The OPEC oil cartel's meeting in Vienna on Friday went largely as expected. Production was maintained at 30 million barrels per day with unofficial production numbers about 1.5 million barrels above that as Saudi Arabia opens the spigots and redoubles its price war against U.S. shale oil producers who, for their part, are also increasing production. Moreover, if Iranian economic sanctions are dropped later this month as part of a nuclear deal, another million barrels per day would be pumped.

Long story short: While oil prices have held near the $60-a-barrel level thanks to a slight inventory drawdown associated with the start of the U.S. summer driving season, a combination of deepening oversupply, still high inventories, extended bullish positioning and the regular demand slowdown at the end of the summer suggests prices should start sliding again soon. Storage tank capacity could be tested as soon as September.

Related: Why the Saudis and OPEC Want Cheaper Oil

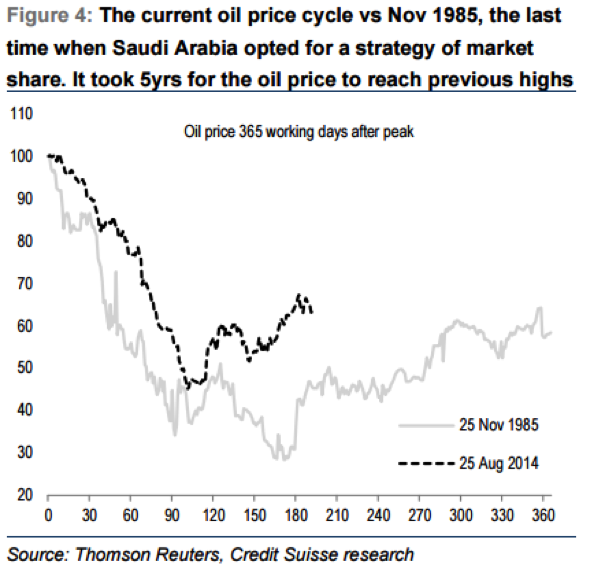

According to research by Credit Suisse, futures market positioning suggests downside price risk of about 30 percent — which would be enough to take West Texas Intermediate back toward $40 a barrel in a test of the March lows.

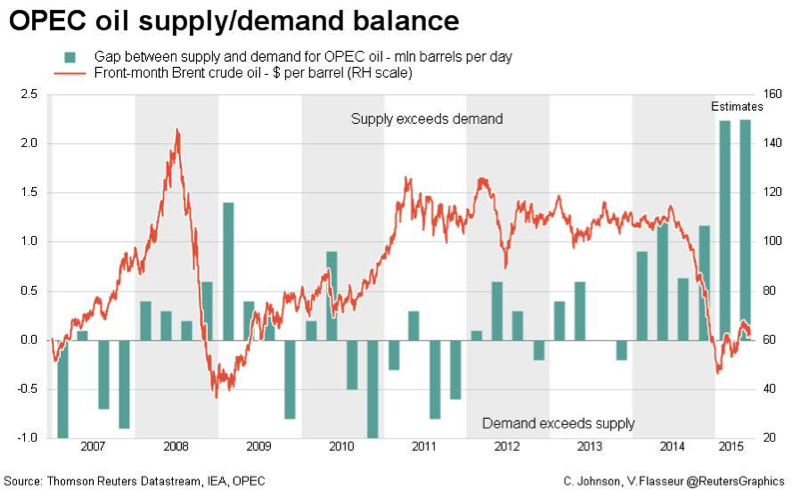

The chart above puts OPEC's decision in the context of an epic supply glut. Remember also that while the U.S. drilling rig count is down about 60 percent from its peak, total production increased in the week of May 22 to a new all-time high of 9.6 million barrels per day.

While weaker OPEC members like Venezuela have been clamoring for a production cut to raise prices and help balance national budgets, the OPEC meeting was described as "amicable" by the Saudi oil minister, indicating that all parties realize it's in their long-term interest to squeeze U.S. producers. The Gulf countries maintain a strong fiscal position and can weather a prolonged period of budget deficits, according to the calculations of Capital Economics. Those nations have the will and the ability to wait out overleveraged but remarkably resilient shale companies.

Related: Boomers, It's Time to Cash Out of This Bubble

Not only that, but lower oil prices now will help restart global economic growth (which has hit a soft patch in recent months) as well as take the momentum out of the push for alternative fuels.

Just look at what's happening in the auto market: As sales soar to a pace not seen since 2005, the action has been in gas-guzzling SUVs and pickup trucks. Demand for fuel-efficient compact cars and hybrid vehicles has waned. Or look at the used vehicle market. According to the Manheim Used Vehicle Value Index, prices for compact cars were down 6.6 percent in May vs. last year while pickup prices are up 6.1 percent. That's exactly what the sheiks in Riyadh want to see.

Traders are simply not prepared for a supply-driven pullback. Net long positions in oil have risen to all-time highs according to Andrew Garthwaite, global equity strategist at Credit Suisse. On the last four occasions when the speculative fever in black gold has reached this level, prices have fallen between 12 percent and 60 percent, for an average loss of about 30 percent over three-and-a-half months.

Related: What's Next for Oil Prices? Look Out Below!

The last time Saudi Arabia enacted a market-share capture strategy, in the 1980s, the battle lasted five years before prices returned to where they started. That suggests we may not see oil at $80 a barrel or above until 2019. Riyadh is also likely irritated by the fact that oil is performing much better now than it did in the late 1980s when it was last actively pushing down prices. In our current world of low volatility, central bank stimulus and easy market gains, bullish sentiment is a hard thing to kill.

Related: Why a New Age of Nuclear Energy Is About to Dawn

Garthwaite lists four reasons he's worried about a slide in oil prices over the near term:

1. Groupthink: The Bloomberg consensus puts oil prices at $75 at year-end 2016, and near that level three years from now based on futures pricing. The tone of energy sector CEOs and in the financial media has also turned noticeably bullish.

2. Bear markets long lived: While oil prices reached their peak near $115 back in 2011, bear markets in oil have historically been quite long lived, lasting between 11 and 28 years.

3. Demand impacts: Lower fuel subsidies and regulation threaten demand growth in the world’s rich economies. Credit Suisse's commodities team highlights that oil growth in the Organization for Economic Co-Operation and Development countries is currently 1.2 percent on a year-over-year basis, a three-year high. However, more than half of the growth in oil demand over the past 10 years has come from oil exporting countries, and a number of these countries are rolling back fuel subsidies for economic and environmental reasons. Don't forget that the miles-per-gallon requirement for U.S. cars is set to nearly double to 52.5 by 2025.

4. The dollar: Crude oil and the dollar maintain a close relationship. The risks to the dollar are poised to the upside, given ongoing frictions in the Greek bailout negotiations and the growing chances of a Federal Reserve interest rate hike this year. All of this should strengthen the dollar, putting pressure on oil in the months to come.

Top Reads from The Fiscal Times: