Good Wednesday evening! The Senate, as expected, failed to advance an abortion-rights bill. And the government reported that inflation dipped a bit in April, though it still topped analysts’ expectations. Here’s what’s happening.

Inflation Dips in April, but Just Barely

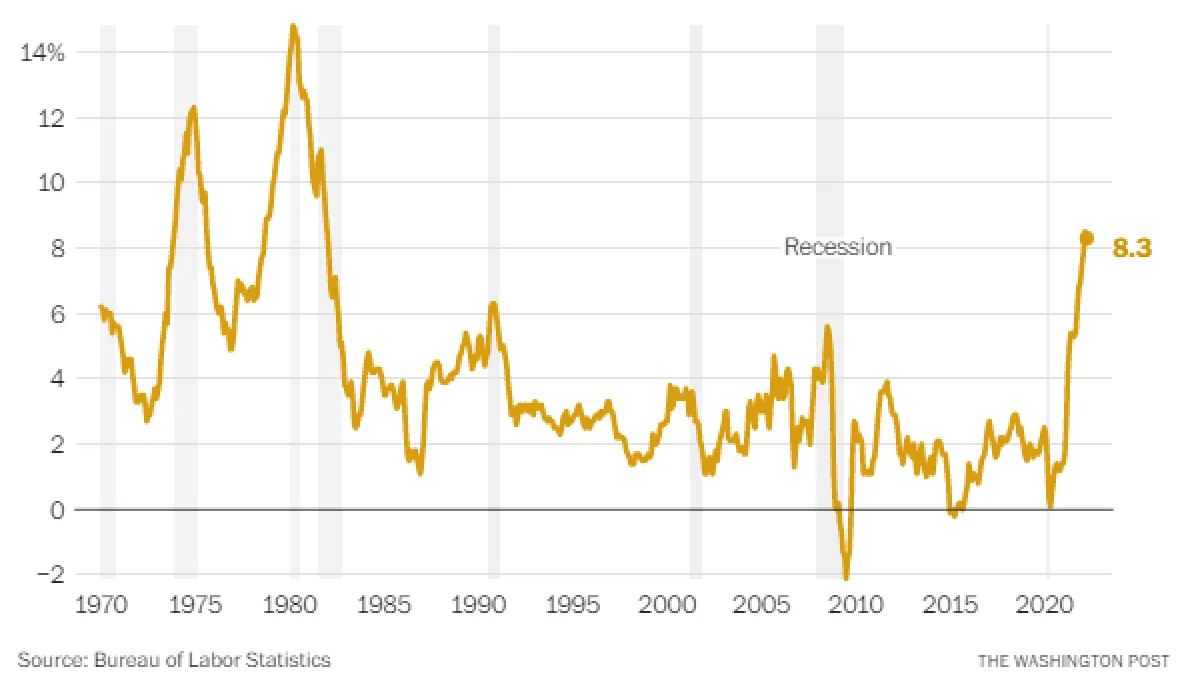

Upward pressure on prices eased a bit in April, the Bureau of Labor Statistics announced Wednesday, providing a ray of hope that the U.S. has put the worst of inflation behind it.

The Consumer Price Index rose by 8.3% in April relative to a year earlier, down from the 8.5% recorded in March. But analysts expected to see a lower number, fueling doubts about whether the economy has truly turned a corner and worries that we’ll still be dealing with inflation for many months to come.

One clear bit of good news is a drop in the month-over-month inflation rate, with prices rising 0.3% in April compared to March, a big decrease from the 1.2% rate recorded last month. Cheaper gasoline played a big role, with prices falling 6.1% on a monthly basis.

Other inflation components were less reassuring. Food prices rose by 0.9%, or 9.4% on a 12-month basis, with dairy increasing by 2.5% in April, the largest increase in 15 years. And inflation in core prices, which leaves out volatile fuel and food components, was higher than expected, doubling to 0.6% on a monthly basis.

Still a long way to go: While the report was mixed and could support both optimistic and pessimistic arguments about where the economy is headed, it’s fairly clear that the fight against inflation is far from over and that the Federal Reserve has a difficult road ahead, especially as it relates to the supply side of the economy, where the pandemic and war continue to create serious problems.

"Unfortunately, this data reinforces the idea that the Fed can do little to nothing around the supply side issues and idiosyncratic risks to the inflation outlook," Joseph Brusuelas, chief economist at the consulting firm RSM, said in a note. "That leaves the Fed little choice but to drop the hammer of rising interest rates on American households that are still adjusting to a series of shocks over the past two years."

US Treasury Sees Record Surplus in April

Tax payments produced a huge surplus in April, the U.S. Treasury reported Wednesday, with receipts exceeding outlays by $308 billion. Although April typically produces a surge in revenues as Americans send in their tax payments, this year saw the largest monthly surplus on record, at least in nominal terms. Receipts totaled $863 billion, while outlays came to $555 billion.

For the year, the U.S. is still running a deficit, with outlays outpacing revenues by $360 billion in the first seven months of the fiscal year.

House Approves $40 Billion in Aid to Ukraine

The House on Tuesday night overwhelmingly approved a nearly $40 billion aid package for Ukraine. The 368-to-57 vote saw all Democrats joined by 149 Republicans in support of the bill while 57 Republicans opposed it.

"It is about democracy versus a dictatorship. Democracy must prevail," House Speaker Nancy Pelosi said ahead of the vote. "The Ukrainian people are fighting the fight for their democracy and, in doing so, for ours as well."

A summary of the bill issued by the House Appropriations Committee said the package includes $6 billion to provide training, military equipment and weapons, logistics and intelligence support and salaries to Ukrainian forces. It also include more than $9 billion to replenish U.S. stocks of equipment sent to Ukraine and nearly $14 billion for State Department programs, including humanitarian support for refugees, economic aid to Ukraine’s government and $760 million to address global food insecurity. The package also includes another $4.35 billion for emergency food assistance to people around the world.

The Senate is expected to pass the aid bill, potentially by the end of the week. In a letter to Senate Minority Leader Mitch McConnell (R-KY) this week, Secretary of State Antony Blinken and Defense Secretary Lloyd Austin said that the administration is running out of authorized funds for Ukraine and would need additional appropriations no later than May 19.

Passage of the latest package would bring the total aid for Ukraine approved by lawmakers to more than $53 billion.

Column of the Day: The Infrastructure Vote That Cost a GOP Rep His Job

Washington Post columnist James Hohmann writes that Rep. David McKinley, a West Virginia Republican, voted for the bipartisan $1.2 trillion infrastructure bill — and it cost him his job.

McKinley lost to fellow West Virginia Rep. Alex Mooney in a primary Tuesday night for the GOP nomination in a newly redrawn district. Mooney was endorsed by former President Donald Trump, who attacked McKinley as a "RINO [Republican in name only] who supported the fake infrastructure bill."

"In the pre-Trump era, McKinley would have easily won this primary. His seniority would have put him in line to chair a powerful energy subcommittee next year," Hohmann writes. "But the infrastructure bill was the chief topic in the only debate between the candidates last week. Mooney claimed the bill is part of ‘Biden’s socialist spending spree.’ He criticized the bill’s subsidies for purchasing electric cars, ‘which will disproportionately help wealthy individuals living in blue cities,’ and complained that the legislation ‘includes sexual identity and gender orientation language.’"

The takeaway, Hohmann argues, is that "President Biden’s governing theory has failed" as the Republican Party has shifted:

"Securing money for popular projects used to be the easiest way for lawmakers to get reelected, especially in West Virginia. But appropriations have become less important in the past 25 years. And among Republican voters, spending has become almost dangerous. … In too many places, fighting culture wars is now far more important to the GOP than investing in clean water, stable bridges and reliable broadband access."

Read the full piece at The Washington Post.

Send your feedback to yrosenberg@thefiscaltimes.com. And please encourage your friends to sign up here for their own copy of this newsletter.

News

- Senate Blocks Bill to Codify Right to Abortion; GOP, Manchin Oppose Measure – Washington Post

- Ukraine Aid Bill Faces Familiar Senate Procedural Obstacles – Roll Call

- Stinger Shortcut: US Army Seeks Special Funding for Missile Supply Chain – Military Times

- Democrats Mull COVID-19 Aid Options as House Preps New Bill – Roll Call

- GOP Opposition Leaves Covid Aid in Peril as White House Warns of Surge – Washington Post

- Biden Seeks to Keep a Focus on Inflation With Farm Trip – Washington Post

- Blue States Want to Become Abortion Safe Havens. It Will Cost Them – Politico

- Crypto Investors Are Likely Paying Less Than Half the Taxes They Owe – Bloomberg

- Biden Administration Reups Child Tax Credit Portal – Politico

- Biden's Personal Recovery Plan: Pump Up Unions, Squeeze Big Business – Politico

- Overdose Deaths Continued to Rise in 2021, Reaching Historic Highs – NPR

- Staffing Shortages Slam Hospitals – Axios

- What if Delaware Disappeared? 1 Million Covid-19 Deaths Explained in 4 Charts. – Politico

- Moderna’s Vaccine Provoked a Strong Immune Response in Children Aged 6 to 11, Researchers Report – New York Times

Views and Analysis

- Inflation’s Biting. Roe’s Fraying. Dems Are Still Trying to Connect With Voters – Sarah Ferris, Politico

- Biden’s Magical Thinking on Inflation Continues – Washington Post Editorial Board

- America’s Economic Outlook Gets Gloomier – Kevin T. Dugan and Benjamin Hart, New York

- Biden and the Inflation Trap – Robert Kuttner, The American Prospect

- Biden Talks Inflation: Another Swing and a Miss – David Winston, Roll Call

- Once Again, GOP Hostage-Taking Is on the Verge of Working – Paul Waldman and Greg Sargent, Washington Post

- What if Taxpayers Could Check a Box on Their Returns to Support Elections? – Matthew Weil, Washington Post

- The Fed Needs to Get Real About Interest Rates – Bill Dudley, Bloomberg

- Why Is Dealing With the Government So Painful? – Romesh Ratnesar, Bloomberg

- Bill Gates’s New Pandemic Book Presents a Plea and a Plan – Michael Gerson, Washington Post