If the economy evolves according to the Federal Reserve’s forecast, quantitative easing is on track to come to a close by the end of this year. Increases in the federal funds rate are likely to follow. Thus, as the Fed’s policies to combat the Great Recession are coming to an end, it’s time to ask: Did these policies work?

Changes in the Federal Funds Rate: When the housing bubble popped in early 2006, the Federal Reserve recognized that “economic growth is moderating from its quite strong pace.” Nevertheless, in late June of 2006 the Fed raised its target interest rate from 5.00 percent to 5.25 percent based upon the fear that “some inflation risks remain.” Thus, initially, despite clear signals of significant problems in mortgage markets the Fed was concerned with inflation, which would not turn out to be a problem, rather than unemployment, which would.

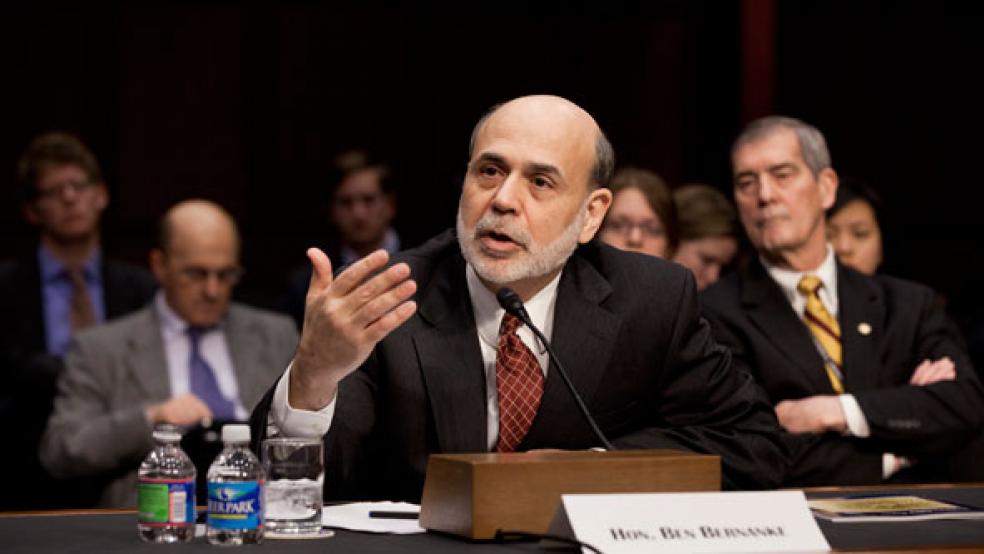

Related: Five Myths about the Federal Reserve

How well did this work? Had the Fed left the federal funds rate at 5.25 percent instead of lowering it to the zero bound, it would have had a large negative impact on consumption and investment and that would have been a disaster. However, it’s hard to make the case that the fall in the federal funds rate did much above and beyond avoiding these negative consequences. Reducing interest rates creates the incentive to invest and consume more, but in a severe recession firms and households – looking forward and seeing a depressed economy – have little incentive to act on those incentives.

Special Liquidity Facilities: The evaporation of liquidity was a huge problem during the financial crisis, especially after Lehman was mistakenly allowed to fail. The Fed’s “lender of last resort” function is supposed to allow troubled financial institutions access to the liquidity they need through the discount window, but legal restrictions prevented many troubled large financial institutions outside the traditional banking sector from getting needed loans from the Fed. In addition, banks that did have access to the discount window were reluctant to use it due to the potential stigma it might cause when investors found out the bank needed a loan to survive.

Related: Who’s to Blame for the Power Shift at the Fed?

In response, the Fed created several lending facilities to get liquidity to troubled sectors of financial markets– to primary dealers, money market funds, commercial paper, etc. – and the efforts were very successful. This is one of the unrecognized successes of Fed policy. These facilities were able to overcome barriers and get liquidity where it was needed; without these efforts, the problems in financial markets would have been much more severe.

Quantitative Easing: There is evidence that quantitative easing, which tilted toward the purchase of long-term assets, lowered long-term interest rates and inflated asset values. However, the fall in the long-term interest rates was not large, and the response of consumption and investment to the fall in long-term rates and the increase in asset values was muted. Still, there are quite a few papers that find a significant positive effect. Thus, while the impact was far from enough to turn things around and propel the economy back to full employment, quantitative easing should be regarded as a success.

Communications Strategy: The Fed’s communication strategy, particularly about the intended future path for interest rates, was a mess. The Fed began with vague language indicating it would keep the federal funds rate exceptionally low for an extended period. Then, when that failed to convey the Fed’s intentions, it switched to “date-based” communications, e.g. “exceptionally low levels for the federal funds rate at least through late 2014.”

Related: Fed Bars Shareholder Payouts from Citi, Four Others

However, the dates kept being revised when the economy turned out worse than the Fed expected, and the guidance was of little value. To try to fix this, the Fed changed to language linking the federal funds rate to unemployment and inflation. Recently, however, as the economy has approached the unemployment threshold but continued to struggle, the Fed dropped the state-dependent language and went back to vague communication about watching a wide variety of indicators.

The idea behind all of this is to communicate that the federal funds rate will remain low even after the recovery is well underway – in modern macro models that type of communication can stimulate the economy – but the attempt has created more confusion than certainty, and it would be very difficult to call this a success.

Regulation: The Fed has tried to institute new regulations to make the financial sector more resilient and reduce the chances of future problems, but two key problems remain. First, capital requirements/leverage limits have been too slow to come to fruition, and are not as high as they should be. This is a key vulnerability-- the unwinding of leverage created huge problems for the financial sector, and more needs to be done. Second, the problem of bank runs in the shadow banking system, the main source of liquidity problems during the financial crisis, has not been solved (see here).

Overall Assessment: While the Fed was far from perfect, a bit behind the curve, and too quick to see “greens shoots” and inflation around every corner, we would have been much worse off without the Fed’s creative response to the crisis. Overall, it was clearly a success.

Top Reads from The Fiscal Times:

- Why Bloomberg’s Nanny Campaign Will Backfire

- GM Risked Lives to Save 25 Cents Per Car

- $6 Billion Goes Missing at State Department