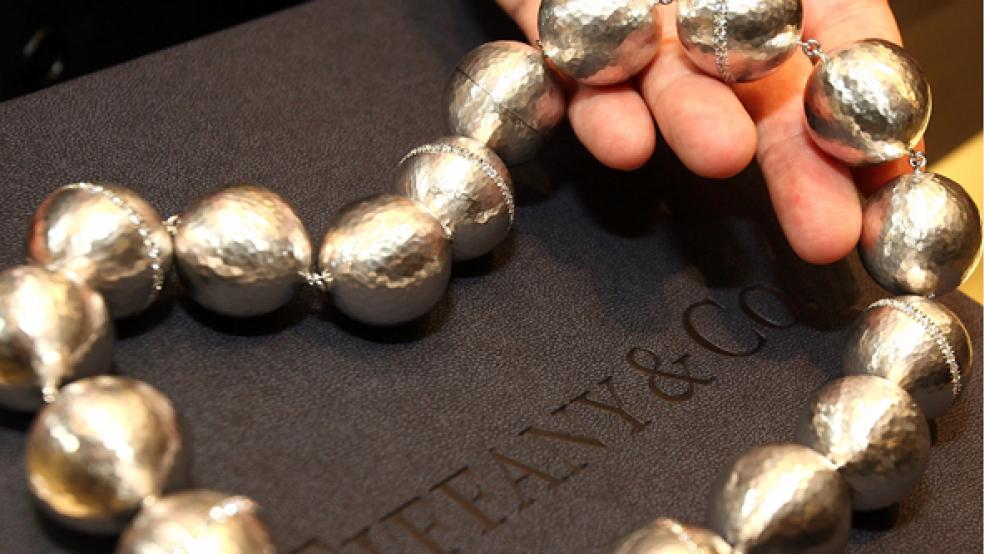

Tiffany's (TIF) earnings may look glittery on the surface, with the jeweler on Tuesday reporting a 63 percent jump in its third-quarter results and boosting its forecast for the year by another nickel a share to as much as $3.80. But even the news that Tiffany's same-store sales climbed by 16 percent (excluding currency fluctuations) in the third quarter – at a time when other retailers have a tough time topping 4 percent or 5 percent – wasn't enough to allow the stock to shine. Even as the broader market rallied strongly Wednesday, Tiffany’s shares edged lower, following a drop of almost 9 percent the day before.

Sales growth at Tiffany’s seems to be slowing, and the fourth quarter will be a slower one than the company expected. Investors also were unnerved by the company's news that gross margins narrowed, in large part due to the fact that sales were of more costly items, which usually have lower margins.

That news may well unnerve others, notably diamond mogul Laurence Graff, who is reported to be preparing to take his Graff Diamonds business public in Hong Kong next year, raising about $1 billion in an IPO. Graff relies on just those high-end, lower-margin customers to fuel its sales. While the company's image has been built on Graff's purchase of iconic gems at auction – like the Wittelsbach Diamond, later re-named to include the Graff name after being re-cut – those items aren't its bread and butter.

True, Graff's decision to go public in Hong Kong, close to vital markets in China and the rest of Asia for luxury goods producers, will help its IPO prospects. But combined with the hints of slower economic growth in China and India that have been recorded in recent weeks, any sign that the mass-affluent shoppers aren't spending as lavishly on diamond trinkets, or that luxury retailers can't push up margins on the bigger-ticket items marketed to multi-millionaires, might mean that growth at Graff will be harder to come by as well.

So far, betting on luxury retailers has proven to be a wise strategy, as upscale firms like Saks (SKS), Harry Winston (HWD) and Nordstrom (JWN) have appeared to be sheltered from the uncertain economic times because their clientele can still afford to spend. Even when Saks reported a slump in third-quarter earnings, the department store was able to point to stronger same-store sales and higher margins. But the future may be just as uncertain and uncomfortable a place for this group as the present is for the likes of Target (TGT) and the Gap (GPS).