A big day for Congress and the Biden administration. The House passed the $280 billion “Chips and Science Act” in a bipartisan vote that delivers a win for President Joe Biden. And Democrats seemed to (mostly) coalesce behind the big new climate and tax deal announced Wednesday by Sen. Joe Manchin (D-WV) and Senate Majority Leader Chuck Schumer (D-NY). “It’s been a momentous 24 hours here in Congress, a legislative one-two punch that the American people rarely see,” Schumer reportedly crowed Thursday afternoon. But economic concerns could still burst Democrats’ newfound optimism.

Here’s what’s happening.

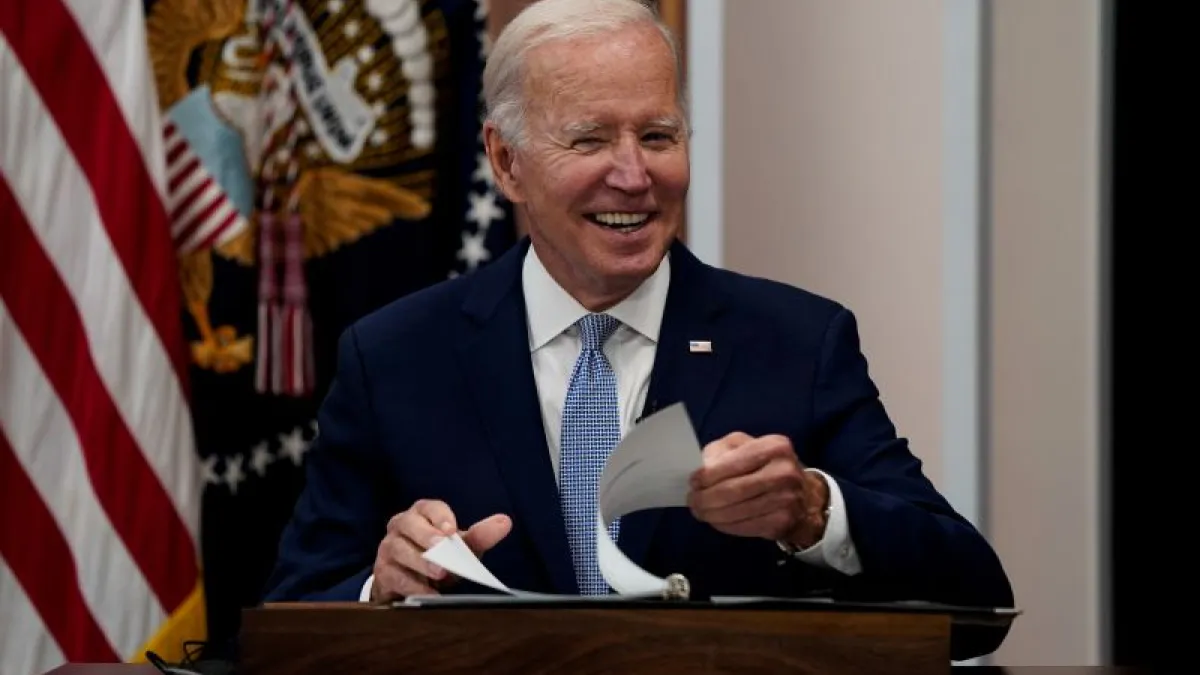

Biden Touts New 'Inflation Reduction Act'

President Biden on Thursday touted Democrats’ new package of climate, tax and health care measures — now dubbed the Inflation Reduction Act of 2022 — and urged Congress to quickly pass the deal unveiled Wednesday in a surprise announcement by Sens. Joe Manchin (D-WV) and Chuck Schumer (D-NY).

“Look, this bill is far from perfect,” Biden said. “It’s a compromise. But it’s often how progress is made: by compromises. And the fact is that my message to Congress is this: This is the strongest bill you can pass to lower inflation, cut the deficit, reduce health care costs, tackle the climate crisis, and promote energy security, all the time while reducing the burdens facing working-class and middle-class families. So, pass it. Pass it for the American people.”

Here, a few takeaways on the bill — click here for more on what’s in it — and the path it faces.

It would reduce inflation, and the deficit: Manchin had previously balked at Democrats’ climate and tax measures, but he told reporters Thursday that he came around on the deal after concluding that it would help lower inflation. Manchin reportedly reached that conclusion with some help from Larry Summers, the former Treasury secretary who had been vocal in opposing last year’s $1.9 trillion stimulus act and warning that it would fuel inflation.

And the fiscal watchdogs at the Committee for a Responsible Federal Budget say that the bill’s $305 billion in deficit cuts represent “the first meaningful deficit reduction in a decade,” adding that those budgetary effects, along with some of the policies in the bill, will help fight inflation and lower the risk of a recession.

“The Most Ambitious Climate Action Undertaken by U.S.”: The Democratic package includes $385 billion in energy and climate provisions, and while the funding for such measures is less than the $550 billion Democrats sought under the failed Build Back Better Act, the new deal still represents “the most ambitious action ever taken by the United States to try to stop the planet from catastrophically overheating,” as Lisa Friedman and Brad Plumer report in The New York Times. Senate Democrats reportedly estimate that the legislation will enable the country to cut greenhouse gas emissions from 2005 levels by 40% by the end of the decade, close to the 50% goal set by Biden in accordance with scientific guidance.

Manchin won more concessions: Emily Cochrane of the Times reports that Manchin ultimately agreed to the deal after getting Democrats to make some more changes. “The critical concessions that ultimately won Mr. Manchin’s support included jettisoning billions of dollars’ worth of tax increases he opposed and winning a commitment from President Biden and Democratic leaders to enact legislation to streamline the permitting of energy infrastructure,” Cochrane writes. “That could ease the way for a shale gas pipeline project in West Virginia in which Mr. Manchin has taken a personal interest.”

It’s not a done deal: Democrats could still snatch defeat from the jaws of victory ... again. Most notably, Sen. Kyrsten Sinema (D-AZ) has yet to sign off on the deal and had previously opposed some elements included in the new package. Analyst Chris Krueger of the Cowen Washington Research Group suggests that the proposed reforms to the carried interest tax law might get cut to win Sinema’s support, calling it “classic DC negotiation-style to put something in a bill only to have it removed later so that a lawmaker (see: Sinema, Kyrsten) can claim a ‘win’.”

House Passes Chips Bill, Delivering a Bipartisan Win for Biden

The House of Representatives on Thursday passed a $280 billion package aimed at bolstering the U.S. semiconductor industry and boosting domestic scientific and technological research in order to improve competitiveness with China. The bill, which passed the Senate Wednesday, now head to President Joe Biden’s desk for his signature, providing the administration with a legislative victory.

“Today, the House passed a bill that will make cars cheaper, appliances cheaper, and computers cheaper,” Biden said in a statement Thursday afternoon. “It will lower the costs of every day goods. And, it will create high-paying manufacturing jobs across the country and strengthen U.S. leadership in the industries of the future at the same time. The CHIPS and Science Act is exactly what we need to be doing to grow our economy right now.”

The House vote was 243-187, with 24 Republicans joining 219 Democrats in backing the bill even after House Republican Leader Kevin McCarthy of California urged GOP members to reject it — a stance that The Washington Post said came as retribution for Senate Democrats’ surprise agreement on a budget reconciliation package, “an effort to deny Biden and Senate Majority Leader Charles E. Schumer (D-N.Y.) a legislative win.”

Rep. Frank Lucas (R-OK), the top Republican on the House Science Committee, said he “regrettably” could not support the chips bill because of Democrats’ other spending plans. "I cannot ignore the fact that the immense tax hikes and irresponsible spending in the expanded reconciliation package change the calculus when it comes to supporting spending bills, particularly a bill that has come to be tied to reconciliation," Lucas said.

The Senate’s 64-33 vote a day earlier saw 17 Republicans, including Senate Minority Leader Mitch McConnell (R-KY), support the bill along with 47 Democrats.

The legislation will provide $52.7 billion for U.S. chipmakers and some $24 billion more in tax credits for the industry. It also provides hundreds of billions of dollars for scientific research and technological development.

US Economy Shrinks Again: Recession or Not?

Gross domestic product fell at an annual rate of 0.9% in the second quarter, the Bureau of Economic Analysis announced Thursday in its preliminary analysis of the April-June period, sparking fresh worries that the economy may be in a recession.

The second-quarter contraction was driven by a slowdown in consumer consumption, a drop in business inventories and a substantial decline in gross private investment. Government spending fell, as well, at both the federal and state and local levels.

Inflation played a major role, as well. In addition to battering consumers and businesses alike, inflation consumed all of the nominal growth during the quarter as prices grew faster than consumption. Without adjusting for inflation, in purely nominal terms, GDP grew at a 7.8% annual rate, the BEA said.

Recession or not? The economy has now contracted for two quarters in a row, satisfying an informal — though by no means definitive — rule of thumb that defines a recession as two quarters of negative growth. As countless economists and journalists have reminded us, though, the group that formally declares when a recession occurs, the nonprofit National Bureau of Economic Research, considers a variety of factors when determining the incidence of a recession, with quarterly growth one key factor among several others. For example, the experts also look closely at the labor market, which continues to be quite strong and is not pointing toward recessionary conditions.

“The back-to-back contraction of GDP will feed the debate about whether the U.S. is in, or soon headed for, a recession,” Sal Guatieri of BMO Capital Markets said Thursday. “The fact that the economy created 2.7 million payrolls in the first half of the year would seem to argue against an official recession call for now.”

This line of thinking has considerable support among many economists, as well as Biden administration officials, who have pushed back against talk of recession in the days leading up to the release of the GDP report. On Thursday they pushed back once again.

“We should avoid a semantic battle” over the meaning of the word recession, Treasury Secretary Janet Yellen said at a press conference. What matters is the overall state of the economy, and whether we are seeing a “broad-based weakening,” Yellen said, adding, "That's not what we're seeing right now.”

President Biden also disputed the idea that the economy is now in a recession. The labor market “remains historically strong, with unemployment at 3.6% and more than 1 million jobs created in the second quarter alone,” while consumer spending continues to grow, Biden said in a statement.

“Coming off of last year’s historic economic growth — and regaining all the private sector jobs lost during the pandemic crisis — it’s no surprise that the economy is slowing down as the Federal Reserve acts to bring down inflation,” Biden said.

What comes next? While there may be reason to doubt that the U.S. is currently in a recession, there is far more uncertainty about where the economy is headed. To ING economist James Knightley, a recession seems likely, if not now, then in the coming months. “Officials will say this isn't a 'real' recession, but with the squeeze on households intensifying, it is only going to be a matter of time,” he said in a note.

Other analysts are less certain, with some emphasizing that the Fed is intentionally slowing the economy in its effort to bring inflation under control, and slowing doesn’t necessarily mean shrinking. “We’re seeing a sharp and necessary deceleration rather than a recession,” said David Mericle, chief U.S. economist at Goldman Sachs. “I wouldn’t say we seem to be in contractionary territory on a go-forward basis.”

For RSM’s Joseph Brusuelas, the economy is teetering on the edge. “While the broader economy is likely not in a formal recession, economic activity in the real economy will remain on a knife’s edge in the near term,” he said in a note. Some parts of the economy are probably contracting already, Brusuelas said, including consumption by lower-income households, big-box retailers and housing.

“The economy contracted for the second consecutive quarter which does meet the conventional definition of a recession even if the formal definition of a recession is not yet met,” Brusuelas concluded. “From our point of view that is immaterial given the energy, inflation and rate shocks currently cascading through the economy, which for many households and firms will feel like a recession.”

Quote of the Day

"We’ve seen partisanship and games within Congress for years. But what is shocking is that so many senators would literally be willing to play with veterans’ lives so openly like this."

– Jeremy Butler, CEO of the nonprofit Iraq and Afghanistan Veterans of America, as quoted by NBC News after Senate Republicans unexpectedly sank a bill called the PACT Act that would expand VA health care eligibility for veterans who exposed to toxic burn pits during their service.

Jon Stewart, who has advocated for the legislation, unleashed some choice quotes of his own in response to the GOP votes.

News

- Democrats Race to Adopt Climate, Health Deal After Manchin Breakthrough – Washington Post

- Biden Pledge to Tax Wealthy, Companies Revived With Manchin-Led Bill – Reuters

- Drugmakers Are Waging a ‘Hail Mary’ Campaign to Sink Reconciliation Bill – Politico

- Carried Interest Is Back in the Headlines. What Would a New Tax Proposal Do? – New York Times

- Sinema Is Potential Obstacle for Senate’s Landmark Tax, Climate and Drug Bill – Bloomberg

- Rich Wall Streeters Face Shock Tax Hike While Rest of Wealthy Escape – Bloomberg

- Seven Key Provisions in the Climate Deal – New York Times

- Congress Passes Bill Boosting US Semiconductor Production – CNN

- GOP Senators Block Bill Expanding Care for Veterans Exposed to Toxins – The Hill

- U.S. GDP Fell at 0.9% Annual Rate Second Quarter; Recession Fears Loom Over Economy – Wall Street Journal

- The Report Is a Snapshot of the Economy, Not the Last Word on Recession – New York Times

- Group of Republicans and Democrats Form New Political Party to Appeal to Moderates – CNN

Views and Analysis

- What You Need To Know About The Manchin-Schumer Climate and Tax Compromise – Howard Gleckman, Tax Policy Center

- Joe Manchin’s Climate Deal Isn’t Enough, but It’s Still a Miracle – Eugene Robinson, Washington Post

- Joe Manchin and Chuck Schumer Have a Surprise for You – David Dayen, American Prospect

- Joe Biden’s Presidency Is Suddenly Back From the Dead – Jonathan Chait, New York

- Biden Enters the Always Be Closing Phase of His First Term – Adam Cancryn et al, Politico

- US Economy Sending Mixed Signals: Here’s What It All Means – Paul Wiseman, Associated Press

- How Goes the War on Inflation? – Paul Krugman, New York Times

- This 150-Year-Old Mining Law Hurts Taxpayers and the Environment – Sen. Martin Heinrich (D-NM) and Chris Wood, New York Times

- Why We Need Social Housing – Ramenda Cyrus, American Prospect

- ‘Fossil-flation’ Fuels the Climate Crisis and Costs Americans Money: Electrification Is the Answer – Ari Matusiak, The Hill