When an idea took hold of the largest generation in U.S. history, it had a profound impact. The numbers alone — 78 million Americans — changed everything from popular music to who would go to war for the country.

Baby boomers changed almost everything. And they’re not done yet. Now they’re quickly and fundamentally redefining their latest role: Grandparents.

In a new book, The Grandparent Economy, author Lori K. Bitter outlines how boomers are spending both time and money to make life easier for their children and grandchildren. More than half of grandparents have provided financial assistance to their adult children, ranging from emergency help after a job loss to help with tuition or a down payment on a home.

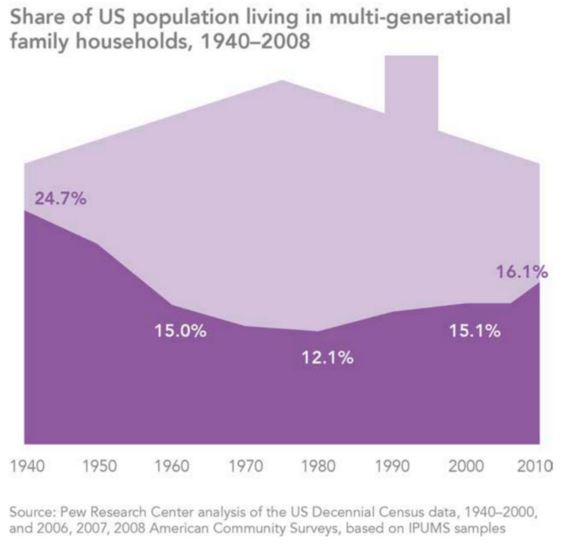

A fifth of all grandparents now live in multi-generational houses. The amount of money that people over age 65 are spending on things like baby food and toys more than doubled from 1999 to 2009, while spending on those same items among parent-age households fell during the period. Nearly a third of grandparents watch their grandchildren five days a week or more, and more than 40 percent babysit in some capacity.

The Fiscal Times caught up with Bitter to talk about how the way grandparents spend on their children changed following the 2008 financial crisis and how that affected the dynamics of extended families. This interview has been edited and condensed for clarity.

Beth Braverman: There has been a lot written about the resurgence of the multi-generational family home. In addition to the financial crisis, is there something else driving this shift?

Lori Bitter: Baby boomers have different parenting relationships with their millennial children than the previous generation. Boomers have always been more engaged and more involved with their children’s lives. That style of parenting led to much more of a ‘return-to-the-nest’ mentality. It’s been a very comfortable nest to land in, and very welcoming. Even when there’s not a lot to share, boomer parents tend to enjoy their children as adults and enjoy having them back in their lives. They’re also really enjoying the grandchildren.

BB: Do you think today’s young adults need help from their parents more than previous generations?

LB: We have created an environment in the United States where people go, go, go. It’s a very loaded, full life day-to-day for families. A lot of mothers are recognizing that it’s nearly impossible. The idea of having it all, which was created by the boomer generation, is hard and not really attainable without help and without reaching across the generations for support. Grandparents are the most likely place to do that. We have a generation of parents who are were very involved and are more than happy to be over-involved grandparents. It’s good for the children, as well.

BB: What’s the benefit to the kids?

LB: It’s good for them to have other loving adults who are invested in them in a way that’s different than their parents. Parents are down in the trenches with the day-to-day stuff, but grandparents have a bigger picture, longer-term view. It’s good for children to have that duality in their lives. They know that even though today was a bad day and mom and dad weren’t in a great place, there’s a longer game there.

BB: Are boomers thinking longer term financially as well?

LB: Yes, but not in the same way that their parents did. They think about legacy differently. The World War II generation, and to some extent the silent generation, thought about legacy in terms of assets, in terms of what money and property and things they would pass on. The boomer generation is dependent on what’s being left to them, and they have debt and haven’t saved for retirement. So when it comes to their grandchildren, their idea of legacy is more around creating experiences with them and living in the now. For them it’s more about time and giving the gift of time now while they’re here rather than leaving them something later in life.

BB: So does that mean they’re not spending as much money on the grandkids?

LB: They’re spending more on them now rather than saving that money to leave in an estate. The spending for first-time grandparents gets absurd. There are grandparents who set up whole nurseries in their homes that are bigger than the nurseries in the children’s house. Boomers wanted the best for their kids, and now they want the best for their grandkids, and they’re spending that way. This happens at every socioeconomic level. There are grandparents just above the poverty line who will not refill prescriptions that they need so that they can pay for doctors’ visits for their grandchildren or make sure that their grandchildren can go on fieldtrips at school.

BB: A lot of families combined households to cut down on expenses, but your research shows that on the grandparents’ side, that hasn’t always worked out.

LB: The grandparents end up spending more on grandchildren in multi-generational households, mostly because they’re there every day and can identify what the needs are. But a lot of that spending is happening at the expense of their own retirement. For some, the multi-generational house may also end up being a long-term care strategy for when the parents are taking care of the grandparents, since they’re not saving for that.

BB: Are grandparents choosing to take on a greater role when it comes to caring for grandchildren?

LB: Yes, but it’s also filling a need for their adult children. We see a lot of people who are near retirement who opt for more flexibility at work because they have a young son or daughter in the workforce who needs a safety net when their child is sick or their child care is unreliable. In a lot of families, even if they’re still working, the grandparents have the status and seniority to take the time away and be more flexible in the workplace than young people starting out in their careers. We see it in both grandmothers and grandfathers. For those who were working parents and couldn’t be there for their own kids, they see this as a do-over, a chance to really engage with their grandchildren.

BB: We hear about millennials asking about flexibility at work all the time, but it sounds like older generations may be in an even better position to demand and enjoy it.

LB: There is a lot more flexibility in the workplace now for older employees. That’s something that younger employees have given to the boomer generation, and they’re realizing that flexibility is not a bad thing.

This article was updated to correct a statistic about grandparents in multigenerational housing.