Happy Groundhog Day! Both Punxsutawney Phil and Staten Island Chuck predicted early springs today, but we wouldn’t recommend trusting these rodents for any crucial weather-related planning; The National Centers for Environmental Information, part of the National Oceanic and Atmospheric Administration, says that Phil has been right only three times in the past 10 years.

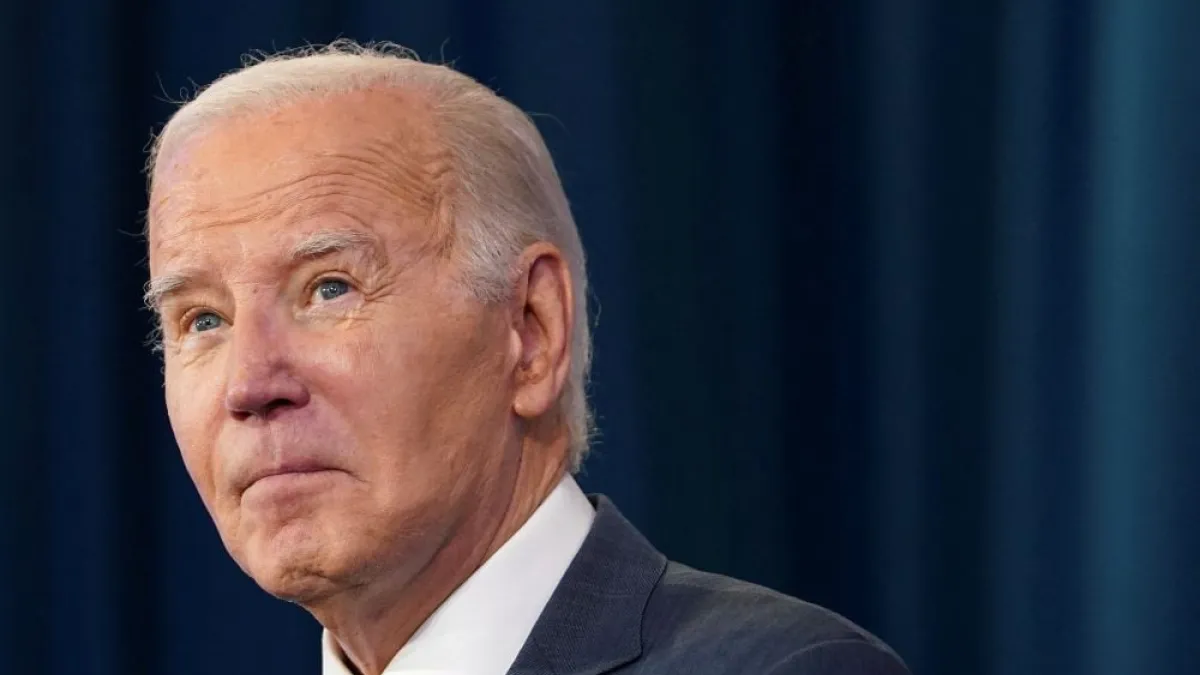

Biden Touts a Jobs Boom After Another Stunningly Strong Report

A U.S. labor market that just won’t quit turned in another strong performance in January, once again defying expectations of a slowdown as employers created 353,000 new jobs to start the new year.

The results crushed economists’ expectations, nearly doubling the Dow Jones estimate of 185,000 jobs added. The unemployment rate also beat expectations, as it held steady at 3.7% rather than ticking slightly higher. And job growth in previous months was revised higher, adding 126,000 more jobs to the totals for November and December.

Job creation was broad-based, with new jobs created in almost all sectors, led by professional and business services (74,000 jobs), healthcare (70,000), retail (45,000) and governments at all levels (36,000). Manufacturing also saw growth, adding 23,000 positions. Mining and gas extraction were among the few sectors reporting job losses.

Wages growth was also robust, with average hourly earnings climbing 0.6% from December to January. On an annual basis, wage growth clocked in at 4.5%.

Biden touts a continuing jobs boom: President Joe Biden took a victory lap after the news was released. “America’s economy is the strongest in the world,” Biden said in a statement that linked the strong performance to his economic policies. “Today, we saw more proof, with another month of strong wage gains and employment gains of over 350,000 in January, continuing the strong growth from last year. Our economy has created 14.8 million jobs since I took office, unemployment has been under 4% for two full years now, and inflation has been at the pre-pandemic level of 2% over the last half year.”

It remains to be seen, however, whether the latest in a stream of good economic news will benefit Biden politically. A new CNN poll released Friday shows that nearly half of Americans think the economy is still in a downturn, while just 26% think it is recovering. More broadly, only 35% of poll respondents said the country is doing well overall – an improvement over the 28% who said so in the fall, but still a troublingly small percentage for a political leader heading into an election.

What the experts are saying: One big takeaway from the latest jobs data is that the labor market is showing no sign of cooling down, which is great news for workers but potentially problematic for Federal Reserve officials who are looking for signs that inflation will continue to ease.

“There is simply no way that 350,000 job gains in a month is consistent with a further cooling of the labor market,” Fitch Ratings economist Brian Coulton said in a note. “This elevates the risk that nominal wage growth will not fall back to levels consistent with reaching the inflation target on a sustained basis, particularly as the labor force participation rate refuses to rise any further.”

Analysts now expect the Fed to hold its benchmark rate at the current level of 5.25% to 5.5% for longer, with a March rate cut all but ruled out. Rubeela Farooqi, chief U.S. economist at High Frequency Economics, told the Associated Press that Fed officials “will be in no rush to lower rates if job and wage growth continue to be robust over coming months.” Interest rates on Treasuries jumped on Friday as investors adjusted their expectations.

Still, leaving aside potential issues for the Fed, the report was widely seen as good news all around. “The report was pretty universally positive,” said Gennadiy Goldberg, head of U.S. rates strategy at TD Securities, per The Wall Street Journal. “We’ve seen strong gains on headline payrolls, strong revisions and the unemployment rate staying unchanged. It is showing that the labor market is doing better than previously expected.”

Joseph Brusuelas, chief economist at RSM US, told CNN that the report could be described in one word. “The fact that the unemployment rate has been below 4% for 24 months straight for the first time since 1967 is truly remarkable,” he said. “And that’s the word I keep saying as I look through this report: ‘This is remarkable.’ ‘Remarkable,’ is the takeaway here.”

Numbers of the Day: $2 Billion and $650 Million

California on Thursday agreed to spend at least $2 billion to help students recover from pandemic-related learning disruptions. The agreement settles a class-action lawsuit representing families in the Oakland and Los Angeles school districts that claimed the state had failed to provide and equal education to lower-income, predominantly Black and Hispanic, students.

Connecticut, meanwhile, announced Friday that it will cancel about $650 million in medical debt for 250,000 state residents, saying it is the first state in the nation to take such action. The state reportedly plans use some $6.5 million in pandemic funds from the American Rescue Plan Act to cancel roughly $1 billion in medical debt this year. It will do so by contracting with a nonprofit that buys the debt at a reduced cost and then wipes it out.

Residents with household income up to 400% of the federal poverty line (or $124,800) or whose medical debt amounts to 5% or more of their annual income will be eligible, but those households reportedly will not need to apply for the cancellation and are instead expected to have their debts automatically cleared by June.

The Connecticut announcement comes after New York City last month said it would spend $18 million over three years to retire medical debt totaling more than $2 billion, benefiting as many as 500,000 city residents.

RIP, Carl Weathers. Send your feedback to yrosenberg@thefiscaltimes.com. And please encourage your friends to sign up here for their own copy of this newsletter.

Fiscal News Roundup

- Congress Braces for Border Deal Text – The Hill

- Supplemental Vote Expected Next Week, but Path to Passage Fraught – Roll Call

- House-Passed Tax Bill Heads Into Senate GOP Buzzsaw – The Hill

- Speaker Johnson Says Biden Not ‘Allowed’ by Staff to Take Action on Border – The Hill

- Poll: Public Views of the Economy Are on the Rise, but Remain Dim – CNN

- The Soft Landing Is Global, but It’s Cushiest in America – New York Times

- A Suddenly Media-Shy Speaker Can’t Answer Questions. He’s on the Phone. – New York Times

- Six Reasons Why It’s So Hard to Get Your Weight-Loss Drugs – New York Times

- California Aims $2 Billion to Help Students Catch Up From the Pandemic – New York Times

Views and Analysis

- Biden Should Begin the Tax Wars Now – Dylan Gyauch-Lewis, American Prospect

- Crisis! Crisis! Crisis! Oh, Never Mind. – Dana Milbank, Washington Post

- Republicans’ Immigration Bill Is Not Serious Legislation – Eduardo Porter, Washington Post

- Senator Lankford Paints a Stark Portrait of GOP Border-Deal Critics – Aaron Blake, Washington Post

- One of Biden’s Two Problems on the Economy Is Improving – Philip Bump, Washington Post

- The Economy Looks Sunny, a Potential Gain for Biden – Jim Tankersley, New York Times

- 5 Takeaways From a Stunning January Jobs Report – Tobias Burns, The Hill

- Economists Expected a Hiring Slowdown. So Much for That – Jeanna Smialek, New York Times

- Our Economy Isn’t ‘Goldilocks.’ It’s Better – Paul Krugman, New York Times

- It’s Crazy That the Booming Economy Is Hurting Biden – Jonathan Chait, New York

- Inflation Has Fallen. Why Are Groceries Still So Expensive? – Abha Bhattarai and Jeff Stein, Washington Post

- Mad at Biden Over the Economy? Take Our Quiz. – Washington Post Editorial Board