Once again, the very fate of Western civilization depends on a September policy decision by the Federal Reserve.

Ok, so it’s not quite that momentous, but after raising interest rates last December for the first time since 2006, all eyes really are on Fed Chair Janet Yellen and her cohorts to see if they will hike rates again later this month.

A handful of unelected bureaucrats are tasked with single-handedly setting the price of money for the world's largest economy. And in this post-crisis financial system, and after trillions worth of asset purchases, they are indirectly responsible for setting the price of stocks, bonds and pretty much everything else.

So, you know, no pressure.

Related: Mark Cuban Says Stocks Will Crash if Trump Wins

As recently as June, Yellen teased two quarter-point hikes before the end of the year. A batch of strong economic data and red-hot jobs reports supported that view.

In her first public comments in months, Yellen triumphantly told a gathering of global central bankers in Jackson Hole, Wyoming, on Aug. 28 that the Fed was nearing its inflation and employment goals and that "the case for an increase in the federal funds rate has strengthened in recent months." Vice-chair Stanley Fischer told CNBC shortly afterward that her comments were consistent with a September hike.

Since then, however, the Fed's confident outlook has been battered by a disappointing August jobs report, weak factory orders, an outright contraction in manufacturing activity (first since February) and a continued decline in construction spending. The non-manufacturing ISM, which measures growth in the larger services sector of the economy, suffered its largest month-over-month slowdown since 2008 and fell to its weakest level since early 2010.

Related: Why It’s Time for the Fed to Green Light a Strong Stimulus

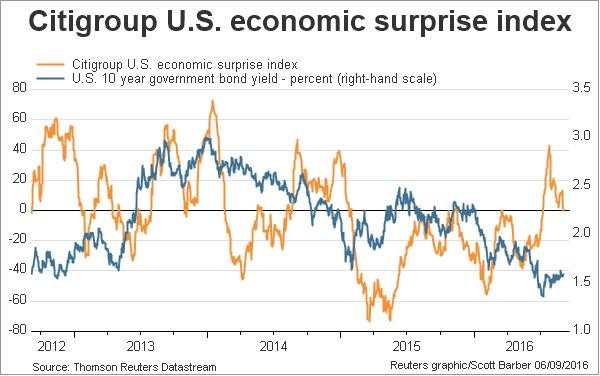

The Citigroup Economic Surprise Index, which measures where the economic data is coming in relative to expectations, is poised to fall back into negative territory, as shown below. This reverses a short-lived period of economic data surprising to the upside in a way not seen since late 2014.

The futures market, seeing through the Fed's hawkish chest thumping, has dropped the odds of a September rate hike to 18 percent, while odds of at least a single hike by December have fallen near 50 percent.

Related: Why the Stock Market Is Rooting for Hillary Clinton to Win

Yet many at the Fed and many on Wall Street continue to pound the table about a September rate hike — continuing string of September cliffhangers for the central bank. In September 2013, then Fed Chair Ben Bernanke shocked the world with a surprise "no taper" decision, deciding to keep the now expired QE3 bond purchase program at full power. Last September, Yellen surprised with a "no hike" decision.

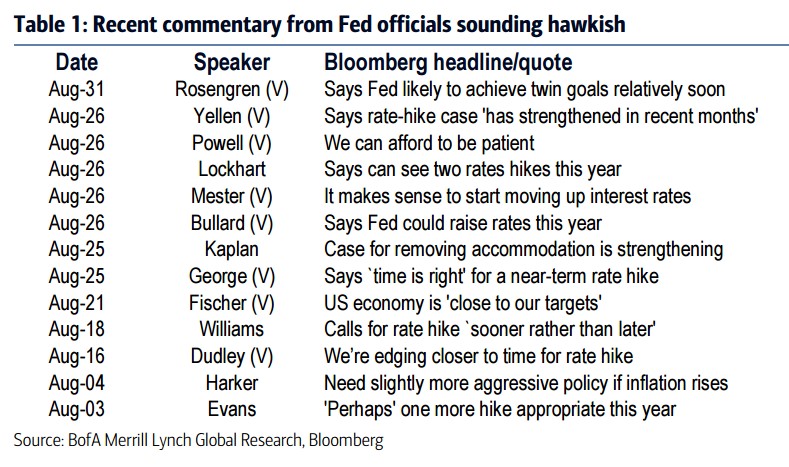

The chart above, from Bank of America Merrill Lynch, summarizes the recent commentary. One wonders: Will the Fed make a hawkish policy mistake and risk rattling sensitive financial markets just months before a presidential election?

It's possible. But highly unlikely.

This kabuki dance makes sense when you consider the Fed's role not only in setting monetary policy but also setting expectations. If the Fed didn't constantly express confidence in the economy, and thus threaten a more aggressive path for rates, people would wonder if the economy had entered a prolonged period of weakness instead of just encountering occasional mid-cycle speedbumps.

Related: Are Stocks Ready for a Trump Victory?

Actions speak louder than words. Bank of America Merrill Lynch economist Michelle Meyer notes that back in September 2014 Fed officials expected more than five quarter-point hikes before the end of 2015. Instead, we got one. In her mind, the Fed will only do as much as investor expectations will allow. For better or worse, the Fed isn't in the mood to rattle liquidity-addicted markets. At least, not with inflation still below target. Should that change — and it might soon, as year-over-year calculations for energy inflation are about to get easier (reflecting the October-February selloff) — then it'll truly be time to worry about hawkish surprises.