Trick or treaters looking for a hauntingly scary Halloween costume this year might want to pass on the Freddy Kruger mask and dress as a hacker instead.

That’s because Americans are more scared of hackers getting hold of their credit card information than getting murdered, raped or being a victim of terrorism.

Related: Corporations Strain to Stay Ahead of Hackers

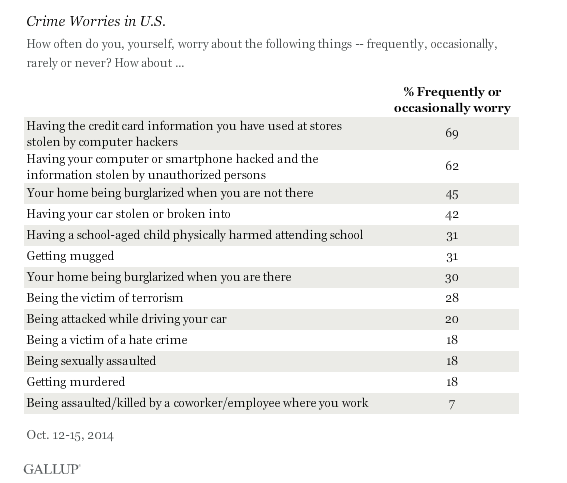

A new Gallup survey released today found that a majority of people--69 percent—said they fear being hacked more than any other crime. The growing concern over hackers is not surprising given that about a quarter of respondents had experienced some form of credit card information theft.

The poll also found that people earning $75,000 or more annually were more likely than lower-income people to frequently worry about hackers getting access to their credit card information.

Gallup’s findings come in the wake of several high profile security breeches at major retail companies including Target and Home Depot. Both stores fell victim to major hacking operations where credit card information from millions of consumers was stolen from thousands of stores across the country. Overall, the Department of Homeland Security estimates that more than 1,000 U.S. companies have been victims of cyber attacks.

The threats hackers pose to companies and consumers are huge—and protecting them comes at a major price. In a study released earlier this year, the Center for Strategic and International Studies estimated that hackers cost companies and consumers an average $445 billion each year. The study, commissioned by McAfee, a cyber-security software company, includes the gains to criminals as well as the costs to companies for recovery and defense.

Target, for instance, spent more than $146 million to resolve all of its data breach-related issues; most of those expenses went toward settling breach-related claims brought by consumers, Reuters reported.

Related: Beware of Hackers and the ‘Heartbleed’ Bug

Experts also note that the growing concern over credit card breeches likely affects consumer behavior.

“With credit card hacking clearly a concern to many Americans, it may affect their shopping habits as they take measures to protect their identities and finances,” Gallup’s Rebecca Rifkin wrote in a blog post. “Consumers may avoid stores that have been hacked, and begin paying more frequently with cash or prepaid cards to protect their identities.”

Aside from the increasing fear of hackers stealing credit card information, Gallup also found that the next most feared crime is data theft on personal computers and smart phones.

That fear has likely been stoked by the recent media attention surrounding the iCloud security breach that resulted in leaked nude photos of celebrities like Jennifer Lawrence.

Related: Porn, Drugs, Hitmen, Hackers: This is the Deep Web

Meanwhile, the federal government has suffered its share of security breaches. Earlier this year, the Department of Homeland Security reported that Chinese hackers may have infiltrated the Office of Personnel Management’s computer network, which includes files on all federal employees, including those with top-secret clearances. Likewise, this summer, HealthCare.gov—the federal website that facilitates Obamacare—also fell prey to hackers.

The problem is so widespread that just last week, President Obama signed an executive order aimed at protecting Americans’ personal and financial information from hackers. The actions include upgrading government credit and debit cards to include “chip and PIN technology” that are supposed to have stronger security safeguards that the old cards.

“These crimes don't just cost companies and consumers billions of dollars every year, they also threaten the economic security of middle-class Americans who worked really hard for a lifetime to build some security," Obama said during an event at the Consumer Financial Protection Bureau in Washington. "The idea that somebody halfway around the world could run up thousands of dollars in charges in your name just because they stole your number or because you swiped your card at the wrong place at the wrong time, that's infuriating. For victims, it's heartbreaking."

Still, from box store shoppers to Hollywood celebrities, and even the federal government—no one seems to be completely immune from hackers.

Top Reads from The Fiscal Times: