Housing stocks have been on a tear – at least in relative terms – for months now, with the S&P index of homebuilders dramatically outpacing the broad S&P 500 benchmark. Is it time to double up, especially now that the Fed has launched a third round of bond purchases that could lower mortgage rates even further? Or would it be wiser to take some of those gains off the table?

A lot of those who take the bullish perspective on the group base their thinking on the numbers – both current and historical. For instance, it’s clear that the housing market is in its early stages of recovery – and if historical comparisons are valid, the odds are strong that it will continue and strengthen. The inventory of single-family homes is at its lowest level in decades; the Joint Center for Housing Studies at Harvard University calculated back in June that it would take only six months to sell off all those homes at the then-current rate of sales.

The numbers being recorded by some of the homebuilders are also reason for optimism. No, not the stock market gains – those are striking, but simply reflect investor sentiment – but instead the financial results. Lennar (LEN), for instance, reported its second-quarter revenues jumped 22 percent, its backlog soared 61 percent and orders for new homes climbed 40 percent over year earlier figures. Its earnings were significantly ahead of analysts’ forecasts: Instead of the 17 cents a share predicted, Lennar reported profits of 21 cents a share. Numbers like those are what have transformed stocks like Lennar and D.R. Horton (DHI) into some of the star performers of 2012.

Still, there are two important questions investors in homebuilders and real estate investment trusts (REITs) need to ask themselves at this point: Can the good news last? And is it already priced into the stocks?

Let’s tackle the first question immediately, because it’s the most critical. On the plus side, many pundits argue that the rebound is based on solid fundamentals. Moody’s Investors Service, for instance, pointed out last week that three homebuilders it tracks – Lennar, Toll Brothers (TOL) and Standard Pacific (SPF) – have seen their gross margins top 20 percent already and that the average for the industry should approach that level next year, even as revenues should climb about 10 percent on average for both 2012 and 2013. That’s part of the reason Moody’s boosted its outlook on the homebuilding companies to positive from stable, and predicted that volumes will improve as prices stabilize, leading to a jump in home sales over the next 12 to 18 months.

But the Moody’s survey of the industry did point to some factors that investors need to ponder before they ramp up their holdings in the sector. The report mentioned historically low interest rates – being held artificially below the rate of inflation by the Federal Reserve in a longstanding effort to jolt the rest of the economy back into life – as one factor that will boost sales. Well, free money is lovely, but it’s not going to last forever, and there are too many would-be buyers who simply won’t qualify now that banks have tightened up their credit policies.

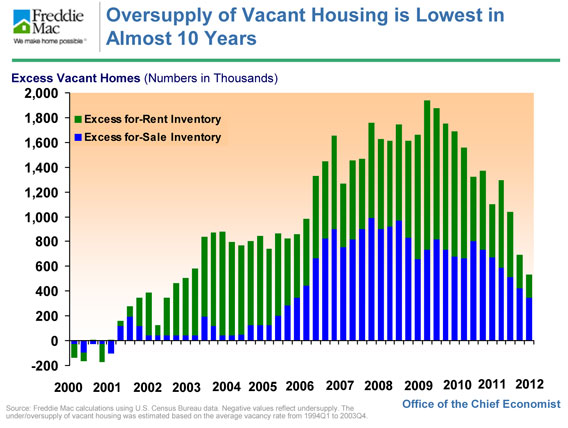

The report also cited the risk that another surge in foreclosures could put downward pressure on home sales. As Barry Ritholtz pointed out in a broadside attack on a recent Barron’s cover story trumpeting the revival of the housing industry, there are 25 percent fewer distressed sales today than usual. But that is due to foreclosure abatement programs enacted while the robo-signing scandal played itself out. When the foreclosure pipeline starts flowing more normally, it’s not completely clear how home prices will respond. An August market outlook report from the chief economist at Freddie Mac suggested that the shadow inventory – home loans that are seriously delinquent or in foreclosure – is much less of a threat to housing prices than it had been, given that the excess supply of empty homes has been “substantially reduced.” Still, if prices do come under downward pressure as the volume of distressed sales begins to climb once more, it’s hard to argue that builders of new homes wouldn’t see some impact from that.

On top of those market-specific concerns, you need to ponder the macroeconomic environment. And that’s a pretty glum picture, as Fed policymakers acknowledged when they launched the third round of quantitative easing – an open-ended program focused on mortgage securities – late last week. Job creation is sluggish (and that’s a polite word to use for the rate at which employers are hiring); household incomes aren’t climbing. Consumers may be willing to buy a new pair of jeans – especially at a discount price – but are they confident enough that the economy will continue to expand to keep on buying homes? To keep the housing market rally going, more and more potential homebuyers will have to decide they are confident enough to trade up to a new home, or to shift from renting to owning. Where will they come from?

Let’s say that you have thought through all of these macro issues and remain convinced that the housing market still appears likely to do better than many other parts of the economy and that homebuilders or REITs seem to be more appealing investments than you can find elsewhere. Remember then that the iShares Dow Jones U.S. Home Construction Index Fund, one of a cluster of ETFs and other indexes that can be looked at for indications of just how big those advances have been, has gained 108 percent over the last 12 months.

Bulls can – and do – argue that the lofty price/earnings ratios of companies like Lennar (which trades at about 25 times next year’s expected earnings, not quite double the level of the S&P 500) aren’t meaningful because the “E” part of the P/E ratio is still artificially depressed in the wake of the massive slump in the industry. Fair enough, but will the pickup in earnings really outpace the gains in the company’s share price at a time when fewer companies are poised to deliver above-trend earnings growth?

The higher these stocks have soared in the context of an economy that is only stumbling along, the greater the risk associated with owning them, much less buying more of them. If you do opt to take some cash off the table, it might be worth taking some time to look through the universe of residential REITs. Not only do these securities offer healthy yields, but to the extent that the housing market’s growth slows, it is this sector that may become one of the beneficiaries as more potential homebuyers are stuck in rental apartments that make up the REIT portfolios.