Wall Street pros love talk about how regular investors are terrible market timers and thus should just buy and hold for the long haul. Small investors tend to panic sell at the lows and greedily buy at the highs.

But this stimulus-fueled bull market has proven that the pros are no better. Hedge funds and active mutual funds are badly lagging their performance benchmarks as "alpha" — risk-adjusted outperformance — disappears and stocks across the market increasingly rise and fall together. And now, with stocks near record highs amid very quiet trading — with volatility near historic lows — regular investors are aggressively cashing out.

Related: Why the Stock Market Is Rooting for Hillary Clinton to Win

Is Main Street onto something? Or have they made a blunder? And who is buying stocks if they're not?

As a reminder, many Street titans like Carl Icahn and George Soros have also recently become very bearish on stocks. Much of the recent buying out of the June market lows has come from a combination of short covering and purchases in the equity futures market. So the only people that are really "bulled up" here are likely central banks like the Swiss National Bank, the Bank of Israel and the Bank of Japan, all of which are actively buying equities.

According to Jason Goepfert of SentimenTrader, domestic mutual funds have lost more than $26 billion in assets over the last four weeks, the largest outflow since 2011. Oddly, this runs counter to many measures showing investor sentiment is dangerously bubbly. But it's a hard data point that cannot be easily dismissed.

Related: Why This Boring Market Is About to Get a Lot Wilder

To be fair, this reflects a change of opinion at the margins, since investors are still holding nearly the largest allocation to stocks as a percentage of total financial assets in 50 years. And equity assets compared to safe money market assets, while down from recent highs, is above levels seen at the 2000 and 2007 market peaks.

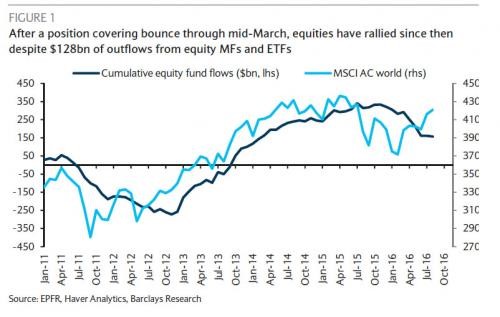

Barclays Capital notes that a similar dynamic is playing out globally as well. Since the middle of March, global markets have suffered $128 billion in outflows from equity funds:

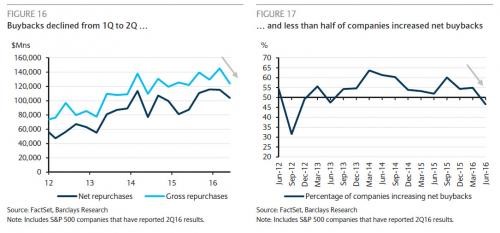

In addition to short covering and futures buying, Barclays analysts note that corporate buybacks have been a major source of support in recent months. Combined with a drought of new IPOs, this has effectively reduced the supply of equities at a time of tepid demand, helping push prices higher. S&P 500 net buybacks rose to $500 billion over the last four quarters from $375 billion in 2013. (Compare that to the $159 billion in total inflows to equity mutual funds and ETFs by "regular" investors in 2013.)

Worryingly, the Barclays team warns that S&P 500 gross buybacks declined by $22 billion in the second quarter (down 15 percent) and new purchase announcements are down $115 billion year-to-date.

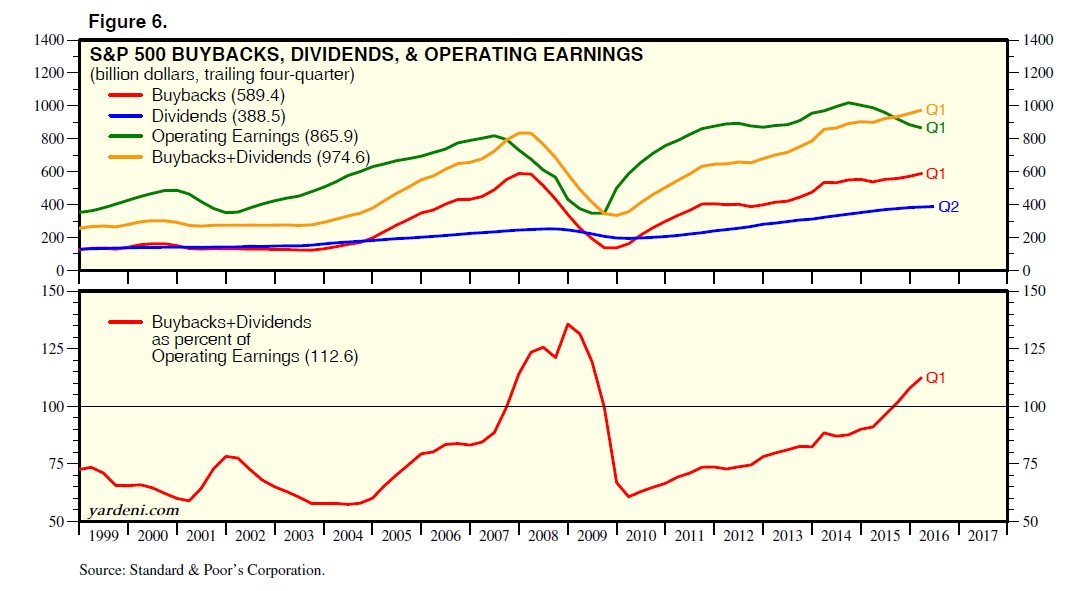

Stepping back, regular investors may be onto something here: The mindless share buyback spree — fueled by cheap debt, the "reach for yield" and executives trying to boost earnings-per-share performance by any means — cannot last much longer unless revenue and profits start growing again.

Related: Why It’s Time for the Fed to Green Light a Strong Stimulus

Remember, we're in the midst of a five-quarter-long earnings recession that is expected to last at least six quarters. Analysts expect earnings growth to resume before the end of the year, but that depends on ongoing strength in energy prices, a weakening of the dollar and a rebound in tepid GDP growth. Not to mention the outcome of the upcoming U.S. presidential election and the Federal Reserve's September and December policy decisions on whether or not to raise interest rates.

According to Yardeni Research, and illustrated in the chart above, companies are living on borrowed time as they pay out more in dividends and buybacks than they are earning. The largest offender is the energy sector, with buybacks and dividends exceeding operating earnings by nearly $96 billion.

Unless something changes, foreign central banks could soon be the only ones left buying American stocks.