Stocks are taking a breather Wednesday after reaching record highs, as the Dow Jones Industrial Average surged more than 300 points to cross the 21,000 level for the first time ever on Wednesday, roaring back from a minuscule decline the day before that broke a record 12-in-a-row win streak.

The exuberance has been thick in the air, with stock prices climbing despite political uncertainty, extended valuations and narrow breadth. Sentiment reached extreme levels. It's incredible to see. But it also sets the stage for some serious disappointment from higher interest rates. Perhaps as soon as two weeks from now.

Related: Dow at 21,000 — but Many Stocks Are Getting Left Behind

I know it's probably sacrilegious to say this aloud right now, but all recent bull markets (and economic expansions) have been killed by the Federal Reserve. The current uptrend and expansion will no doubt end with a similar fate: Undone by higher credit costs.

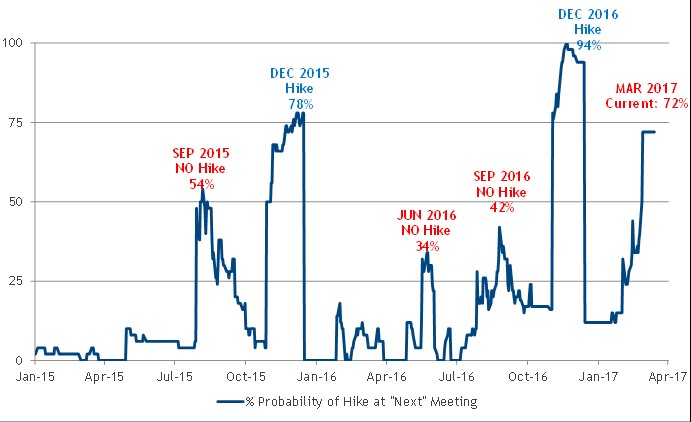

On Tuesday afternoon, after some very hawkish commentary from three separate Federal Reserve officials, futures markets odds of another quarter-point rate hike at the March policy meeting surged above 70 percent. They moved above 80 percent on Wednesday, up from 31 percent on Monday. Market expectations for interest rates have now crossed the unofficial threshold that has presaged the last two rate hikes in this tightening cycle, in December 2015 and December 2016, as shown below. The March policy meeting is very much in play.

On Tuesday, Philly Fed president Patrick Harker, speaking at Temple University, reiterated his comments from Feb. 15 that not only is the economy firming up but that he sees three quarter-point rate hikes as appropriate this year.

Related: Will Trump Restore 4% Growth or Crash the Economy?

This was followed by comments from San Francisco Fed President John Williams, speaking in Santa Cruz, where he said the economy is "too hot" and that a March rate hike is "very much on the table for serious consideration." He added that "right now interest rates are abnormally low."

Finally, New York Fed President Bill Dudley told CNN in an interview that the case for further policy tightening had become a "lot more compelling."

The hawkishness continued on Wednesday, with Dallas Fed President Robert Kaplan saying policymakers should be in the process of removing accommodation and that new rate hikes may be needed in the "near future."

Stocks have yet to fully react to these headlines, which in years past would've rattled stimulus-addicted traders to the core. But these days, attention has moved from the Fed's machinations to what President Trump will do on deregulation, taxes and stimulus spending.

Related: Republican Hopes for Tax Reform Hinge on a Trillion-Dollar Gimmick

Yet let's not forget: With the national debt swelling toward $20 trillion, and with corporate profitability growth tepid, a more aggressive pace of Fed rate hikes will not only pressure the U.S. budget deficit by raising the government’s interest costs but it will undermine U.S. equity valuations as well. Higher interest rates — while a positive for banks — act like a wet blanket on the rest of the economy (as monetary policy tightening intends). As rates rise, they will weigh on consumer confidence, credit availability and corporate expenditures.

And they will make stocks relatively less attractive, since higher interest rates reduce the value of future earnings.

There is also a political element in all this as well: Trump criticized Fed Chair Janet Yellen on the campaign trail for holding interest rates artificially low to boost the stock market for the Democrats and President Obama. Should the Fed hike again in March, following a hike in December, and signal two further hikes in 2017, it will surely attract Trump's ire.

Wall Street is unlikely to be pleased with a casting of the Federal Reserve as a political entity. But recent Fed history could feed into Trump's argument, especially when one considers the chart above from Bank of America Merrill Lynch showing massive policy accommodation was afforded to President Obama during his eight years in office (which, admittedly, began in the midst of the worst economic downturn since the Great Depression).

Related: The Federal Reserve Bank, Explained

In one clear sign the stock market's post-election dynamic is changing, the CBOE Volatility Index (VIX), known as Wall Street's "fear gauge," pushed above its upper Bollinger Band (a measure of volatility and trend) for the first time since late October on Tuesday.

Put simply: With the Fed's March 15 policy meeting fast approaching, many market insiders are bracing for a return of weakness and volatility. Keep an eye on Yellen, who will be speaking on Chicago on Friday and could use the opportunity to lean against the mania in stocks.