Happy Wednesday! President Joe Biden and President-elect Donald Trump each announced a ceasefire deal between Israel and Hamas today after more than 15 months of devastating violence in the Middle East. "It is the result not only of the extreme pressure that Hamas has been under and the changed regional equation after a ceasefire in Lebanon and weakening of Iran — but also of dogged and painstaking American diplomacy," Biden said in a statement.

There are still many questions about how the multi-phased deal will work and play out, but Biden said the agreement follows the exact framework he proposed in May but will be implemented by the Trump administration. The first phase of the deal calls for a six-week break in hostilities and the release of 33 of the 94 hostages. "We're handing off to the next team a real opportunity for a better future for the Middle East," Biden said in afternoon remarks from the White House. "I hope they will take it."

Biden will speak to the nation again tonight when he delivers a farewell address from the Oval Office. Here's what else is happening.

Trump's Pick for Budget Director Previews Constitutional Fight Over Power of the Purse

The Senate on Wednesday ramped up its consideration of President-elect Donald Trump's Cabinet picks, holding six confirmation hearings, including for Sen. Marco Rubio, nominated to be secretary of state, and Pam Bondi, Trump's choice for attorney general.

While those two may generate the most headlines today, the Senate also considered the nomination of Russ Vought to head the Office of Management and Budget (OMB), a position that may come with a lower public profile but is very powerful, with critical responsibility for spearheading the president's budget and coordinating policy and regulations across the federal government.

Vought would play a key role in enacting the Republican agenda to slash spending and shrink the federal government — and he signaled that the Trump administration might pick a constitutional fight over Congress's power of the purse.

An 'aggressive cost cutter': Vought, 48, has years of experience as a congressional budget staffer and policy wonk, and he was OMB deputy director and director during Trump's first term. In the White House, he was behind a controversial Trump plan to replace thousands of civil servants with political loyalists, among other things.

After leaving government in 2021, Vought started a conservative think tank called the Center for Renewing America, which says its mission, in part, is to "renew a consensus of America as a nation under God with unique interests worthy of defending... ."

Vought was also a key author of the controversial Project 2025, and Trump called him "an aggressive cost cutter and deregulator" when he announced his nomination in November. "Russ knows exactly how to dismantle the Deep State and end Weaponized Government, and he will help us return Self Governance to the People," Trump said at the time.

Vought, along with Trump and others in the incoming administration, has indicated that he stands ready to challenge the congressional power of the purse and the requirement that the president spend funds appropriated by Congress. He has claimed that congressional appropriations are a "ceiling not a floor" for spending. And, along with Trump, he has claimed that the Impoundment Control Act of 1974, which limits a president's ability to refuse to spend appropriated funds, is unconstitutional, even though courts have ruled otherwise.

Republicans back Trump's pick: "Mr. Vought has been a consistent advocate for fiscal sanity and has continually suggested strategies to decrease excess spending," said Republican Sen. Rand Paul, chair of the Senate Committee on Homeland Security & Governmental Affairs. "We need someone with the strength of character like Mr. Vought to put the foot down, to put the hammer down, and say, 'Enough is enough.'

Paul did express some concerns, though, about the president usurping Congress's power.

Democrats raise alarms: Sen. Gary Peters of Michigan, the top Democrat on the committee, said Vought's record at OMB was problematic and raised questions about whether he would follow the law. "Unfortunately, your record and actions in these roles raise serious concerns about how you're going to lead this critical agency that touches literally every single part of the federal government," Peters said. "Above all, I am concerned by actions you took to demonstrate a total disregard for following the laws that Congress has passed, particularly regarding how to spend taxpayer dollars."

Peters asked if Vought would abide by the Impoundment Control Act if confirmed to lead OMB again.

"I will always commit to upholding the law," Vought responded. But he also insisted that he had followed the law during the first Trump administration, disagreeing with findings by the Government Accountability Office that the first Trump administration violated the law by freezing funds for Ukraine.

Asked about the Impoundment Control Act specifically, Vought acknowledged that it is the law of the land but also signaled that the incoming Trump administration will decide whether to follow it or challenge it. "As you know, the president has run on that issue. He believes it's unconstitutional," Vought said, adding, "We'll be developing our approach to this issue and strategy once his administration is in office."

Democratic Sen. Richard Blumenthal of Connecticut said that Vought's stance should be disqualifying. "I'm astonished and aghast that someone in this responsible a position would, in effect, say that the president is above the law and that the United States Supreme Court is entitled to their opinion, but mine should supersede it," he said.

Blumenthal also asked Vought to commit to disburse the $3.8 billion in remaining funds congressionally approved for Ukraine. Vought would not explicitly do so. "I'm not going to get ahead of the policy response of the incoming administration," he said.

Sen. Elissa Slotkin of Michigan said that she was disturbed by Vought's evasive, bureaucratic answers on constitutional issues. "I don't quibble at all with the fact that the president is going to put in people that I don't agree with on a policy perspective," she said. "My concern with you and with potential secretary [of defense] Hegseth yesterday is that, when asked clear constitutional questions about the allocation of money, you can't answer a straight constitutional question."

Vought responded by pledging that he "absolutely will abide by the Constitution at all times."

The bottom line: Vought appears likely to sail through to confirmation by the Republican-led Senate, and the incoming Trump administration appears headed for a constitutional fight over presidential authority over spending.

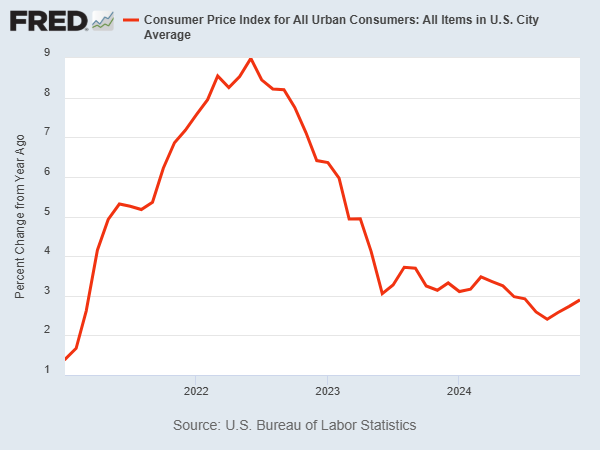

Inflation Picks Up in December, but Underlying Trend Is Muted

The Consumer Price Index rose 2.9% in December on an annual basis, accelerating from the 2.7% rate recorded in November, the Labor Department reported Wednesday. While the annual result met expectations, the monthly increase of 0.4% was higher than expected by a tenth of a point and the highest reading since February.

The jump in inflation was driven by energy, with gasoline prices rising 4.4% in December, accounting for 40% of the overall index increase. Food prices rose, as well, up 0.3% on a monthly basis.

The overall CPI index points toward sticky inflation that remains stubbornly above the Federal Reserve’s 2% target. However, the core measure — which leaves out volatile food and fuel prices and is seen by the Fed as providing a better sense of the underlying trend — told a different story, providing some good news as it came in below expectations at 3.2% on an annual basis, down from the 3.3% rate recorded during each of the last three months.

The mixed results were interpreted in different ways, with many celebrating the drop in the core rate. “The underlying inflation trends look very healthy,” said Julia Coronado, a former Fed economist and president of MacroPolicy Perspectives, per The Wall Street Journal. Investors agreed, sending stocks sharply higher as analysts contemplated lower inflation rates over the medium and long term.

At the same time, the prospects for more interest rate cuts by the Fed are looking a bit worse. “With a labor market that’s stabilizing, with inflation already above target and with risks further to the upside, I think it’s difficult to make a case to keep cutting,” said Aditya Bhave of Bank of America, per The New York Times.

And some analysts saw worrying signs in the details. “While we welcomed a modest deceleration in core CPI ... once one digs beneath the headline figures, the data all points to sticky inflation in both the service sector and in housing,” RSM Chief Economist Joseph Brusuelas wrote in a research note. “This data in our estimation is not well aligned with arguments for near-term rate cuts as the aggregate demand driven by consumer spending continues to support economic growth near 3%, which is well above the long-term trend of 1.8%.”

Fed officials are expected to take a wait-and-see approach to interest rate policy, especially as the new Trump administration takes over and pushes for potentially inflationary policies including tariff hikes and tax cuts. “The Fed has the luxury of a little bit of time to wait for President Trump to take office and to see exactly what happens,” James Egelhof, chief U.S. economist at BNP Paribas, told the Times.

The bottom line: Inflation has come down significantly over the last two years, but the Fed’s 2% target rate remains elusive.

Yellen Defends Pandemic Spending

Treasury Secretary Janet Yellen defended the Biden administration’s economic policies in a speech Wednesday to the New York Association for Business Economics.

Noting that the U.S. economy is outperforming its peers, Yellen attributed the strong performance to the Biden administration’s focus on maintaining employment during the pandemic through massive federal spending, which included stimulus checks, enhanced child tax credits and more generous unemployment benefits. As a result of those policies, the economy achieved a “soft landing” from the burst of inflation that accompanied the pandemic, with strong growth, cooling inflation and low unemployment, making the U.S. the “envy of the world,” she said, quoting The Economist magazine.

“All policy choices entail tradeoffs, but the Biden Administration made sound decisions that set the economy on a strong course,” she said in her prepared remarks.

Yellen admitted that challenges remain, including rising costs and stagnating wages. The Biden administration’s effort to boost the economy’s productive capacity was focused on those issues, she said, though it could take years of sustained effort to see significant results.

An unsustainable path: Yellen also addressed the fiscal outlook, saying that the “projected fiscal path under current budgetary policies is simply not sustainable,” citing “multiple rounds of tax cuts for the wealthiest Americans” as a key driver. She called on Congress to pass tax increases on the wealthy as proposed by President Joe Biden, and to allow the 2017 tax cuts to expire for those earning more than $400,000 per year.

“As we look ahead, the government must give more weight to fiscal sustainability concerns when determining both tax and spending priorities,” Yellen said. “Long-term interest rates are not within the government’s control, but the current, higher interest rate environment necessitates lower primary budget deficits than in the past to ensure fiscal sustainability.”

Pharma Middlemen Cost Consumers $7.3 Billion: FTC

The Federal Trade Commission released a report this week charging that the three largest middlemen in the prescription drug business, known as pharmacy benefit managers, jacked up the prices of specialty generic drugs by thousands of percent between 2017 and 2022, costing U.S. consumers $7.3 billion.

The firms, known as PBMs, are UnitedHealth Group's Optum RX, CVS's Caremark and Cigna's Express Scripts. The FTC said the drugs involved include treatments for cancer, heart disease and HIV, and the price markups over acquisition costs came to “hundreds and thousands of percent” in some cases.

“FTC staff have found that the Big 3 PBMs are charging enormous markups on dozens of lifesaving drugs,” Hannah Garden-Monheit, director of the FTC’s Office of Policy Planning, said in a press release. “We also found that this problem is growing at an alarming rate, which means there is an urgent need for policymakers to address it.”

Anjalee Khemlani of Yahoo Finance noted that the PBMs are all part of larger healthcare businesses. “The higher markups mean more money is being transferred internally within the verticals of these larger companies,” she wrote. “The three PBMs all belong to companies that also have insurance plans, and some also have pharmacies. That means higher prices contribute to the companies' profits.”

All three companies dispute the FTC’s findings, claiming that they save money for consumers overall.

Fiscal News Roundup

- Trump's Pick for Budget Chief Echoes His 'Power of the Purse' Dreams – Politico

- Russell Vought Poised to Expand Power of White House Budget Office – New York Times

- Vought Distances Himself From Past Statements About Government Shutdowns – The Hill

- Jeffries: With Narrow Margin, House GOP Can't 'Pass Anything Close' to Bill Johnson Floating – The Hill

- Freedom Caucus Floats Corporate Tax Boost in Exchange for Easing State, Local Deduction Cap – Politico

- GOP Rep to Reintroduce Bill to Eliminate Taxes on Overtime Pay – The Hill

- House Democrats Announce New Appropriators, With Clyburn Bumping Quigley Off Transportation Panel – Politico

- Inflation Sped Up in December, a Fresh Challenge for the Fed – New York Times

- GOP to California: Build Back Better – Politico

- Padilla Calls for 'No Strings Attached' Support for California Amid GOP Criticism – The Hill

- Biden Administration Cancels Loans for 260,000 Former Ashford University Students – Associated Press

- US Recovers $31 Million in Social Security Payments to Dead People – Associated Press

Views and Analysis

- The Most Terrifying Answer in Trump's Budget Chief Hearing – Ellie Quinlan Houghtaling, New Republic

- Inflation Vibes Get Another Nasty Surprise – Jonathan Levin, Bloomberg

- Economists Say Los Angeles Fire to Have Limited National Economic Impact – Michael S. Derby, Reuters

- Donald Trump Is Already Bungling Disaster Relief – Ryan Cooper, American Prospect

- Trump Assembles His Wrecking Crew as He Tries to Take on Washington – Tom Foreman, CNN

- Trump's Delight in Disruption Threatens the Economy – Bloomberg Opinion Editorial Board

- Save the Inflation Reduction Act (in Part) – Ted Nordhaus and Alex Trembath, Wall Street Journal

- We Deserve Pete Hegseth – David Brooks, New York Times

- Ramaswamy Has a High-Profile Perch and a Raft of Potential Conflicts – Rebecca Robbins, Maureen Farrell and Jonathan Weisman, New York Times