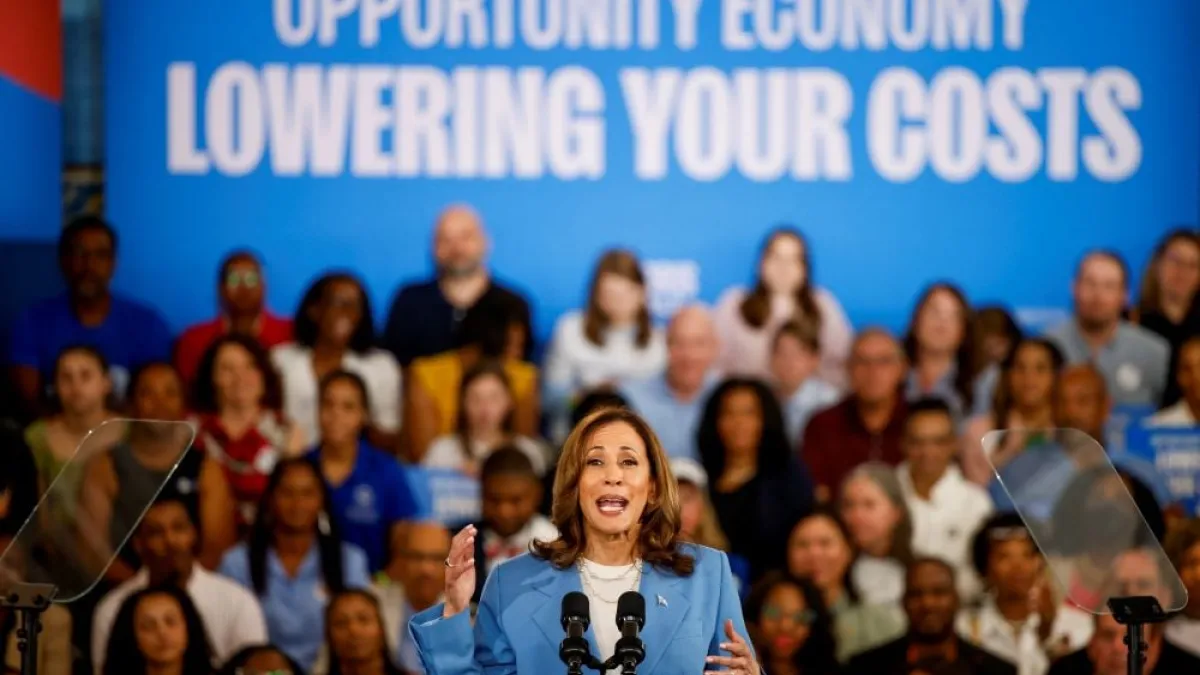

TGIF! Vice President Kamala Harris today made her first major policy speech since entering the 2024 presidential race, laying out an economic plan that she said would lower costs and increase economic security and opportunity for American families. Here’s what you should know.

Harris Targets Middle-Class Affordability in New Economic Agenda

Vice President Kamala Harris on Friday outlined the economic policies she aims to pursue in the first 100 days of her administration, including proposals to subsidize homebuyers, reward families with children and restrict price increases on rent and groceries.

At a campaign rally in Raleigh, North Carolina, Harris said she is focused on the affordability crisis facing many middle-class families, and her proposals target the high prices of food, housing, child care and prescription drugs.

In a document outlining her agenda, Harris broke her proposals into four broad categories:

* Cutting middle-class taxes: In a move her campaign says will benefit more than 100 million Americans, Harries proposes to increase the Child Tax Credit to $3,600 per child – with an extra bump to $6,000 for children in middle-income and low-income families in their first year of life. She would also expand the Earned Income Tax Credit to include households without children, and extend the enhanced subsidies for health insurance provided through the Affordable Care Act that are currently set to expire in 2025.

Though it’s not mentioned in the official campaign outline, Harris — following an earlier proposal from her opponent, former President Donald Trump — has indicated that she supports the idea of eliminating federal income taxes on tips and gratuities.

* Lowering housing costs: Harris calls for the construction of 3 million new homes over the next four years, spurred by tax incentives for homebuilders who focus on first-time buyers, expanded tax benefits for builders of rental units, a $40 billion innovation fund to help local governments build more housing, and an effort to cut red tape and streamline the building process. Harris also proposes to deny tax benefits to real estate investors who buy large numbers of single-family homes and who raise rents by excessive amounts. And she wants to provide first-time homebuyers with as much as $25,000 to assist with down payments.

* Lowering health care costs: Building on the Biden administration’s effort to reduce drug costs for seniors, Harris proposes to cap the cost of insulin at $35 a month and limit out-of-pocket expenses for prescription drugs to $2,000 a year for all Americans. She wants to speed up the process for Medicare to negotiate lower drug prices, and crack down on pharmaceutical firms that block competition and raise prices for consumers. She is also calling for the widescale cancellation of medical debt.

* Lowering grocery costs: In one of her more controversial proposals, Harris says she wants to impose a federal ban on price gouging on groceries, with newly defined rules on what constitutes excessive profits on food sales. As part of that effort, Harris says she’ll crack down on "unfair mergers and acquisitions that give big food corporations the power to jack up food and grocery prices."

Overall, Harris’s economic plans echo the agenda that Biden has pursued over the last four years, with new proposals that address the high prices that remain in place following a period of high inflation during the Covid-19 pandemic. "We all know that prices went up during the pandemic when the supply chains shut down and failed, but our supply chains have now improved and prices are still too high," she told the crowd in North Carolina. "Costs are still too high, and on a deeper level, for too many people, no matter how much they work, it feels so hard to just be able to get ahead."

In her pledge to reduce costs for the essential goods of food, medicine and housing, Harris is trying to convince voters that she can recreate an economy focused on the broad middle. "As president, I will be laser-focused on creating opportunities for the middle class that advance their economic security, stability, and dignity," she said. "Building up the middle class will be a defining goal of my presidency, because I strongly believe when the middle class is strong, America is strong."

Harris also attacked Trump’s economic plan: She was especially critical of his plan to impose tariffs of up to 20% on foreign goods. "It will mean higher prices on just about every one of your daily needs," she said. "A Trump tax on gas, a Trump tax on food, a Trump tax on clothing, a Trump tax on over-the-counter medication."

What the Harris plan would cost: The nonpartisan Committee for a Responsible Federal Budget estimates that the Harris proposals would increase deficits by $1.7 trillion over a decade, or $2 trillion if housing policies the Harris plan says would be temporary are instead made permanent. The total costs include $1.2 trillion for the expansion of the Child Tax Credit, $400 billion for keeping enhanced Affordable Care Act insurance subsidies in place, $150 billion for expanding the Earned Income Tax Credit and $200 billion for housing proposals. Those would be partially offset by $250 billion in prescription drug savings.

Harris did not get into details about how she might pay for the plan. She has pledged to abide by President Joe Biden’s promise not to raise taxes on people earning less than $400,000 a year, and the campaign fact sheet laying out the economic agenda says that Harris and her running mate, Minnesota Gov. Tim Walz, will "fulfill their commitment to fiscal responsibility, including by asking the wealthiest Americans and largest corporations to pay their fair share—steps that will allow us to make necessary investments in the middle class, while also reducing the deficit and strengthening our fiscal health."

Her campaign told the Committee for a Responsible Federal Budget that Harris supports the revenue-raising provisions in Biden’s 2025 budget.

Trump campaign slams "Comrade Kamala": Trump and his allies have been blasting Harris’s proposals, calling some "communist" and saying others were cribbed from them. "If Kamala is elected and implements her Communist Price Caps, there will be famine, starvation, and poverty, the likes of which we have never seen," Trump posted to his social media account. "America will NEVER recover!

Sen. JD Vance, Trump’s running mate, shared a social media post claiming that Harris’s plan was copying his earlier pitch to raise the child tax credit from $2,000 to $5,000 per child. "Kamala Harris will soon propose that we finish the border wall and Make America Great Again," Vance wrote. "No one should be fooled by the fake campaign copying President Trump's vision. The difference is: Trump actually lowered prices as president; Harris is in power *now* and does nothing."

More pushback on Harris’s proposed price-gouging ban: "There is some real skepticism, even among Harris allies, that a federal ban on price gouging would be effective — and whether it is politically wise to seek one," Reid J. Epstein of The New York Times reports. "Some progressive policy wonks I spoke with today said she’d be better off adopting a more Trumpian strategy of shaming specific companies rather than aiming to impose an across-the-board federal government solution to the price of groceries."

Washington Post Columnist Catherine Rampell writes that "it’s hard to exaggerate how bad this policy is," adding that at best it "would lead to shortages, black markets and hoarding, among other distortions seen previous times countries tried to limit price growth by fiat. … At worst, it might accidentally raise prices."

Some economists question how much price gouging is to blame for inflation: "Economists have cited a range of forces for pushing up prices in the recovery from the pandemic recession, including snarled supply chains, a sudden shift in consumer buying patterns, and the increased customer demand fueled by stimulus from the government and low rates from the Federal Reserve," The New York Times reports. "Most economists say those forces are far more responsible than corporate behavior for the rise in prices in that period."

But researchers at the liberal Groundwork Collaborative said in a report early this year that "corporate profits drove 53 percent of inflation during the second and third quarters of 2023."

On the other hand — economists tend to have lots of other hands — some analysts say that companies were only able to book those profits due to strong consumer demand fueled by stimulus efforts. "If prices are rising on average over time and profit margins expand, that might look like price gouging, but it’s actually indicative of a broad increase in demand," Joshua Hendrickson, an economist at the University of Mississippi, told the Times. "Such broad increases tend to be the result of expansionary monetary or fiscal policy — or both."

Harris would need help from Congress: While some parts of Harris’s plan rely on regulatory authority, much of it would have to be enacted via congressional legislation — meaning that it might never happen, even if she’s elected.

What’s next: Trump will hold a rally Saturday in Wilkes-Barre, Pennsylvania. Harris and her running mate, Minnesota Gov. Tim Walz, will campaign in the western part of the state on Sunday ahead of the Democratic National Convention, which kicks off on Monday in Chicago. Harris is also set to lay out other elements of her economic agenda in the weeks ahead.

Quote of the Day

"That is not an example of inflation; it’s just two different sizes of breath mints. I mean, my understanding of macroeconomics is limited, but I do know for a f---ing fact that inflation is not defined as ‘big Tic Tac, little Tic Tac.’"

– "The Daily Show" host Desi Lydic responding Thursday night to remarks purportedly on the economy by Donald Trump on Wednesday, when the former president held up two different sized boxes of Tic Tacs, the smaller of which he said was an example of inflation.

The Inflation Reduction Act Turns 2

Today marks the second anniversary of President Joe Biden’s signature Inflation Reduction Act, which, despite its name, was really aimed more at combatting climate change, making historic investments in clean energy, reducing healthcare costs and raising taxes on corporations.

The political battle over the legislation has picked up again, now in the context of the presidential race. Biden and Vice President Kamala Harris, who cast a decisive tie-breaking vote for the bill in the Senate, yesterday celebrated key elements of the law, which allowed for Medicare to negotiate some drug prices and capped out-of-pocket costs for prescription drugs at $2,000 a year.

"We finally beat Big Pharma and, I might add, with no help from Republicans — not a single Republican voted for this bill, period," Biden said. "Not one in the entire Congress."

Biden warned that Republicans still want to undo the law. "The guy we’re running against — what’s his name? Donald Dump or Donald whatever — they want to get rid of this, what we passed," Biden said.

Trump has certainly been critical of the law and has tried to use it against Harris, claiming that it caused inflation and unleashed an army of IRS agents targeting the middle class.

"Their Inflation Reduction Act, by the way, was a disaster," Trump said Thursday. "It’s what caused the inflation." He also called the law a "con job," saying that the title had little to d with the contents and that people didn’t really understand what was in the bill, though he did.

A recent analysis by Climate Power, an advocacy group, said that companies have announced or started projects representing more than 334,000 new clean energy jobs since August 2022, and more than $372 billion in investments across 47 states.

"A bulk of the new clean energy projects are located in congressional districts represented by Republican members of the House of Representatives — totaling 190,727 new jobs and over $286 billion in investment," the group said.

And earlier this month, 18 House Republicans urged House Speaker Mike Johnson to keep the clean energy tax credits in the law, though they remain critical of the legislation overall.

The bottom line: The impact of the law will increasingly be felt as time goes on, and the debate over it will continue throughout this election.

Fiscal News Roundup

- Kamala Harris Unveils Populist Policy Agenda, With $6,000 Credit for Newborns – Washington Post

- Harris Offers Proposals to Cut Food and Housing Costs, Trying to Blunt Trump’s Economic Attacks – Associated Press

- Trump Advisers Slam Harris Economic Plan: ‘Something Out of Venezuela or Cuba’ – The Hill

- Harris Vows Biden-Era Health Care Programs Will Get Bigger if She’s Elected – The Hill

- Republicans Can’t Help But Love Biden’s Signature Piece of Legislation – Rolling Stone

- Trump Says Presidential Civilian Award Is 'Better' Than Top Military Honor Whose Recipients Are 'Dead' or 'Hit' by Bullets – NBC News

- Trump Transition Chair Pick Signals Think Tank Influence– Politico

- US Consumer Sentiment Increases for First Time in Five Months – Bloomberg

- Jamie Dimon Says the 'Buffett Rule' Approach to Taxing the Wealthy Could Solve America's Debt Problem – Business Insider

- Data Analytics Firm That Has Helped Major Health Insurers Make Billions Faces Growing Scrutiny – New York Times

- U.S. Awards $1.6 Billion to Texas Instruments to Build Semiconductor Plants – New York Times

Views and Analysis

- Kamala Harris’s Economic Plan: Good Politics, Meh Policy – Jonathan Chait, New York

- Harris Plans to Ban Grocery ‘Price Gouging.’ What Does the Evidence Say? – Jim Tankersley and Jeanna Smialek, New York Times

- Kamalanomics Contains Too Much of Some Good Things – Gabriel Rubin, BreakingViews

- Economics According to Harris – Robert Kuttner, American Prospect

- When Your Opponent Calls You ‘Communist,’ Maybe Don’t Propose Price Controls? – Catherine Rampell, Washington Post

- 30 Years Ago, Two Young Strategists Cracked How to Beat a Guy Like Trump. Are Democrats Ready to Listen? – Timothy Shenk, New York Times

- 5 Takeaways From First Medicare Drug Price Negotiations – Nathaniel Weixel and Joseph Choi, The Hill

- Are You Ready for ‘Kamalanomics?’ – Merrill Matthews, The Hill

- Project 2025 Is Still a Threat – Sarah Jones, New York

- The Inflation Reduction Act at Two – David Dayen, American Prospect

- It's Been Two Miserable Years Since the Biden-Harris Inflation Reduction Act. And It's Worse Than You Think – Rep. Jodey Arrington (R-TX), Fox News

- Two Years in, the Inflation Reduction Act Is Uniting America and Driving Clean Energy Growth – Anne Kelly, Reuters