Happy Thursday and best wishes for a joyous National Burrito Day! Here’s your fiscal update.

IRS Releases Roadmap for the Future

The Treasury Department on Thursday released a “strategic operating plan” for the IRS that includes new details on how the tax agency will use $80 billion in extra funding over 10 years provided by Congress through the Inflation Reduction Act.

The 150-page plan, which identifies 190 key projects and more than 200 milestones for the tax agency as it seeks to rebuild and modernize following years of budget cuts, is built around five objectives:

1. Dramatically improving customer service;

2. Speedy resolution of taxpayer issues;

3. A focus on complex returns from high-income filers to reduce the tax gap;

4. Enhanced efficiency with up-to-date technology and analytics;

5. Maintaining a highly skilled workforce.

IRS Commissioner Danny Werfel said in a memo to Treasury Secretary Janet Yellen that the most important goal is to improve customer service. That objective includes providing more information to “help taxpayers identify potential mistakes before filing and quickly fix errors that delay their refunds.”

The largest share of the $80 billion in extra funding, though, will be used to target wealthy scofflaws who intentionally avoid paying their taxes in part or in whole. “We will focus [Inflation Reduction Act] enforcement resources on hiring the accountants, attorneys, and data scientists needed to pursue high-income and high-wealth individuals, complex partnerships, and large corporations that are not paying the taxes they owe,” Werfel said.

The new commissioner also vowed to adhere to Yellen’s stated goal of focusing its enforcement efforts on the rich and not middle-income households. “All efforts will comply with your directive not to use [Inflation Reduction Act] resources to raise audit rates on small businesses and households making under $400,000 per year, relative to historic levels,” Werfel said. “Our efforts outlined in the Plan to provide better service to taxpayers, help them file accurately and resolve issues at filing, coupled with technology and data advances, will allow us to focus enforcement on taxpayers trying to avoid taxes, rather than taxpayers trying to pay what they owe.”

In a phone call with reporters, Werfel underlined the theme. “People who get W-2s or Social Security payments, or have a small business, should not be worried about some new wave of IRS audits. We’re taking that off the table,” he said. “We have years of work ahead of us, where we will be 100 percent focused on building capacity for higher-income individuals and corporations.”

The need to rebuild: Werfel said the IRS clearly needs the funding Congress has provided. "I can’t overstate the importance of sustained annual resources for IRS operating costs," he wrote. “To help put this issue in perspective, IRS funding has steadily declined over the last decade causing suboptimal staffing and investment.” Werfel noted that in 2010, the IRS had more than 95,000 workers serving a U.S. population of 310 million, whereas today, the IRS is about 20% smaller while serving a population that is 7% larger – and the tax code has grown more complex in the meantime.

In a nod to threats from Republicans to eliminate almost all of the $80 billion provided to the IRS by the Inflation Reduction Act – which GOP lawmakers have claimed would be used to hire an “army of 87,000 IRS agents” to harass middle-income taxpayers, as House Speaker Kevin McCarthy (R-CA) put it – Werfel warned that any cuts to funding would damage the agency’s effort to improve customer service and likely result in less revenue being collected, increasing deficits.

As far as hiring is concerned, the report does not specify an estimate or target for the number of hires the IRS plans to make. The 87,000 figure derives from a 2021 Treasury report that estimated the IRS could hire 86,852 full-time employees over the course of a decade with a nearly $80 billion investment – not solely enforcement agents. Many of those hires would simply replace the estimated 52,000 IRS employees expected to retire in the coming years. Werfel said Thursday that the share of IRS employees working on criminal investigations would not change.

Extra funding having an effect: The IRS received a budgetary boost from the Inflation Reduction Act this year, and agency officials say the effects are already evident following its hiring of 5,000 new customer service agents.

“People can see the first signs of change this filing season following this infusion of funding,” Werfel said. “Taxpayers and tax professionals can see the difference as we have dramatically improved our phone service thanks to more staff. More walk-in services are available across the country. New digital tools have been added. And these are just first steps.”

McCarthy Sees His Budget Chief as Incompetent: Report

As House Republicans struggle to put together a budget plan and their demands for raising the debt limit, The New York Times reports that the process has been made more challenging by tensions between House Speaker Kevin McCarthy and his Budget Committee chairman, Rep. Jodey Arrington of Texas.

McCarthy reportedly has told colleagues that he has no confidence in Arrington, who apparently approached fellow Republicans early this year about backing Rep. Steve Scalise of Louisiana to be speaker when McCarthy was battling to win the position. “Aside from the perceived disloyalty, Mr. McCarthy regards Mr. Arrington, a former official in the George W. Bush administration, as incompetent,” the Times’s Jonathan Swan and Annie Karni report, citing “more than half a dozen people familiar with his thinking, who spoke on the condition of anonymity to describe private conversations.”

That perception could not have been helped when Arrington recently told reporters that Republicans were preparing a “term sheet” listing their demands for the White House in exchange for raising the debt ceiling. McCarthy quickly and bluntly shot down the idea, telling reporters, “I don’t know what he’s talking about.”

McCarthy has also criticized Scalise, the No. 2 House Republican, describing him “as ineffective, checked out and reluctant to take a position on anything,” according to the Times report.

McCarthy rejected the notion that there were serious differences between him and his leadership team, but the Times notes that he has relied more on loyal allies for sensitive assignments and negotiations.

The bottom line: It’s been clear that Republicans would have trouble finding the 218 votes they’d need to pass a budget resolution. McCarthy reportedly wants to avoid producing a budget that would give President Biden ammunition for further attacks and instead prefers to pass a bill that pairs a short-term increase in the debt limit with spending cuts. That approach could put more pressure on Democrats.

What Americans Are Most Worried About Now

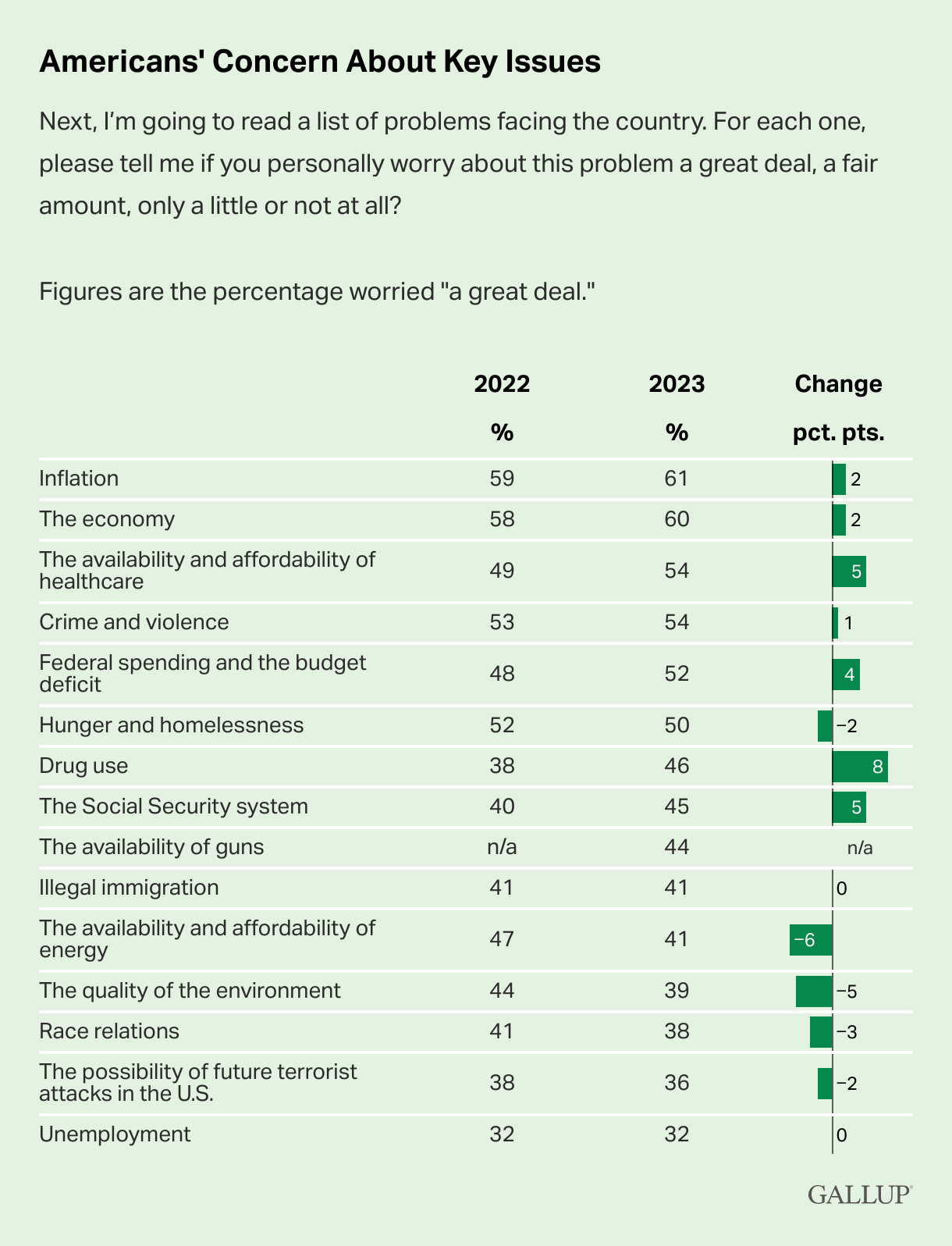

Inflation and the economy continue to be Americans’ top concerns, but drug use, Social Security, health care, federal spending and the deficit are increasingly worrying people, according to a new Gallup survey.

Gallup’s pollsters asked 1,009 adults last month about a list of 15 “problems” facing the country. They found that 61% of Americans said they worry “a great deal” about inflation, similar to the 59% who said the same last year. And six in 10 people said they worry a great deal about the economy, up from 58% last year. On the other hand, unemployment — now near a half-century low — ranked at the bottom of Gallup’s list of 15 issues, with just 32% of poll respondents saying they have great concern about the job market.

Rising concerns about drugs, health care and Social Security: High levels of concern about drug use rose 8 percentage points, the most of any issue, climbing from 38% in 2022 to 46% now. The share of Americans worried about the availability and affordability of health care rose by 5 percentage points, from 49% to 54%, while those expressing concerns about Social Security also rose by 5 points to 45%, reflecting a nine-point jump among Democrats and a seven-point rise among independents.

Worries about Social Security had eased in recent years, with a low of 38% of Americans saying they worry a great deal about the program in 2020, according to Gallup. But Social Security has become a hot topic this year as President Joe Biden and Democrats have challenged Republicans on the issue, warning repeatedly that some in the GOP want to cut retiree benefits as part of an effort to slash federal spending.

Social Security’s trustees reported recently that the program’s main trust fund is on pace to be insolvent by 2033.

With the new Republican majority in the House pressing for spending cuts in exchange for raising the national debt limit, fiscal concerns have risen to the fore again. More than half of those polled by Gallup, 52%, said they worry a great deal about federal spending and the budget deficit, up 4 percentage points from last year.

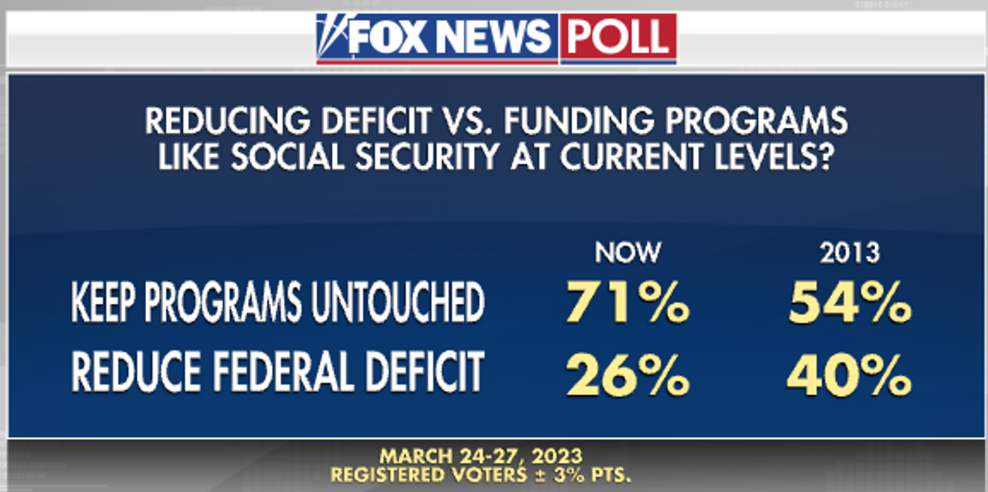

The Fox survey, conducted March 24 to 27 by Beacon Research and Shaw & Company Research, found that 50% of voters call the national debt a major problem, up from 43% in 2013, but only 28% call it a crisis, down from 40% a decade ago and 47% in 2011.

The same poll found that nearly two-thirds of voters say that Social Security funding is a major problem or a crisis, similar to the poll results from 2013. But 71% said that it is more important to them to continue to fund Social Security and Medicare at current levels than to cut the deficit. That’s up from 54% a decade ago, when 40% of voters said they preferred deficit reduction.

“Key groups across the board are all more inclined to subsidize Social Security and Medicare than they were 10 years ago, including double-digit surges among Democrats (+12 points), Republicans (+19 points), and independents (+25),” Fox’s Victoria Balara wrote.

“Majorities, including Democrats, Republicans, and independents, oppose reducing Social Security benefits for some future retirees (82% oppose), increasing income tax rates for all Americans (80%), and raising the age for Medicare from 65 to 67 (66%),” Balara noted.

Giving younger Americans the option of investing some of their Social Security withholdings in a private retirement account did poll well, though, with 70% supporting the idea.

The Gallup poll has a margin of sampling error of plus or minus 4 percentage points. The Fox poll was conducted among 1,007 randomly selected registered voters and has a margin of sampling error of plus or minus 3 percentage points.

The bottom line: The takeaway from the polling is clear. Fiscal concerns, including about Social Security’s finances, may be on the rise, but voters emphatically reject the idea of cutting entitlement benefits. “It’s clear that any proposals to reduce entitlement benefits will be met with fierce bipartisan resistance," Democratic pollster Chris Anderson, who conducted the Fox poll, told the Fox News site. “There is some tinkering that could be done around the edges, but the proposition that entitlements need to be reduced to decrease the deficit is a non-starter.”

News

- I.R.S. Unveils $80 Billion Plan to Overhaul Tax Collection – New York Times

- IRS: Average Taxpayers ‘Should Not Be Worried’ About Audits as Agency Grows – CNN

- Staring Down a Debt Crisis, McCarthy Toils to Navigate G.O.P. Divisions – New York Times

- Trump Comment Adds Fuel to House Push to Cut DOJ Funds – Roll Call

- House G.O.P.’s Plan to Cut Food Stamps Threatens a Tough Vote – New York Times

- Global Economy Faces Weakest Growth Patch Since 1990, IMF Chief Warns – Washington Post

- JPMorgan CEO Jamie Dimon Says Banking Crisis Has Increased Odds of Recession – CNN

- Assisted-Living Homes Are Rejecting Medicaid and Evicting Seniors – Washington Post

- Clarence Thomas Secretly Accepted Luxury Trips From Major GOP Donor – ProPublica

- Private Planes and Luxury Yachts Aren’t Just Toys for the Ultrawealthy. They’re Also Huge Tax Breaks – ProPublica

Views and Analysis

- The U.S. Built a European-Style Welfare State. It’s Largely Over – Claire Cain Miller and Alicia Parlapiano, New York Times

- The US Economy Is Unwell. April Could Be a Cruel Month – Nicole Goodkind, CNN

- The Republican Plan to Cut the Deficit on the Backs of Struggling Americans – Grace Segers, New Republic

- Biden Throws a Wrench Into His Own Infrastructure Plans – Washington Post Editorial Board

- Prisoners of Their Own Device: How Congress Underwrites the Models That Trap American Policymaking – Philip Rocco, American Prospect

- A National Bullying of the Poor: The Trouble With America’s Bootstrapping Myth – Alissa Quart, Guardian

- Our Two-Tiered Justice System and the Trump Indictment – David Dayen, American Prospect