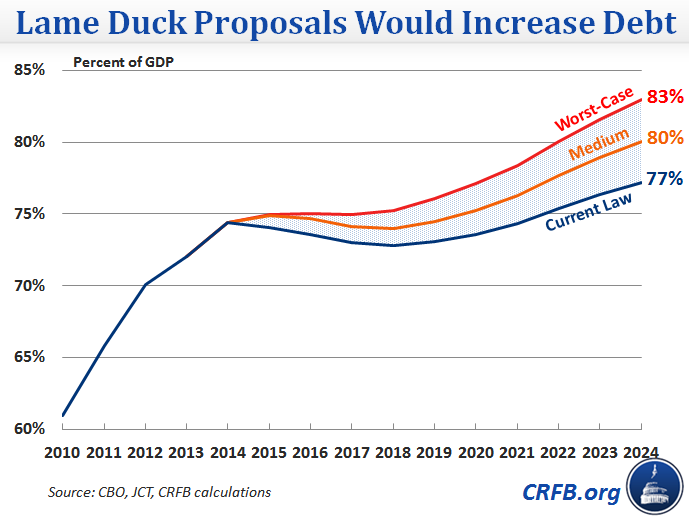

If these and other policies now on the table are approved during the lame duck session, ten-year deficits would increase by nearly $1.3 trillion – or $1.5 trillion after interest on borrowing is factored in.

Related: CBO Warns Anew of Uncontrolled Long-Term Debt Risk

“The lame duck should not be an excuse to add trillions to our national debt,” CRFB said in a new analysis. “Policymakers can make constructive choices during the lame duck session by finding savings to offset the costs of any policies they choose to extend.”

Last week Politico reported that high-ranking Democrats and Republicans in both chambers are exchanging ideas along these lines, although nothing is yet set in stone. Sen. Richard Durbin of Illinois, the deputy Democratic leader, told Politico there could be some horse trading going on, but wouldn’t say more. Sen. Chuck Grassley (R-IA), a senior member of the Finance Committee, agreed that permanently extending some provisions benefitting individual taxpayers is under discussion.

Here’s a chart from the Committee for a Responsible Federal Budget showing how the proposals could increase the national debt over the coming decade:

Top Reads from The Fiscal Times:

- Why Gruber-gate Is So Devastating to Democrats

- Man and Uber Man: Do Startup CEOs Have to Be Jerks?

- Perry Might Have to Run for President While on Trial