We’re just 11 days into 2016 and the Dow Jones Industrial Average is already down 6.2 percent for the year while the Russell 2000 small-cap index, which is on the verge of an outright bear market, is off 7.9 percent for the year and has lost 19.2 percent from its high set last summer.

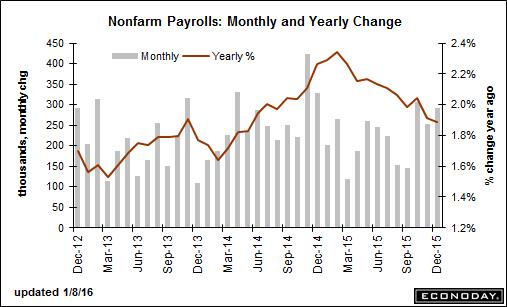

The bears were emboldened by Friday’s better-than-expected December payroll gain of 292,000 — well ahead of the 200,000 consensus estimate — which supports the Federal Reserve's expectation of four more quarter-point rate hikes in 2016. Although this is about half the pace of a typical tightening cycle, it’s twice as fast as the market expects.

Fears of faster rate hikes, combined with the decline in crude oil to 2004 lows, volatility in China, Mideast tensions, a sure-to-be-soft Q4 earnings season and fresh weakness in the corporate bond market, have greatly raised the stakes for the next Fed policy decision on Jan. 27 and the next expected rate hike on March 16.

Related: Why the New Year's Selloff Is So Scary

Fed Chair Janet Yellen will be forced to either acknowledge labor market tightening as reason to continue with the four-hike schedule for 2016 or risk her credibility, belittle job market stability and sound a warning about the risks of lower oil prices and cheap gasoline (sacrilege to regular Americans) by slowing the hiking pace after a single 0.25 percent increase last month.

If she gets it wrong, things could get ugly fast.

The Russell 2000 has dropped all the way back to levels last seen in October 2013 as it has dropped below its 200-week moving average for the first time since 2011.

Unless the bulls can turn things around soon, benefited by the extreme selling seen last week, doubt will linger about whether the current bull market is in its death throes. We're due for a short-term bounce. But the quality and strength of that bounce will determine, in large part thanks to the "January effect," what the rest of 2016 will bring for investors.

Technically, stocks continue to look vulnerable as the CBOE Volatility Index (VIX) — known as Wall Street's "fear gauge" — rises to levels last seen in late September.

Related: Oops! The Government Screwed Up 10 Years of Housing Data

One measure, the slope of the 12-month moving average on the S&P 500, was a solid predictor of the last two bear markets, dipping into negative territory in late 2000 and early 2008. It's been in negative territory since September.

Admittedly, there was also a false alarm in 2011 amid the fallout from the U.S. credit-rating downgrade.

But fresh hurdles will soon appear: The Q4 earnings season starts on Monday when Alcoa (AA) reports, and we’re likely to get the third consecutive quarter of negative earnings growth for the S&P 500. That's a run of falling profitability not seen since the financial crisis. A strong dollar, lower commodity prices and a falling unemployment rate (which leads to higher wages) are all dragging corporate earnings lower since they peaked in the third quarter of 2014, according to Deutsche Bank.

And yet the strength of the labor market is undeniable. December's job gains capped the second-best year for job creation since 1999, behind only 2014. Wage inflation is also relatively stable, with average hourly earnings up 2.5 percent vs. last year. The unemployment rate is on the verge of dropping below the 5.0 percent level.

Related: Once Again, Economists Say Wage Growth Is Coming ‘Soon’

We'll know more about the health of the job market today when the Job Openings and Labor Turnover data is released, including some of Yellen's favorite indicators. Keep an eye on the hiring and quits rates, which Deutsche Bank analysts point to as indicators of the trend in wage growth.