President Joe Biden today marked the one-year anniversary of the landmark Inflation Reduction Act, calling it “one of the most significant laws” ever enacted.

In an event at the White House, Biden sought to use the anniversary to again trumpet the success of his economic agenda, which he has labeled Bidenomics. “This law is one of the biggest drivers of jobs and economic growth this country has ever seen,” Biden said of the legislation, which included hundreds of billions of dollars in climate-related spending and tax breaks along with measures to lower health care and prescription drug outlays. “We have a plan that’s turning things around. The Inflation Reduction Act is a part of that plan.”

Biden highlighted the private-sector investments spurred by the law and the jobs those investments will generate. He said the law had already helped create some 170,000 clean energy jobs since it passed. And he reminded his audience that Republicans did not provide a single vote for the law, though some have sought to capitalize on benefits in their states and districts.

But Biden faces several challenges as he looks to sell voters on the Inflation Reduction Act. As we’ve mentioned recently, polling has found that provisions of the law are popular but most Americans aren’t aware of the legislation. A Washington Post-University of Maryland poll conducted this summer found that 71% of those surveyed said they know little or nothing about the law.

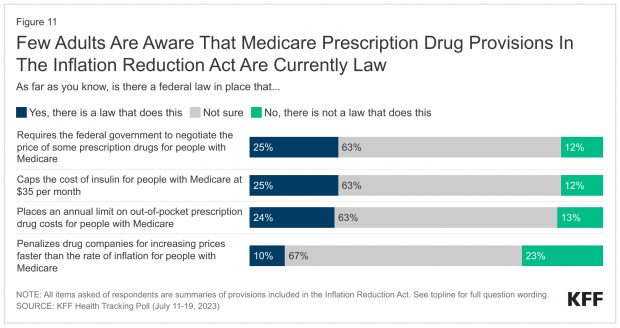

Similarly, July polling by the health care non-profit KFF found that just a quarter of the public is aware that there is now a law enabling the federal government to negotiate some drug prices for Medicare, capping insulin costs for Medicare beneficiaries and limiting Medicare enrollees’ out-of-pocket drug costs. Only 10% know that the law now penalizes drug companies that raise drug prices for Medicare faster than the rate of inflation.

The White House’s efforts to raise those numbers may struggle to reach the public in a news environment dominated by the historic criminal charges facing former president Donald Trump, a GOP presidential primary, persistent questions about Hunter Biden, natural disasters and other events. “It’s very, very frustrating,” Democratic pollster Celinda Lake told The Washington Post about the lack of public awareness of the law. “But I think it just speaks to how difficult it is to break through, how much repetition and volume you need to break through.”

The political challenge is made even greater because some of the law’s biggest changes won’t be visible to voters in the immediate future. The first negotiated Medicare drug prices, for example, won’t take effect until 2026 — and that’s only if the program survives legal challenges.

Some Democrats and analysts reportedly suggest that those legal challenges may help build awareness of the law’s health policy changes. “The fact that Big Pharma is suing, to me, I wear that as a badge of honor,” said Democratic Rep. Angie Craig of Minnesota told the Post. And KFF’s Larry Levitt, who said the law is “probably the biggest political victory over the pharmaceutical industry ever,” tweeted this week: “Politically speaking, getting sued by the pharmaceutical industry over curbing drug prices is likely to be perceived by voters as a badge of honor.”

True cost unclear: Bloomberg’s Leslie Kaufman notes that, while the White House and others have tagged the cost of the climate measures in the law at about $370 billion, the popularity of the tax breaks mean that “the cost of the tax credits and incentives to the US Treasury is clearly going to be much higher — and even after a year, there’s no way to pinpoint the amount of spending that will ultimately occur.”

Bill Hoagland, senior vice president at the Bipartisan Policy Center, tells Bloomberg that the budget scoring of the law fails to account for the climate impact it can have. “If you believe in — and I do — that climate change is an existential threat to the economy and that this law will reduce some of these external costs, whether it's health care or disaster coverage,” said Hoagland, “then that could be a plus to revenues in the long haul.”