Good evening. President Donald Trump said he had a "very good telephone call" with President Volodymyr Zelensky of Ukraine today after speaking yesterday with Russian President Vladimir Putin. In a joint statement, Secretary of State Marco Rubio and National Security Advisor Mike Waltz described the phone conversation as "fantastic" and said the leaders had agreed on a partial ceasefire of attacks against energy targets. They added that Trump had suggested having the United States run Ukraine's electrical and nuclear power plants. "American ownership of those plants would be the best protection for that infrastructure and support for Ukrainian energy infrastructure," they said.

Fed Sees Higher Inflation, Slower Growth in Trump Economy

The Federal Reserve held interest rates steady on Wednesday, maintaining its interbank lending rate in a range between 4.25% and 4.5% amid uncertainty over a potentially slowing economy and stubborn inflation.

At the same time, in a move some analysts attributed to concerns about the need to raise the federal debt limit in the coming months, the Fed tapped the brakes on its effort to shrink its holdings of Treasuries, a process known as quantitative tightening, saying it would slow its runoff rate from $25 billion a month to $5 billion a month starting in April.

In a statement, the central bank's Federal Open Market Committee said the economy continues to grow at a "solid pace," but its growth projections for the rest of the year have been trimmed and its estimates for inflation have been raised.

Economic growth is now estimated to be a modest 1.7% in 2025, down from the 2.1% rate forecast in December. Unemployment will climb to 4.4% by the end of the year, the Fed said, a bit higher than the previous 4.3% estimate and three-tenths of a point higher than the current rate. Inflation expectations have climbed, too, as officials now expect the inflation rate to rise this year to 2.7%, up from 2.5% in January. The core inflation rate, which ignores volatile food and fuel costs, is now expected to end the year at 2.8%.

Bumps ahead, maybe: Fed Chair Jerome Powell emphasized the growing questions about the economy, telling reporters that "uncertainty is remarkably high." One major reason for the uncertainty is the trade policy of the Trump administration, which is already starting to negatively affect sentiment among consumers and business owners as it causes turmoil.

"Inflation has started to move up, we think partly in response to tariffs," Powell told reporters following the conclusion of the FOMC meeting.

Still, economic activity continues to expand and Fed officials expect to cut interest rates twice this year. Powell said the tariffs may cause disruption in the economy, but that would delay rather than derail the Fed's effort to reduce inflation. The Fed expects to get inflation back to 2% by the end of next year.

As he has done many times before, Powell said the Fed would wait and see what the data tells them in the coming weeks and months. "We're not going to be in any hurry to move," he said. "We're well positioned to wait for further clarity and not in any hurry."

What the experts are saying: The Fed's outlook reflects what most economists say about the effects of tariffs, even if that clashes with how Trump administration officials describe them. "They tend to bring growth down, they tend to bring inflation up," Powell said.

"The Fed Chair just said what every credible economist, every economics textbook, and every empirical study shows: Tariffs reduce output and raise prices," University of Michigan economist Justin Wolfers wrote on social media. "This is quite uncontroversial stuff, folks. (Also, depressing.)"

Some analysts wondered how the Fed could issue a weaker economic outlook without changing its view on interest rate cuts, since a weaker economy is usually associated with more rate reductions. Diane Swonk, chief economist at KPMG, said investors "upped the probability of rate cuts following the press conference," suggesting they were seeing the Fed's message as hawkish. But "that is not what the Fed's own forecast is showing," Swonk wrote.

George Catrambone, head of fixed income at DWS Americas, said the central bank's mixed message was simply a reflection of the uncertainty most experts are feeling right now - an uncertainty that we can only hope will resolve once the Trump administration's policies are more clearly defined. "It's neither dovish or hawkish, it's the Fed calling a timeout until its May meeting and doing its best to find a middle ground amidst a wide distribution of outcomes," he told Bloomberg. "The fact investors saw hawkishness and dovishness in the statement means they've done their job for the moment."

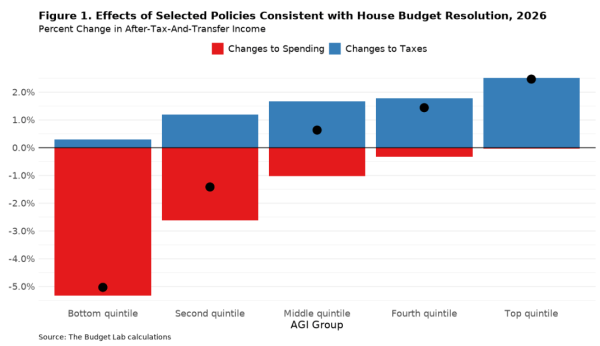

Chart of the Day: Who Might Benefit From the Republican Budget Plan

Republicans have yet to flesh out the details of their budget blueprint that calls for a $4.5 trillion in tax cuts and $1.5 trillion or more in spending cuts over a 10-year period, but their plan is likely to involve changes to Medicaid and SNAP, commonly known as food stamps, in addition to the extension of the tax cuts enacted in 2017 and set to expire this year.

To see how the changes might shake out, analysts at the nonpartisan Yale Budget Lab modeled four policies that fit the GOP outline: a 30% reduction in SNAP spending, a 15% reduction in Medicaid spending, a permanent extension of the expiring tax cuts, and a permanent extension of business tax breaks that have expired or are sunsetting.

The newly published analysis finds that the GOP plan would be regressive, with the top fifth of households getting by far the biggest benefits - and the wealthiest 5% seeing nearly 70% of the gains while the bottom 40% lose out. The top 1% of households would see more than 35% of the net change in income.

The bottom line: The analysts note that Republicans might end up making substantially different policy changes than those they modeled, but the Budget Lab report gives Democrats more ammunition to claim that the GOP plan takes from the poor and middle class to help the wealthy.

Most Federal Workers Say Trump Will Make Government Worse: Poll

Most federal workers say that President Trump will make the government worse, according to a new Washington Post-Ipsos poll.

The survey found that:

-

56% of federal employees said that Trump will worsen the way the federal government works in Washington;

-

67% disapprove of the job Elon Musk is doing in the government;

-

52% say they think Musk's DOGE team is cutting necessary programs, compared to 24% who say it is cutting wasteful spending;

-

71% say they are worried about the ability of the government to function if large numbers of workers are laid off;

-

57% of current federal employees believe that Trump's executive orders affecting their agency are mostly or entirely illegal;

-

58% of federal employees predict that Trump will worsen how the government serves ordinary Americans;

-

59% say that Trump will worsen the ability of their agency to fulfill its mission;

-

49% say Trump will hurt efforts to ensure that taxpayer dollars are spent effectively;

-

89% say their work benefited the nation and 81% of current federal employees say they are not likely to voluntarily leave their jobs over the next 12 months.

The poll of 614 federal workers was conducted from February 28 to March 10. Its results have a margin of sampling error of plus or minus 5.1 percentage points.

Fiscal News Roundup

- Trump Aides Prep New Tariffs on Imports Worth Trillions for 'Liberation Day' – Washington Post

- DOGE Official Takes a Leadership Role at USAID, an Agency Musk's Team Has Helped Dismantle – Associated Press

- Trump Aides Circulate Plan for Complete Revamp of Foreign Aid Programs – Politico

- DOGE Plays Hardball in U.S. Institute of Peace Takeover – Washington Post

- Federal Reserve Sees Tariffs Raising Inflation This Year, Keeps Key Rate Unchanged – Associated Press

- Powell: Trump Tariffs Will 'Delay' Progress Against Inflation – The Hill

- Trump Policies 'Promise' an Economic Downturn, Says Prominent Forecaster in First-Ever 'Recession Watch' – CNBC

- Emails Reveal Top IRS Lawyer Warned Trump Firings Were a 'Fraud' on the Courts – ProPublica

- Social Security Requiring in-Office Visits for Millions of Recipients, Applicants – The Hill

- Musk Uses Immigration and Claims of Voter Fraud to Sell Social Security Administration Cuts – NBC News

- Pentagon Weighs Major Cuts to Top of US Military – CNN

- Judge Bars Trump's EPA From Taking Back $20B in Climate Grants - for Now – Politico

- Brother of Trump's GSA Leader Tried to Buy Prime Federal Property – Washington Post

- Food Safety Jeopardized by Onslaught of Funding and Staff Cuts – New York Times

- Trump Administration Considers Scaling Back H.I.V. Efforts at C.D.C. – New York Times

- Probationary Employees Fired at the CDC and NOAA Will Keep Being Paid to Stay Home – Associated Press

- White House Plans to Pause $175 Million for Penn Over Transgender Policy – New York Times

Views and Analysis

- Trump's Tariffs Have Sown Uncertainty. That Might Be the Point – Alan Rappeport, New York Times

- Key Takeaways From the Fed's Decision to Hold Interest Rates Steady Amid Trump's Tariff Chaos – Bryan Mena, CNN

- DOGE Just Might Usher In New Era of Big Government – Kathryn Anne Edwards, Bloomberg

- Trump Has No Plan to Fix the Economy - and Americans Know It – Thomas J. Hicks, USA Today

- Trump's Flood-the-Zone Strategy Has a Big Weakness – Julius Krein, New York Times

- The Entire Future of American Public Health Is at Risk – David Wallace-Wells, New York Times

- Government Data Is Disappearing Before Our Eyes – Anna Massoglia, The Hill

- The Anti-Vax Culture War on mRNA Just Got Worse – Lisa Jarvis, Bloomberg

- The US Is Looking a Lot Like China – Joe Wiesenthal, Bloomberg

- Reagan Republicans Didn't Disappear. They Were Just Demoted – David M. Drucker, Bloomberg

- Trump Has Gone From Unconstitutional to Anti-Constitutional – Jamelle Bouie, New York Times

- It's Time to Reimagine Foreign Aid – Farah Stockman, New York Times

- Trump's Tariffs Could Deal a Blow to Boeing and the Aerospace Industry – Niraj Chokshi, New York Times

- Illustrative Distributional Effects of Policies Consistent with the House Concurrent Budget Resolution for Fiscal Year 2025 – Harris Eppsteiner and John Ricco, Yale Budget Lab