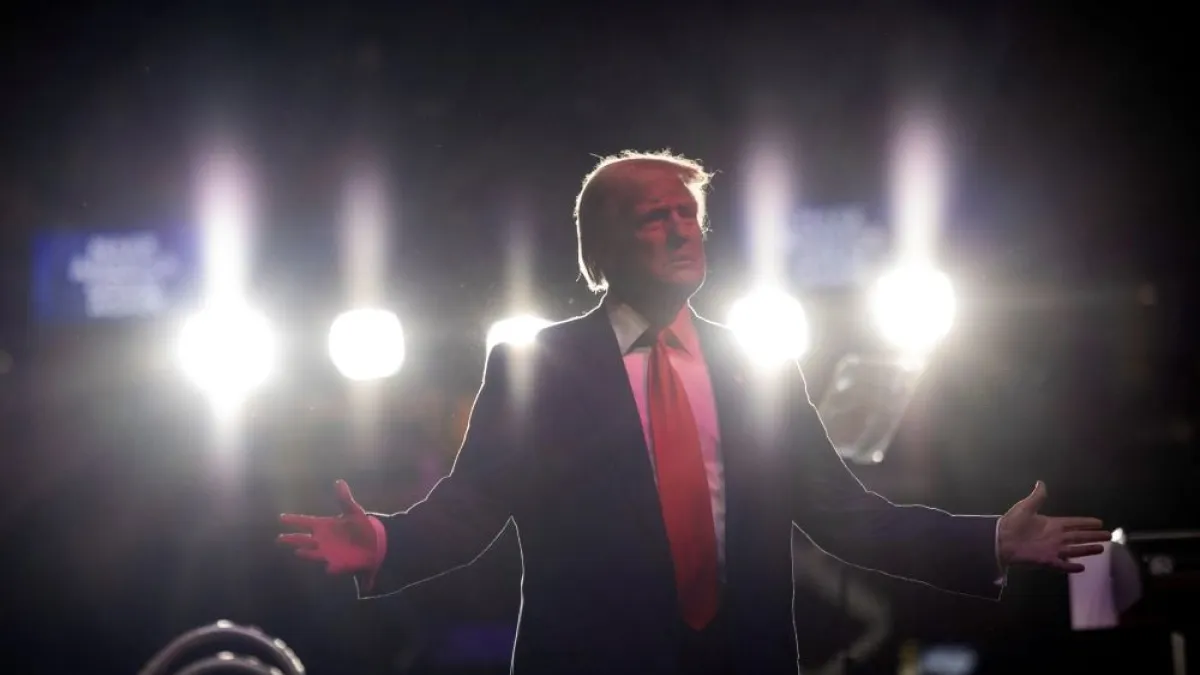

With 12 days and counting until Election Day, former President Donald Trump is campaigning in Tempe, Arizona, and has a rally scheduled in Las Vegas tonight, while Vice President Kamala Harris is set to host a rally in the Atlanta suburbs tonight with former President Barack Obama and Bruce Springsteen. Harris is scheduled to hold another rally in Houston tomorrow, where Beyoncé is expected to appear. Harris’s running mate, Gov. Tim Walz of Minnesota, is campaigning in North Carolina this evening along with musician James Taylor.

We should warn you: The way the race is going, there’s a good chance this newsletter ends up being as much about playlists as about policy over the final days of the campaign. But here’s a fiscal update.

Trump’s Impossible Tax Cut

The New York Times today devotes a little over 1,100 words by reporter Andrew Duehren to examining a policy idea floated vaguely by former President Donald Trump: eliminating federal income taxes and replacing the lost revenue via tariffs.

Under a headline that reads “Trump Flirts With the Ultimate Tax Cut: No Income Taxes at All,” Duehren notes — as we did the other day — that Trump has spoken approvingly of the economic and tariff policies of the 1890s and Republican President William McKinley, and has floated or expressed openness to the idea of returning to such policies, when there was no federal income tax.

“Mr. Trump has not provided specific details of how that would work, and it is unclear if he wants to eliminate all federal taxes, including corporate income taxes and payroll taxes, or only end the individual income tax,” Duehren points out. “Either way, both liberal and conservative experts have dismissed his idea as mathematically impossible and economically destructive. Even if Republicans control Congress, lawmakers are unlikely to dismantle the income tax system.”

Duehren adds that the federal income tax system arose after the high tariffs of the 1890s that funded the federal government were criticized by Democrats of that era as a burden on poor Americans. It was meant to have the rich pay more, addressing concerns about inequality, and to help fund a larger federal government.

The result: “Tariffs dwindled as a source of federal revenue while income taxes expanded,” Duehren writes. “Today, tariffs make up just 2 percent of federal revenue, while income and payroll taxes make up about 94 percent. Overall, the tax system is progressive: In 2020, the top 20 percent of earners in the United States paid about 80 percent of all federal taxes, according to the Congressional Budget Office.”

It would now be essentially impossible to replace all income tax revenue with money from tariffs given that the U.S. imports about $3 trillion worth of goods a year, but the Treasury took in some $4.2 trillion in income taxes and payroll taxes in fiscal year 2024 — and astronomically high tariffs could lead to damaging trade wars that dry up global trade with the United States, producing little tariff revenue.

The bottom line: Trump hasn’t detailed how this idea might work — because it wouldn’t.

Editorial of the Day: Trump’s Social Security Problem

“We might be just one presidency away from the Social Security system’s insolvency,” The Washington Post’s Editorial Board warns today.

Social Security’s trust funds are projected to expire in 2034, meaning that beneficiaries could face a 21% cut in their payments — or that Congress and the president would have to scramble to avoid that outcome, unless they do something about it sooner. “In a more sensible world, Ms. Harris and Mr. Trump would already be laying out credible plans for putting the program’s finances in order,” the editorial board writes.

Instead, a recent report from the Committee for a Responsible Federal Budget said that Trump’s policies would accelerate the depletion of the Social Security trust funds by two or three years. “Mr. Trump’s successor would spend most of their term confronting the mother of all budget problems,” the Post editors say.

They add that Vice President Kamala Harris “hardly deserves a prize for political courage and policy specifics in this context. … And, yet, there is a meaningful difference between not proposing a solution to the program’s long-term imbalances, which is Ms. Harris’s posture, and offering to make the problems worse, which is what Mr. Trump is doing.”

Read the full editorial at The Washington Post.

Medicare Advantage Paid Billions for Questionable Home Diagnoses: Report

For-profit insurers in the Medicare Advantage program boosted payments from the federal government by $4.2 billion last year after adding diagnoses for patients during home visits, even though those diagnoses did not result in any additional care, a new report from the Health and Human Services inspector general said Thursday.

The insurers sent nurses to patients’ homes to perform health risk assessments, which in some cases resulted in additional medical issues being added to the patients’ charts. Medicare Advantage pays insurers more for care when patients are deemed to be sicker, even if treatments remain the same. A patient with a complex condition such as morbid obesity, for example, is worth more to the insurer, which can charge a higher rate for their care.

Investigators found that each home visit produced additional payments of $1,869 per patient on average, purely through increased payment levels rather than added care.

As The Wall Street Journal’s Christopher Weaver and Anna Wilde Mathews noted, the per-patient revenue increase found by the inspector general is similar to that found by the Journal in previous years. In August, the Journal reported that its own analysis found that between 2019 and 2021, insurers were paid an additional $1,818 per patient as a result of adding diagnoses to patient charts, and thereby increasing payment rates.

The bigger picture: Medicare Advantage was supposed to save money through efficiencies generated by marketplace competition, at least in theory, but insurers seem to have figured out ways to game the system to increase their profits.

“We’re seeing that some Medicare Advantage companies are making billions from the health risk assessment diagnoses without providing care for the conditions that they identify,” said Erin Bliss, assistant inspector general for evaluation and inspections, per the Journal. “Profiting off enrollees’ medical conditions without providing treatment for those conditions is wrong,” she added.

UnitedHealth, one of the largest providers of Medicare Advantage, disputed the findings. “A misleading, narrow, and incomplete view of risk adjustment data is being used to draw inaccurate conclusions about the value of in-home care for America’s most vulnerable seniors in Medicare Advantage,” a spokesperson said.

But to some observers, the news comes as no surprise. “I’m not wary of privatized Medicare Advantage plans because I’m a socialist, but because I’m a capitalist,” Brett Arends, a columnist at MarketWatch, wrote Thursday. “What part of ‘profit maximization’ do people not understand?”

Number of the Day: 1.897 Million

The number of Americans filing new applications for unemployment benefits fell by 15,000 to 227,000 last week, according to the Labor Department, but the number of people collecting benefits rose 28,000 to 1.897 million, the highest level since November 13, 2021.

“The rising level of continuing claims suggests that some who are receiving benefits are finding it harder to land new jobs,” writes Matt Ott of the Associated Press. “That could mean that demand for workers is waning, even as the economy remains strong.”

Economists Carl B. Weinberg and Rubeela Farooqi of High Frequency Economics wrote in a note to clients that the rise in continuing claims is “a not-too-alarming sign of a slowing economy… but there is no sign of a crash in employment or a surge of layoffs in these data.”

They added that there is no sign of recession either. “The labor market is softening but not imploding. … There is no call for radical monetary easing or fiscal stimulus here.”

Send your feedback to yrosenberg@thefiscaltimes.com.

Fiscal News Roundup

- Trump Flirts With the Ultimate Tax Cut: No Income Taxes at All – New York Times

- GOP Maps Out Agenda for Trump’s First 100 Days – The Hill

- McConnell: ‘MAGA Movement Is Completely Wrong – The Hill

- Donald Trump Says He Would Fire Special Counsel Jack Smith ‘Within Two Seconds’ of Taking Office if Elected President – Associated Press

- Trump Claims He Is ‘Maybe More Conservative Than Any Human Being That’s Ever Lived’ – Associated Press

- The Group at the Center of Trump’s Planning for a Second Term Is One You Haven’t Heard Of – New York Times

- House GOP Committee That Oversees Elections Hired Two Former Trump Officials Involved in 2020 Fake Elector Scheme – CNN

- Inflation Has Cooled, but Americans Are Still Seething Over Prices – Wall Street Journal

- Tax Lobbying Ramps Up in Third Quarter Ahead of Elections – Roll Call

- New Tax-Credit Rules Aid Montana Mining, to Tester’s Delight – Wal Street Journal

- Bad State Data May Misdirect Nearly $1 Billion in Federal Funds to Replace Lead Pipes – Associated Press

- PBM Math: Big Chains Are Paid $23.55 To Fill a Blood Pressure Rx. Small Drugstores? $1.51 – KFF Health News

- Voters Fret High Medical Bills Are Being Ignored by Presidential Rivals – KFF Health News

- Another Thing at Stake on Election Day: A $246,000-a-Year Pension Perk – Wall Street Journal

Views and Analysis

- Harris Calls Trump a Fascist: 6 Takeaways From Her CNN Town Hall – Reid J. Epstein and Lisa Lerer, New York Times

- People Are Calling Trump a Fascist. What Does That Mean? – Zachary B. Wolf, CNN

- Harris Vague on Legislative Plan, Clear on Trump Critique at Pennsylvania Town Hall – John T. Bennett, Roll Call

- Voters Trust Harris on a Number of Issues. But Is That What They’ll Vote On? – Josh Boak, Associated Press

- The Double Standard for Harris and Trump Has Reached a Breaking Point – Eugene Robinson, Washington Post

- It’s the Inflation, Stupid: Why the Working Class Wants Trump Back – Adam Seessel, New York Times

- Trump’s Tariffs Won’t Bring Us Peace and Prosperity – Sen. Rand Paul (R-KY), Wall Street Journal

- Why Trump 2.0 Would Make the World Poorer – Hanna Ziady, CNN

- Social Security Is in Trouble. Trump Promises to Make Things Worse – Washington Post Editorial Board

- How 2026 Tax Brackets Would Change if the TCJA Expires – Erica York, Tax Foundation

- The Inflation Struggle Is Over. Just Don’t Tell Anyone – Daniel Moss, Bloomberg

- US Hospitals Are Hanging by a Thread – Sarah Green Carmichael, Bloomberg

- One Reason I’m Wary of Medicare Advantage? I’m a Capitalist – Brett Arends, MarketWatch