- Services make up 63% of GDP and 83% of private sector jobs.

- Service sector GDP has grown a scant 0.5% over the past year.

- Consumer spending on services rose only 0.2% since last year.

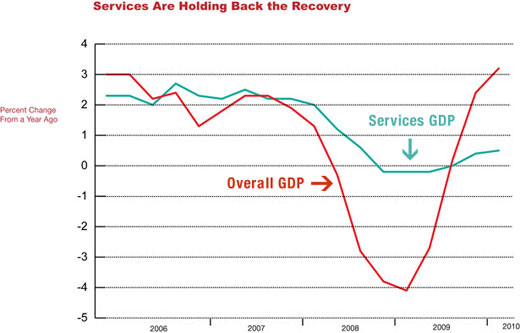

Although housing, jobs, and the financial markets lead most people’s worry list for the economy, much of the disappointment over this tepid recovery can be traced to one of the economy’s most important engines: services. This crucial sector, which makes up 63 percent of gross domestic product and 83 percent of private sector payrolls, is in a serious funk, and it has not been pulling its weight the way it has in past recoveries. Until this sector revs up, economic growth and the job markets will continue to sputter, and the recovery will remain at risk.

Even though the economy has managed to grow 3.2 percent over the past year, the performance of the service sector has been dismal. The Commerce Dept.’s latest revisions show that GDP for services grew a scant 0.5 percent over the past year, sharply weaker than earlier data had suggested. Despite their large share of the economy, services accounted for only 11 percent of the overall growth in GDP over the past year. In the first year of the two previous recoveries, they contributed 60 percent and 80 percent, respectively.

|

Job growth is suffering greatly from the service sector’s lethargy. After the last two recessions, services accounted for nearly all private sector job growth. Even in the past three months, employment in key service industries, including retailing, information and finance, continued to fall. Service industries are leading the overall weakness in payrolls, which played a role in the Federal Reserve’s downgrade of its economic outlook and its policy adjustment on Aug. 10. “However, the shift in the composition of growth away from labor-intensive services has also been an important factor contributing to weakness in the labor markets,” says JPMorgan economist Bruce Kasman.

How has the economy managed to grow 3.2 percent with almost no help from services? As it turns out, the goods-producing sector, weighing in at only 30 percent of GDP (with construction making up the remaining 7 percent), has accounted for all of the economy’s growth over the past year. Consumers have shelled out for autos, computers, TVs, home furnishings, and essentials such as food and clothing, while businesses have laid in new machinery, high-tech gear and other equipment at a rapid rate. Foreign demand has also been very strong. All this shows up in the solid recovery in manufacturing. Factory production has grown 8.3 percent over the past year, more than twice as fast as in each of the last two recoveries.

The problem is that goods production, which always makes sharp downswings and upswings in a business cycle, cannot carry the recovery. Several indicators of manufacturing activity already show that growth in the factory sector is slowing down, especially as global growth cools off. U.S. exports have played a big role in the strength of the goods-producing sector, but China and emerging-market Asia are slowing a notch, and Europe is working through its malaise. JPMorgan’s tally of global export growth has slowed to about 10 percent over the past three months, down from close to 50 percent at the end of last year.

It’s Consumer Spending, Stupid…

The service sector’s exceptional weakness can be traced directly to consumers whose spending on services accounts for nearly two-thirds of all household outlays. Consumer demand for services, adjusted for inflation, fell for three quarters in a row last year, something that has not happened since the 1930s, and spending has made almost no headway over the past year, growing a meager 0.2 percent. That compares to 1.9 percent in the first year after the 2001 recession and 3.2 percent after the 1990-91 downturn. By contrast, retail sales, which rose 0.4 percent in July and include only outlays for goods, are on a stronger track than they were just after the last two recessions.

| SERVICE-SECTOR GROWTH IN THE FIRST YEAR OF RECOVERY | |||

| SERVICES INDICATOR: | 2009:II-2010:II | 2001:IV-2002:IV | 1991:I-1992:I |

| GDP | 0.5% | 2.6% | 2.6% |

| CONSUMER SPENDING | 0.2% | 1.9% | 3.2% |

| PAYROLLS * | 99,000 | 343,000 | 388,000 |

| *INCLUDES STATE & LOCAL GOVERNMENTS | |||

Household demand for services is weak across the board. The housing slump remains a big drag on housing-related services, but consumers also have cut back sharply in discretionary areas, such as recreational activities, where spending is down $8.7 billion over the past year. Outlays for theaters, sporting events, and amusement parks are still falling, as is spending on cable and satellite TV and casino gambling. Foreign travel is also down. Expenditures for financial services are off $13.4 billion from a year ago, with sizable declines in life and health insurance and payments to investment companies. Households are also cutting back on professional services for legal and accounting advice. Spending on personal care is down, as well.

The bottom line is that the recovery cannot take flight without significantly more strength in service sector demand and production, which will be the linchpin for faster job growth in the coming year. The recent upturn in weekly jobless claims is a clear sign that the labor markets are going nowhere and that the economy has lost some momentum. The growing risk is that the continued absence of this crucial sector of the economy could eventually cause businesses to turn more defensive, further squeezing payrolls and putting the recovery in jeopardy.