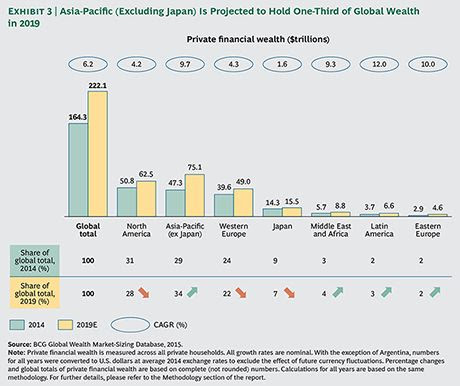

By 2019, millionaire households will control about half (46 percent) of the world’s private wealth, according to data from The Boston Consulting Group. The majority of the wealth will be situated in the Asia-Pacific region (excluding Japan), with an estimated $75 trillion in 2019.

The Asia-Pacific region (excluding Japan) is projected to overtake North America as the world’s richest region in 2016, with $57 trillion in private wealth. The region already overtook Europe to become the world’s second-wealthiest region this year with $47 trillion in private wealth.

So far, the U.S. still has the largest number of millionaires at 6.9 million. The number grew by 4.7 percent from last year. China ranks second, but had the largest number of new millionaires in 2014. China now boasts a millionaire population of 3.6 million, up from 2.4 million in 2013. Japan ranked third with 1.1 million millionaires.

Switzerland is home to the highest density of millionaires, where 135 out of every 1,000 households had private wealth greater than $1 million, a 10.6 percent increase since 2013. Bahrain (123), Qatar (116), and Singapore (107) followed.

Related: Billionaires: 10 Intriguing New Facts About Who’s Getting Rich Now

Global private financial wealth increased by almost 12 percent in 2014, reaching $164 trillion. Market expansion was driven both by the performance of existing assets and by the creation of new wealth, which grew by 17.5 percent in 2014. The Asia-Pacific region (excluding Japan) accounted for 10.7 percent of the increase.

Also notable is the still-growing divide between the ultra-rich and the regular rich. By 2019, the number of ultra-high-net-worth households, defined as $100 million and up, is expected to grow by 19 percent globally and by 12 percent in North America. However, the number of lower high-net-worth households, defined as having $1 million to $20 million, is only expected to grow by 6.9 percent.

Top Reads from The Fiscal Times: