Happy Monday and welcome to what’s sure to be a big week in the Biden presidency. The president will deliver his first State of the Union address Tuesday night at a moment when the geopolitical landscape has been changed dramatically by Russian President Vladimir Putin’s invasion of Ukraine. Russian forces are continuing their assault, shelling Kharkiv, Ukraine’s second-biggest city, and advancing on Kyiv, the capital. Here’s the latest:

Biden to Tackle Inflation and Deficit in State of the Union Speech

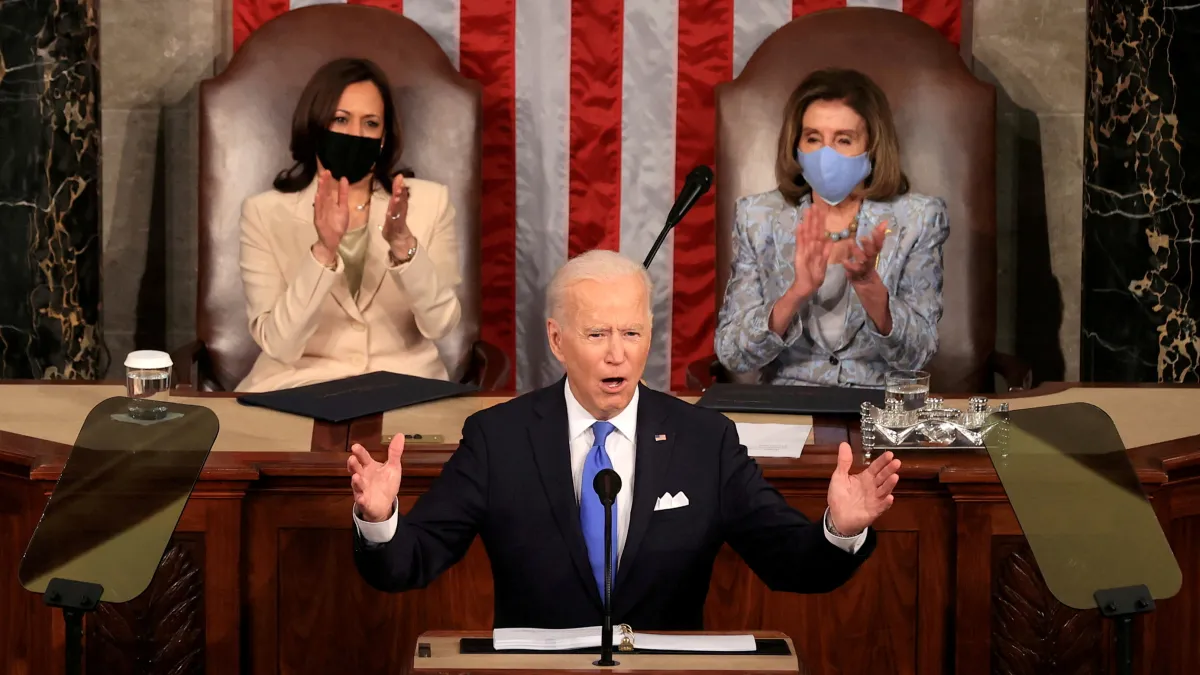

President Biden is set to deliver his first State of the Union address on Tuesday night, and White House aides are already previewing the speech for reporters.

The Washington Post reports that, as you might expect, Russia’s invasion of Ukraine has forced the White House to revise the speech, which the administration had hoped to serve as a reset for Biden’s presidency. The changes, Annie Linskey and Tyler Pager say, "will reflect the way the crisis has added urgency to Biden’s running theme of defending democracies, according to one adviser who spoke on the condition of anonymity to discuss private talks."

Still, the White House has made clear that the speech won’t go light on Biden’s domestic agenda, with the president touting the gains made since he took office, pitching the benefits to come from the $1.2 trillion bipartisan infrastructure law he signed and laying out a four-point plan to strengthen the economy and tackle inflation (see more details below).

Biden will reportedly also call on Congress to pass legislation to improve the nation’s competitiveness with China, increase the maximum Pell Grant award by $2,000, raise the federal minimum wage to $15 an hour and establish a national paid family leave program.

Officials said that Biden will also talk about how any new plans should be paid for, with proposals to ensure that corporations and the wealthiest Americans "pay their fair share" and a call for Congress to both enact his agenda and reduce the deficit.

"We can do both. We can lower costs for families. We can lower the deficit at the same time," administration officials insist, according to The Hill. "The reconciliation bill that is right now on the table would reduce the deficit. The ideas that he has put forward can be used to achieve both, and he’s calling on Congress to send him a piece of legislation that would do both."

What about "Build Back Better"? "Biden aides briefing reporters on the speech Monday afternoon would not say whether Biden would mention his onetime signature legislation by name," the Post’s Linskey and Pager report. Said one official: "It’s not about to name of the bill. It’s about the ideas. It’s about lowering costs to families, and I think you can expect to hear the president talk about those ideas."

The bottom line: Biden’s got a lot to cover as he looks to boost his sagging poll numbers with Election Day just over six months away. But for as much attention as the address may get, the speech itself likely won’t matter nearly as much as events on the ground — here and abroad — in the coming months.

A Battle Over the True Cause of Inflation

As we mentioned above, President Biden is expected to use his State of the Union address to unveil a new plan to address surging prices throughout the U.S. economy, part of an effort by the White House to show voters that it is tackling one of their main concerns ahead of what could be a disastrous midterm election for Democrats this fall.

The plan, White House officials said, includes proposals to:

* Make more things in America and strengthen our supply chains;

* Reduce the cost of basics such as prescription drugs and education — and reduce the deficit;

* Promote competition;

* Raise the minimum wage and eliminate barriers to good-paying jobs for workers.

Even in skeletal form, though, Biden’s plan raises the question of just what is causing inflation right now. Many economists have expressed doubts about the ability of the federal government to reduce inflation by doing things like subsidizing education costs and negotiating drug lower prices — useful measures, perhaps, but unlikely to move the needle in the short and medium term.

For many economists, the cause of the current inflationary trend is simple: too much relief and stimulus spending during the Covid-19 crisis. Former Treasury Secretary Larry Summers is one of the most prominent proponents of this view and has recently been taking something of a victory lap as inflation continues to come in hotter than expected.

The over-spending argument: Summers warned last year that Congress was running the risk of creating excess inflation by spending too much, too fast on Covid relief. "I think policy is rather overdoing it," Summers said last May, just a few weeks after Biden signed the $1.9 trillion American Rescue Plan into law. "We’re taking very substantial risks on the inflation side."

Summers argued that the spending passed by Congress in response to the coronavirus crisis would exceed the level of spending on President Lyndon Johnson’s Great Society programs and the Vietnam War — and many economists blame the latter for sparking the inflation that cropped up in the late 1960s.

"We are printing money, we are creating government bonds, we are borrowing on unprecedented scales," Summers said. "Those are things that surely create more of a risk of a sharp dollar decline than we had before. And sharp dollar declines are much more likely to translate themselves into inflation than they were historically."

Summers has also been critical of what he sees as excessive accommodation by the Federal Reserve and has expressed doubts about the ability of the Fed to move quickly and decisively to reduce inflationary pressure. "There are lots of reasons to suspect the Fed is well behind the curve," Summers said earlier this month. "I suspect next month it will get worse rather than better," he added, referring to the inflation numbers.

And given the persistence of inflation, the American Rescue Plan may have undercut Biden’s ability to enact the rest of his agenda, a result Summers warned would come. "Inflation did accelerate and people did link it back to the ARP and those policies, and connected the dots and said they did not want additional support for the economy," Mark Zandi, chief economist at Moody’s Analytics, told Bloomberg.

Summers recently told Bloomberg that the American Rescue Plan was "a serious error" that "both set the stage for the inflation and politics that we have today and it eliminated the chance to make fundamental investments in our country given the political context."

The supply chain argument: Not everyone agrees with Summers, even though he appears to have nailed the call on inflation. Slate’s Jordan Weissmann wrote in December that while Summers was clearly prescient about the risk of short-term inflation, he hedged his bets more than he admits and, perhaps more importantly, he didn’t really get it right as to why inflation could be expected to run so high.

For one thing, the dollar declines Summers warned about never materialized. For another, the overheating Summers was concerned about hasn’t quite worked out as expected.

"As far as I know, Summers never really spelled out step by step how he thought inflation would take hold, but he pretty clearly seemed to have in mind a standard textbook model, where government spending would swamp the economy with demand and drive unemployment unsustainably low, creating pressure for higher wages and eventually inflation," Weissmann wrote.

But as many economists have noted, the inflation the U.S. has experienced doesn’t fit the textbook model. "Rather, they’ve resulted from massive, stimulus-fueled consumer demand running smack dab into supply chain problems related to the pandemic," Weissmann said. "That’s really not the toxic brew Summers expected."

American Prospect Executive Editor David Dayen has recently taken up the supply-chain argument in particular, and in Thursday’s New York Times he lays out the argument that instead of overheating, as Summers predicted, the economy is suffering from structural defects that were put in place under the guidance of neoliberal economists — Summers among them — who encouraged businesses in the 1990s to trade stable and resilient production systems for speed, low prices and high profits.

"Democrats put their faith in an economics profession that is far too distant from on-the-ground realities to grasp the consequences of globalization, monopolization, financialization, deregulation, and just-in-time logistics," Dayen writes. "They failed to recognize how things could crumble because of the vulnerability they engineered."

The irony, in Dayen’s view, is that one of the main architects of the fast, lean and now broken supply chain is taking credit for predicting the inflation he helped cause. "Larry Summers shares the blame for inflation," he writes. "Mr. Summers shouldn’t be an obstacle to this effort or even an interested bystander, watching it unfold; he should be an active enthusiast for cleaning up the mess he made."

Send your feedback to yrosenberg@thefiscaltimes.com. And please tell your friends they can sign up here for their own copy of this newsletter.

News

- State of the Union Address Will Seek to Revive Dormant Budget Reconciliation Bill – Roll Call

- Biden State of the Union to Cast Climate Bill as Anti-Inflation – Bloomberg

- Biden’s $1.9 Trillion Win on Covid Aid Hobbles Rest of Agenda – Bloomberg

- Corporations Raise Prices as Consumers Spend ‘With a Vengeance’ – New York Times

- Biden to Vow Nursing Home Crackdown as Part of State of the Union – Washington Post

- Biden Wants to Declare a New Chapter in the Covid Fight. He’s Trigger Shy. – Politico

- For Older Americans, Some Positive Health News – New York Times

- Amazon to Launch Voice-Activated Health Care Service With Alexa – The Hill

- Moderna Faces New Lawsuit Over Lucrative Coronavirus Vaccine – Washington Post

- Nearly Half of Biden’s 500M Free COVID Tests Still Unclaimed – Associated Press

- Health Workers’ Vaccine Mandate Undone by Religious Exemptions – Politico

- New Research Points to Wuhan Market as Pandemic Origin – New York Times

Views and Analysis

- Why Health-Care Costs Are Rising in the U.S. More Than Anywhere Else – Charlotte Morabito, CNBC

- The Not-So-Secret Republican Plan to Raise Taxes – Matthew Yglesias, Bloomberg

- The Economic Consequences of the Ukraine War – Jason Furman, Project Syndicate

- Five Ways the Russian Invasion of Ukraine Could Impact the US Economy – Sarakshi Rai and Sylvan lane, The Hill

- States Are in a Tax-Cutting Frenzy. It’s a Sign of Excess Pandemic Aid. – Washington Post Editorial Board

- Republicans Have Laid a Dangerous Trap for Biden. Here’s How to Avoid It. – Paul Waldman and Greg Sargent, Washington Post

- The State of the Union Is Biden’s Chance to Rebrand – Michael Gerson, Washington Post

- Biden’s State of the Union Task: Show Americans a New Economic Future – Felicia Wong, New Republic

- Relax, Democrats, Biden’s Presidency Isn’t Screwed – John F. Harris, Politico

- The CDC’s New Mask Guidelines Finally Got It Right – Leana S. Wen, Washington Post