The Russian government has spent the last few days giving the world a lot more to worry about. From moving more tanks into Ukraine, to transferring nuclear weapons-capable units to Crimea, to announcing that it will start flying long-range bombers over the Gulf of Mexico, the Kremlin hasn’t exactly been a stabilizing force in global affairs for the past few days.

Then, there’s this: It turns out that in addition to invading neighbors and taking an increasingly belligerent global posture, the Russian government has been stockpiling gold. Lots and lots of gold.

Related: Russia Seen ‘In Denial’ as Economy Stagnates

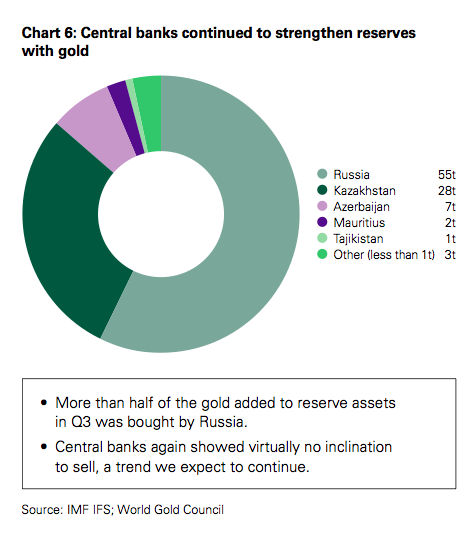

The World Gold Council, which tracks demand for the metal, said in its report for the third quarter of 2014 that the Russian central bank accounted for more than half of the gold purchased by central banks in the three months ending with September.

Since this time last year, Russia has increased its total gold holdings by 25 percent, meaning its gold reserve is now the fifth largest in the world. Its holdings have tripled in the past decade.

Now, generally, advice to start hoarding gold comes from people who also predict imminent economic catastrophe. Or war.

So, has Vladimir Putin has been watching too many Glen Beck reruns? Is he planning to start World War III?

Related: Putin and Europe Are Still Preparing for War

Fortunately, there is another likely driver of Russia’s gold purchases.

The Russian ruble has been taking a beating in the foreign exchange markets this year, largely due to the economic sanctions imposed by the U.S. and its allies after the invasion of Ukraine’s Crimean peninsula over the summer, and the continued Russian participation in the ongoing civil war in eastern Ukraine.

A large gold reserve would give the Russian government the wherewithal to further prop up its currency in the global foreign exchange market, one presumably insulated from currency fluctuations, should the confrontation with the West continue for an extended period, which seems increasingly likely.

While it’s increasingly unclear just what Putin is thinking and planning, hopefully his increasing interest in gold is simply an indicator of monetary insecurity rather than crisis planning based on inside information.

Top Reads from The Fiscal Times