The shoe hasn’t dropped yet, but in the next few months or years, big, successful corporations in the S & P 500 are likely to do the unthinkable—stop offering employer sponsored health insurance to their employees.

Why? The combination of penalties imposed by Obamacare on so-called “Cadillac plans” as well as potential savings are impossible to ignore if you’re in the C-suite and responsible to investors. A new report by S&P Capital IQ shows exactly why companies can’t resist shifting the burden of providing health care to the feds. The report says:

- By shifting insurance to the employee, the Affordable Care Act presents an opportunity for U.S. companies to radically redefine the role they play in the health care system.

- The ACA could save S & P 500 companies nearly $700 billion through 2025, about 4 percent of those companies’ current market capitalization.

- If all U.S. companies with 50 or more employees made the switch, the total savings to businesses could be as high as $3.25 trillion through 2025.

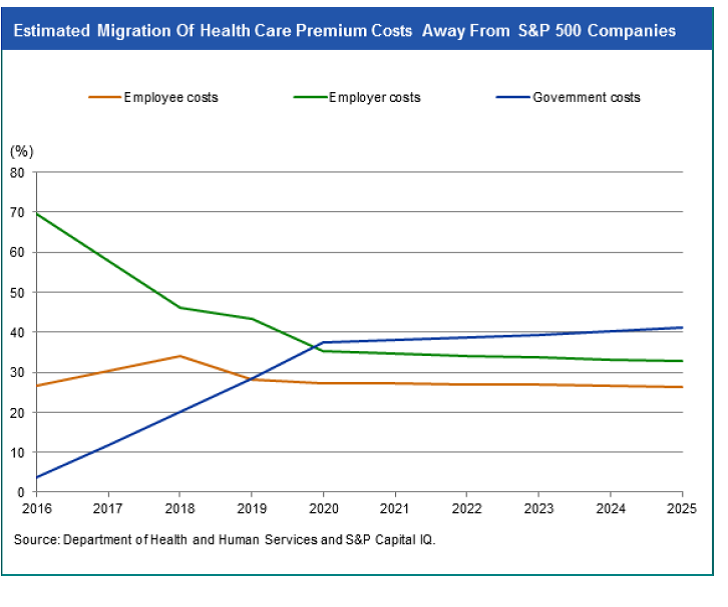

- The shift benefits employers the most as the government and consumers take on a larger funding role.

Top Reads from The Fiscal Times: