Good evening. The Trump-fueled turmoil at the Internal Revenue Service continued today. We've got details.

Trump Replaces Acting Head of the IRS Just Days After Appointing Him

President Donald Trump's tumultuous first term was characterized by extraordinary levels of senior staff turnover. The historic churn was exemplified by the tenure of Anthony Scaramucci as White House communications director in 2017, which led to pundits adopting "Scaramuccis" as a measure of time equaling 11 days.

As the turmoil continues in Trump's second term, the Scaramucci may have just been made obsolete, replaced by an even shorter unit. Today we learned that Trump is replacing the acting head of the Internal Revenue Service just three days after naming him to the post.

Trump picked Gary Shapley on Tuesday to serve as acting commissioner of the tax agency. Shapley had gained prominence in conservative circles as a whistleblower who alleged in 2023 that the Justice Department was slow-walking an investigation into Hunter Biden. Shapley was named to replace Melanie Krause, the previous acting IRS chief, who resigned after the agency agreed to a controversial deal to help immigration officials deport undocumented immigrants.

But the Shapley appointment reportedly triggered a clash between Treasury Secretary Scott Bessent and Elon Musk, the billionaire leading the new Department of Government Efficiency, who has riled multiple members of Trump's Cabinet. Bessent reportedly had not been consulted about the Shapley appointment, even though the IRS is part of Bessent's department.

"Mr. Bessent had complained to Mr. Trump this week that Mr. Musk had done an end run around him to get Mr. Shapley installed as the interim head of the I.R.S., even though the tax collection agency reports to Mr. Bessent," The New York Times reported Friday.

Trump approved another change atop the agency. Michael Faulkender, who was just sworn in as deputy treasury secretary, will now be the new acting IRS commissioner. He will be the agency's fifth leader since January and its third acting leader this week.

Shapley lasted less than a third of a Scaramucci.

The agency has also lost a slew of other top officials in recent weeks.

"Trust must be brought back to the IRS, and I am fully confident that @TreasuryDepSec Michael Faulkender is the right man for the moment," Bessent said in a statement posted on X Friday afternoon. "Gary Shapley's passion and thoughtfulness for approaching ways by which to create durable and lasting reforms at the IRS is essential to our work, and he remains among my most important senior advisors at the @USTreasury as we work together to rethink and reform the IRS."

Bessent had previously brought Shapley and another IRS whistleblower, Joseph Ziegler, into the Treasury and had said that he would give the pair "a year to investigate the wrongdoing that's going on at the IRS." Bessent said Friday that he will ensure that both men are in "senior government roles that will enable the results of their investigation to translate into meaningful policy changes."

Trump's choice to lead the IRS on a permanent basis, former Rep. Billy Long, has yet to be confirmed by the Senate.

Column of the Day: What Could Be Worse Than Tariffs

Wall Street Journal columnist Joseph C. Sternberg warns in a piece today that, as dumb as President Trump's tariffs may be, the president may be preparing to try out an idea that is "much, much dumber."

Sternberg explains that Trump's economic advisers see the global economy as terribly distorted and that the United States, as the economic powerhouse that supplies the world with dollars and safe Treasury notes, is forced to run a whopping trade deficit as a result.

One major threat of the Trumpist approach, Sternberg says, is that the administration may look to rein in the market for Treasurys. He points out that Stephen Miran, the chairman of Trump's Council of Economic Advisers, has laid out three options for addressing the imbalances he sees in the global economy. One is a global push to devalue the dollar and revalue foreign currencies. A second would have the United States build up a reserve of foreign government bonds so as to manage the value of the dollar.

"The third proposal," Sternberg writes, "counts as the single worst idea ever floated by anyone associated with either Trump administration about anything: a tax on foreign holdings of Treasury securities."

Sternberg says that there's no strong evidence to support the underpinnings of the Trumpist view: "The real link between the dollar, foreign investors and the trade deficit is that America's status as issuer of the world's preferred safe assets means the rest of the world is happy to buy as much debt (government or private) and equity as we sell to finance our political choice to subsidize domestic consumption-a political choice that is popular here in the U.S."

He adds that taxing foreign Treasury holdings - reneging to pay the full amount promised - would be a default, and would be hugely risky as such. "The great folly of a capital tax on Treasurys is that it would undermine the desirability of those assets even as our fiscal deficit continues to rage more or less out of control," Sternberg writes. "I argued last week that Mr. Trump's trade protectionism is a roundabout way of avoiding politically painful entitlement reforms. Wait to see how excruciating such budgetary decisions will become if Washington faces a sustained global selloff of Treasurys."

Read the full piece at The Wall Street Journal.

Trump Plans New Fees on Chinese Ships as Trade War Expands

The Trump administration plans to impose new fees on Chinese ships that enter U.S. ports, saying it wants to boost demand for vessels made domestically.

The U.S. Trade Representative posted a 42-page notice in the Federal Register on Friday providing the details of the plan, scheduled to take effect in about 180 days. Under its terms, ships operated by China-based transportation companies would get hit with new fees when they enter U.S. ports, as would ships that were built in China but operated by non-Chinese companies. New fees would also be applied to car carriers made anywhere outside the U.S.

"The Trump administration's actions will begin to reverse Chinese dominance, address threats to the U.S. supply chain, and send a demand signal for U.S.-built ships," U.S. Trade Representative Jamieson Greer said in a statement.

The new plan is more moderate than an earlier version, which could have added as much as $3.5 million to a Chinese ship's delivery costs, with charges applied every time a ship reached a U.S. port. The new fee schedule, which will be phased in over time, is less aggressive and caps the number of times a given ship can be charged in a year. But it will add to the cost of shipping nevertheless, with port fees potentially rising over $1 million per visit, depending on the amount of goods a ship is carrying.

China made it clear Friday that it does not support the plan. "China is strongly dissatisfied and firmly opposed to this," China's commerce ministry said. "China will closely follow the relevant developments of the US and will resolutely take necessary measures to safeguard its own rights and interests."

The plan traces back to an investigation initiated during the Biden administration, prompted by complaints from U.S. labor unions about Chinese domination of the shipbuilding and transport industries. As a result of that investigation, the U.S. Trade Representative found that "China's targeting of the maritime, logistics, and shipbuilding sectors for dominance is unreasonable and burdens or restricts U.S. commerce," and is therefore actionable under U.S. law.

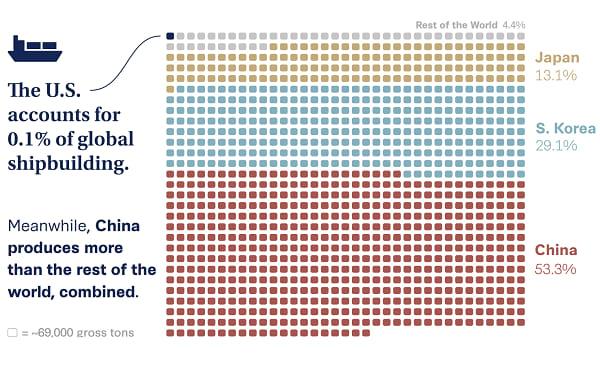

Whatever effect the new fees may have on the U.S. shipbuilding industry, it's clear that domestic capacity has a long way to go before it becomes a serious part of the global market. The chart below from a recent study by the Center for Strategic and International Studies shows just how small the U.S. industry is, with domestic production accounting for less than 1% of global output, which is dominated by China, South Korea and Japan.

Of the big three producers, China is clearly the dominant player. As the CSIS report says, "China's lead in the global commercial shipbuilding market is huge and growing. The country's largest state-owned shipbuilder built more commercial vessels by tonnage in 2024 than the entire U.S. shipbuilding industry has built since the end of World War II."

Quote of the Day

"It is your patriotic duty, I'll say it again, the patriotic duty of all Americans to take care of themselves because it is important for serving in the military, but it is also important because healthy people don't consume health care resources. The best way to reduce drug spending is to use less drugs 'cause you don't need them, 'cause you're healthy."

- Dr. Mehmet Oz, in comments made Friday after he was sworn in as the new administrator of the Centers for Medicare and Medicaid Services, the federal agency that oversees healthcare for nearly half of the American population.

Fiscal News Roundup

- Head of IRS Is Ousted Amid Treasury's Power Struggle With Elon Musk – New York Times

- Van Hollen Says White House Paid El Salvador $15 Million to Detain Prisoners – Washington Post

- Trump Revamps "Schedule F," Making It Easier to Cut Federal Workers – Axios

- Trump Studying If Removing Powell Is Option, Hassett Says – Bloomberg

- Trump Wants Powell Out of the Fed. Waiting in the Wings is Kevin Warsh – CNN

- Risk of Financial Panic Tempers Trump on Firing Powell – New York Times

- Immigrants Prove They Are Alive, Forcing Social Security to Undo Death Label – Washinton Post

- Supreme Court to Hear Challenge to Obamacare Rule on Free Preventive Care – NBC News

- DOGE Begins to Freeze Health-Care Payments for Extra Review – Washington Post

- Ford Halts Shipments of F-150s and Other Models to China – Wall Street Journal

- Judge Pauses Mass Firings at Consumer Financial Protection Bureau as She Considers Whether Layoffs Violated Court Order – CNN

- Agencies Will Still See Strict Limits on Recruitment Once Hiring Freeze Expires in July – Federal News Network

- Trump Shifted on Tariffs After Bond Holders Got Jittery. He Held Millions Himself – New York Times

- As International Tourists Pull Back on US Travel and Purchases, $90 Billion in Lost Revenue Looms – NBC News

- Trump Moves You Might Have Missed This Week – Axios

- White House Embraces Lab Leak as 'True' Pandemic Origin, Axes Covid Website – Washington Post

Views and Analysis

- As Tariffs Darken the Economic Outlook, Trump Sizes Up Powell as a Scapegoat – Stephen Collinson, CNN

- An Even Dumber Idea Than Tariffs – Joseph C. Sternberg, Wall Street Journal

- Trump Revives a 1930s Mistake That Hurt More Than It Helped – Fareed Zakaria, Washington Post

- Trump Is Flirting With Economic Disaster – Annie Lowrey, The Atlantic

- Trump Wants His Tariffs to Reset the World. He Might Get His Wish – Luciana Lopez, CNN

- With Harvard Threat, Trump Tries to Bend the IRS to His Will – Andrew Duehren, Alan Rappeport and Russ Buettner, New York Times

- If You Care About Your Savings, Pay Attention to Trump's Attack on The Fed – Chris Hughes, New York Times

- Federal Judge Halts CFPB Purge Again – David Dayen, American Prospect

- Trump's New Medicaid Chief Has Boneheaded Idea to Lower Drug Costs – Edith Olmsted, New Republic

- Did Anyone Really Think Kennedy Would Soften His Hostility to Vaccines? – Benjamin Mazer, New York Times

- Trump Is Wrapping Up 100 Days of Historic Failure – Dana Milbank, Washington Post

- What's Happening Is Not Normal. America Needs an Uprising That Is Not Normal – David Brooks, New York Times