• Private-sector wages have risen at a 4.2 percent annual rate since March • 72 percent of chain stores beat analysts’ sales expectations in September • Households are getting a $10 to $15 billion windfall from mortgage refinancing |

Given that households account for 70 percent of all spending in the U.S. economy, consumer psychology tends to get a lot of attention, especially now. Readings on consumer confidence have plunged in recent months, signaling that people feel lousy about the economy and have little faith that things will turn around any time soon. But that doesn’t necessarily mean that consumers are about to short circuit the economic recovery.

More important to the outlook for consumer spending are income, credit, and wealth and each has shown improvement through the third quarter. Modest job gains are generating income growth. Credit is flowing more freely to households, as consumers cut back on debt with a lot less pain than many analysts had expected. Plus, stock-market gains in the third quarter have been an important wealth booster.

Consumers don’t always behave the way they say they feel. Contrary to earlier fears that consumers were about to abandon the recovery, spending continues to grow at a steady, albeit modest, clip. Although confidence readings are about where they were more than a year ago, when consumer spending was contracting, household outlays in the third quarter appear to have grown close to the first-half pace of about 2 percent. That’s one reason many economists are taking a second look at their forecasts for third-quarter GDP growth. “We see considerable upside risk to our forecast of 1.5 percent growth,” says economist Sam Coffin at UBS, admitting that 3 percent for the quarter is not out of the question.

Consumer spending is holding up partly because of continued gradual improvement in the job markets. Overall payrolls fell by 95,000 workers in September, the Labor Dept. said last Friday, but excluding fewer Census workers and declines in state and local government payrolls, private-sector jobs increased by 64,000 last month with small upward revisions to July and August gains. Monthly increases in private industry jobs have averaged 77,000 since April.

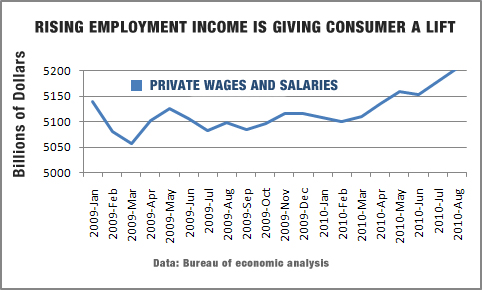

Although that’s a lukewarm pace, employment income has accelerated, reflecting longer work hours and modest growth in hourly pay. In the past six months, private-sector earnings from wages and salaries grew at a 4.2 percent annual rate, compared with no growth at all in the previous six months. Payrolls are still not growing fast enough to dent the unemployment rate, which held at 9.6 percent in September, but the renewed downtrend in weekly jobless claims, which tend to foreshadow labor market trends, suggests stronger job gains in coming months and a further pickup in income growth.

their balance sheets and rebuilding savings faster

than expected”

Gains in employment income are partly responsible for the steady growth in consumer spending, including Thursday’s better-than-expected September sales reports from the nation’s chain stores. A survey by Thomson Reuters showed that 75 percent of stores beat analysts’ expectations last month, amid growing optimism that holiday sales will show improvement over last year. Plus, car sales rose to an 11.8 million annual rate in September, the best monthly showing since the temporary cash-for-clunkers spike last year, and a pace that puts car sales on a clear uptrend.

Buoyant car buying is one sign that cheaper and more accessible credit is helping to lift consumer spending, as households get a little better grip on their finances. Through the second quarter the cash needed to meet monthly payments on consumer credit and mortgages fell to 12.1 percent of after tax income, according to Federal Reserve data, the lowest debt service burden in more than ten years. “We think that American consumers are deleveraging their balance sheets and rebuilding savings faster than expected,” says Morgan Stanley economist Richard Berner.

Record-low mortgage rates are helping the deleveraging process by setting off a refinancing boom, at least among homeowners who can meet eligibility requirements. The 30-year fixed rate in the weekly Freddie Mac survey fell to 4.27 percent on October 7, down nearly a full percentage point since April, and applications to refinance rose about 70 percent over that period. Any new round of Treasury securities purchases by the Federal Reserve, which looks increasingly likely, would push rates down even further. Although low appraisal values, low credit scores, or unemployment are preventing many homeowners from refinancing, Berner estimates that refi activity is still giving households a $10 billion to $15 billion annual windfall.

of the $17 trillion in wealth lost

during the recession.”

Household balance sheets also received a boost from the stock market last quarter. The broad Wilshire 5000 stock index rose 11.1 percent during the third quarter, reversing almost the entire 11.5 percent drop during the second quarter, when worries about European banks and a U.S. double-dip recession spooked investors. That decline resulted in a $1.5 trillion loss in household net worth, which was fully replenished last quarter. In the past year and a half, according to Federal Reserve data, households have regained more than $6 trillion of the $17 trillion in wealth lost during the recession.

A lot of recent consumer angst appears to center around uncertainties about future tax rates. In an unusual divergence, confidence among higher-income households, which are more likely to be adversely affected by an expiration of the Bush tax cuts, fell sharply in September, according to the Reuters/University of Michigan survey, while attitudes of lower-income households actually improved. “We expect confidence to begin to edge higher once political uncertainty subsides,” says economist Theresa Chen at Barclays Capital. However, any substantial gains in optimism will depend on further improvement in the labor market and in household finances, which so far at least are moving in the right direction.