Some widely used diabetes and weight loss drugs could be profitably manufactured for far less than they currently cost, according to a new study.

The analysis, published in JAMA Network Open by researchers at Yale University, King’s College Hospital in London and the nonprofit Doctors Without Borders, finds that the blockbuster diabetes drug Ozempic, widely used for weight loss, can be manufactured at a cost ranging from 89 cents to $4.73 for a month’s supply. That includes a profit margin. The drug has a U.S. list price of about $936 for a month’s supply of injections, though that price does not factor in insurance, discounts or rebates.

“The findings of this study suggest that robust generic and biosimilar competition could reduce prices to more affordable levels and enable expansion of diabetes treatment globally,” the researchers conclude.

Demand for Ozempic and related drugs in a class known as GLP-1s has surged, raising questions about their affordability and leading some insurers to stop covering them. Citing rising costs, North Carolina’s state health plan this year dropped coverage of the drugs for state employees who use the medications for weight loss, though not for those with diabetes.

Sen. Bernie Sanders, the Vermont independent who chairs the Senate Health, Education, Labor and Pensions Committee, pointed to the new study in calling on Danish drugmaker Novo Nordisk to lower the price of Ozempic and a related drug, Wegovy. Sanders said that the company, which earned nearly $15 billion in profits in 2023, had done the right thing by lowering the U.S. price of its insulin products and should do the same for Ozempic.

“Novo Nordisk charges Americans nearly $1,000 a month for this drug, while the same exact product can be purchased for just $155 a month in Canada and just $59 in Germany,” he said in a statement Wednesday. “I am calling on Novo Nordisk to lower the list price of Ozempic – and the related drug Wegovy – in America to no more than what they charge for this drug in Canada. The American people are sick and tired of paying, by far, the highest prices in the world for prescription drugs while the pharmaceutical industry enjoys huge profits.”

Sanders said that, while Ozempic can be a “game changer” in the fight against diabetes and obesity, millions of people who need the drug won’t be able to afford it at current prices — and, he warned, “this outrageously high price has the potential to bankrupt Medicare, the American people and our entire health care system.”

Sanders is looking to discuss pricing with Novo Nordisk CEO Lars Fruergaard Jørgensen.

The drugmaker reportedly responded by noting that it spent nearly $5 billion on research and development last year, and will spend more than $6 billion to increase production of the GLP-1s to meet surging demand. It also said, per CNBC, that three-quarters of its gross earnings go to rebates and discounts to expand patient access to its products.

CNBC’s Annika Kim Constantino also points to a survey released this month by Evercore ISI that found that more than half of people currently taking a GLP-1 said they pay $50 or less per month.

Concerns about Medicare costs: The JAMA study comes just days after a separate analysis found that Medicare spending on Ozempic and other GLP-1s is skyrocketing.

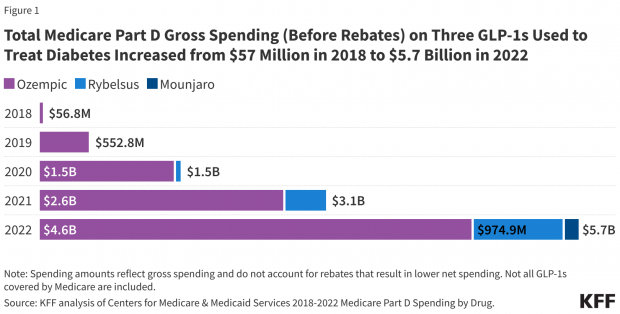

The analysis by KFF, a nonpartisan health policy research organization, of newly released government data showed that Medicare spending on weight loss drugs like Ozempic soared from $57 million in 2018 to $5.7 billion last year.

KFF notes that Medicare could select Ozempic and related drugs for price negotiations as early as next year, with negotiated prices potentially taking effect starting in 2027. But Medicare spending on these drugs could also be heading significantly higher now that some Medicare plans have started covering Wegovy for heart disease patients and GLP-1s get cleared for other uses over time.

“These drugs offer substantial potential health benefits,” the KFF report says, “but the combination of intense demand, new uses, and high prices for these treatments is likely to place tremendous pressure on Medicare spending, Part D plan costs, and premiums for Part D coverage.”