You’d be forgiven for missing the White House’s “infrastructure week” earlier this month. It was full of speeches and splashy events but overshadowed by Former FBI Director James Comey’s Senate testimony. When we do finally get around to focusing on the president’s infrastructure plan, the provision eliminating tolling restrictions on interstate highways deserves particular attention. It is a good idea, but it requires some work to sell.

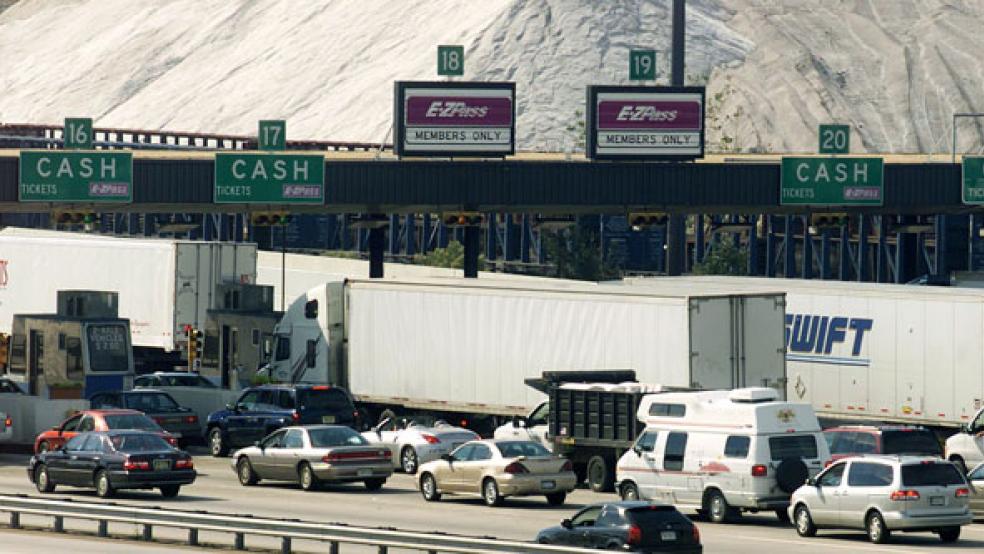

This reform would provide a more stable source of revenues for public or even, potentially, private efforts to manage the interstate highway infrastructure. The plan also recommends using variable tolling to reduce rush-hour congestion in urban areas.

Related: The Biggest Barrier to Rebuilding America’s Infrastructure Is Red Tape

So far, the president has failed to sell the advantages associated with tolling highways to the American people and to Congress. Here’s what he could say:

First, fuel taxes can no longer be relied upon to provide a stable funding source for highway programs. Fuel taxes currently provide about three quarters of the revenues used to fund the federal Highway Trust Fund, and they’re an important source of revenue for state and city highway spending as well. But with vehicles getting better fuel mileage each year, and with the growth of electric cars, fuel taxes may not be effective for much longer. Switching our reliance to tolls will provide a more reliable revenue source for the future.

Second, user fees and tolls are not like other taxes governments use to fund programs. Income, payroll, and corporate taxes alter people’s behavior, resulting in fewer hours worked and less investment, causing the economy to operate less efficiently. Tolls also affect behavior, but in a good way. Tolls reduce congestion and pollution.

Related: Trump’s Smoke-and-Mirrors Infrastructure Plan

Congestion is a major problem in urban areas of the country. Variable tolls — which can be set higher during rush hour drive times and lower during off-peak hours — create incentives for people to car pool, switch to mass transit and change travel times, reducing congestion. This could potentially save billions of dollars each year in wasted time and fuel.

It’s not necessary to toll all the lanes on an interstate to have a positive impact. Tolls can be placed on selected express lanes or implemented to allow solo drivers to use underutilized car-pool lanes. Even this small step leads to improved traffic flows in the non-tolled lanes, benefiting all drivers with faster, more reliable, trips.

Also, with better management of urban congestion, we just might find that we don’t need to build as much highway capacity as we thought, saving billions of dollars that can be put to better use.

So while fuel taxes can’t reduce urban congestion very well, variable tolls do it in several ways. The problem is that most people understandably bristle at the thought of new tolls.

Related: Who’s Going to Pay for Trump’s Huge Infrastructure Plans?

International experience with tolling in places like London, Stockholm and Singapore indicates that, while people are skeptical at first, once they see the benefits of faster trips, support grows. Tolls can conveniently be paid electronically. Using a tolled highway can be as easy as shopping at Amazon. To insure equity, the technology needed to use the system can be provided free of charge and tax credits could offset tolling costs for low-income drivers.

Turning to a third point, the president could emphasize his plans to expand the role of the private sector in building, maintaining and managing highways. To do this, tolls and user fees would provide the needed revenue stream for private businesses to operate highways or make infrastructure investments. Private involvement would most likely occur in urban areas.

A concern over expanding the role of the private sector is that the government loses long-term control of the highway. However, what most people have in mind is not a transfer of ownership or full privatization, but a lease agreement for a fixed period of time. The government maintains ownership of the highway.

Related: What’s Holding Back Private Infrastructure Investment in the US?

Unleashing private-sector initiative would result in new infrastructure projects being completed on time and on budget. It would also result in better highway conditions and service with a bottom line dependent on driver satisfaction. The profit motive creates an incentive to manage the road in a cost-effective manner, which is in the public interest. International experience with private sector involvement in highway building and operation supports this conclusion.

In summary, switching from fuel taxes to tolls would greatly improve the operation of the U.S. transportation system. Removing the restrictions on tolls gives states the option to use tolls where they make sense. It would provide steady revenue to fund maintenance and construction, reduce the need for additional infrastructure spending in some areas, and support policies to reduce congestion and pollution.

The president was elected in part because he convinced voters he was a dealmaker who could get things done in Washington. He now needs to sell the idea that tolls can play a key role in making U.S. infrastructure great again. If Congress listens, the drive home from work each night won’t take so long.

— Robert Krol is a professor of economics at California State University, Northridge, and an affiliated faculty scholar with the Mercatus Center at George Mason University. He writes regularly about transportation issues, most recently in the Mercatus Center study, “America’s Infrastructure Isn’t Crumbling: Some Facts on Highway, Road, and Bridge Conditions in the United States.”