Nothing lasts forever, and all good things must come to an end. These words are ringing in my head as the bull market we've enjoyed since 2009 faces its most serious threat.

Stock markets around the world are coming under intense pressure, with the MSCI World (Ex USA) Index down more than 10 percent from its summertime high as it suffers its largest uptrend break since 2011. The NYSE Composite Index has been more resolute but is wilting as well, falling below its 200-day moving average for the first time since 2012. Other markets, from commodities to high-yield corporate bonds to currencies, are being similarly rattled.

The economic data globally has taken a clear turn for the worse.

Related: Stock Market Scare — Could Recession Loom as Profits Drop?

Germany and Japan are at risk of falling into technical recessions. German industrial production and export activity is dropping at a rate not seen since the depths of the recession in early 2009. Japan's economy contracted outright last quarter. Deflation is washing over the Eurozone as economic activity slows, increasing the risk of a debt-deflation nightmare as the debt loads of countries like Spain and France once again risk becoming unsustainable. In China, electricity production is dropping for the first time since the recession ended.

And as I discussed in a recent post, even corporate profits, by some measures, are beginning to wilt.

This is coming as a massive shock for anyone who grew accustomed to the placid upward drift — in terms of stock prices, jobs, profitability and more — we've seen over the last two years.

Volatility was happily sacrificed at the altar by the cult of central banking, which has been primary belief system of this bull market. Like the idea that home prices couldn't and wouldn't fall nationally, the bulls have been secure in the belief that all will be solved by the printing of fiat currency.

Japan's multi-decade debt-deflation nightmare? Solved by money printing. Europe's unresolved structural flaws in its monetary union? Solved by money printing (or at least the threat thereof). China's overreliance on exports and its epic credit bubble, with bank assets since 2008 swelling by a magnitude that represents 100 years of U.S. financial system growth? Solved by money printing.

And of course, America's hollowed out middle class and debt hangover? Solved by money printing.

Related: 3 Steps to a More Fed-Proof Portfolio

Don't get me wrong. There has been progress. We should expect as much, given that interest rates were pushed to the lowest levels in recorded human history. The printing presses were warmed up — well actually, money creation happens in a few key strokes now as 1s and 0s are changed on computer terminals — and the Fed took the money supply from $800 billion before the recession to more than $4 trillion now. The unemployment rate has dropped to 5.9 percent. Job creation is posting the best pace of growth since the 1990s. Stock prices recently hit record highs. Corporate profitability soared.

Dark clouds are coming in now. It didn't take much. Nothing as vulgar as the Fed starting a rate hike campaign, something that hasn't happened in more than a decade.

Related: New Evidence of How Unemployment Wrecks Families

The Fed is on track to end its QE3 bond purchase program this month, but continues to promise it will hold short-term interest rates near 0 percent well into 2015. That didn't matter when QE1 and QE2 ended in 2010 and 2011. As soon as the Fed's bond buying stopped, markets fell and the economy stalled.

The European Central Bank recently announced new stimulus measures (including a small buying program involving private bonds), but after years of threatening a full-scale Fed-style sovereign bond buying program (which could be illegal under its charter), is getting growing pushback on the issue from the recalcitrant Germans.

China, after being forced into a mini-stimulus after its credit trust scare at the start of the year (remember "Credit Equals Gold #1"?), is trying to back away from any new surge of cheap money stimulus as it only risks further inflating a dangerous credit bubble.

Emerging market economies, as I discussed in another recent post, are suffering from the newly strengthened U.S. dollar and the risk of higher U.S. interest rates, since many have grown dependent on borrowing cheap dollars. If their local central banks try to print money to ease the pains, it will only make the problem worse.

Japan, which has been the most aggressive of all the developed economies with its money printing, is now trapped on the rocks. The Bank of Japan has actively crushed the yen in a last ditch hope of juicing the economy via export growth. It hasn't worked, as many Japanese companies had offshored production.

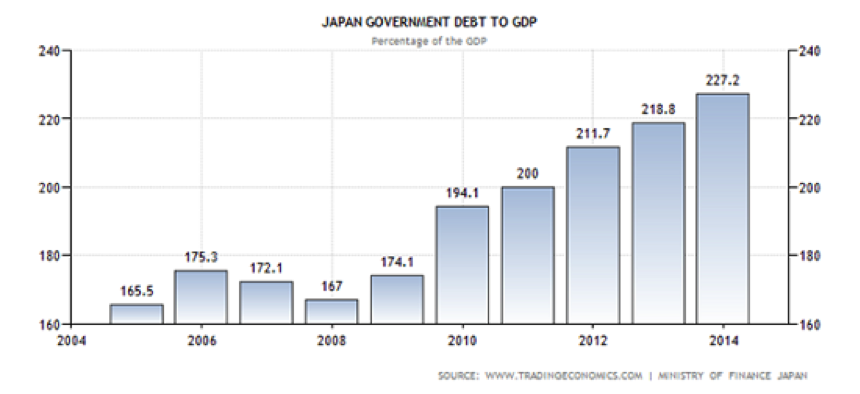

Now, the negative implications of a weak currency — higher import prices, higher energy and food inflation — are hurting Japanese consumers still digesting the largest sales tax hike since the 1990s. Another tax hike looms, forced by the government's 227 percent debt-to-GDP load, more than double America's burden.

The team at Capital Economics notes that inflation-adjusted wages in Japan started falling when this cheap money strategy was launched, and hit a fresh low in August.

We've all seen how fast things can unravel when the meme that powers a bubble — be it tulips in Amsterdam or Las Vegas condos — is proven to be a fiction. This time, it's the dream that deep, structural economic problems can be easily solved by making money cheap instead of doing the hard work of reforming systems, reining in debt, and ending the credit obsession that's resulted in the dizzying boom-and-bust cycle of the last 20 years.

I don't know what comes next, but we’ve arrived at the end of what has been.

Top Reads from The Fiscal Times: