• Small businesses account for 60 percent of new hiring. • Non-coporate borrowing plunged 8 percent over the past year. • Just 4 percent of small businesses have sales of more than 5 percent |

Small business owners feel a lot more downbeat about this economic recovery than executives at big corporations. The divergence is historically wide, which is not a good sign for growth. Small businesses are a crucial cog of the economy’s job generating machinery, and they account for about half of private-sector business activity. That’s why both the Federal Reserve and Congress are searching for ways to pull this important sector out of its funk.

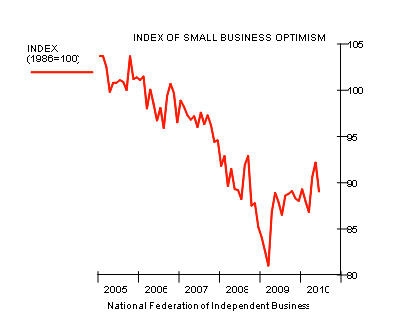

Recent survey results tell the story. Corporate CEO confidence in the second quarter, measured by both the Conference Board and the Business Roundtable, had recovered to levels not seen in about four years. The index of small business optimism, published by the National Federation of Independent Business (NFIB), fell in June and is holding at levels that are still below those plumbed during the last two recessions.

Economists believe two main factors account for the malaise: restricted access to credit and poor sales, both of which have the potential to be aggravated by recent signs the recovery may be losing momentum. The percentage of small businesses telling the NFIB in June that credit conditions tightened over the previous three months remains extremely high by past standards. Federal Reserve Chairman Ben Bernanke made special note of that fact when he addressed a gathering of small-businesses and financial-institution leaders on July 12:

Bernanke said, making credit available to sound small businesses is crucial to our economic recovery because small firms employ roughly half of all Americans and account for about 60 percent of gross job creation. Small start-up companies play an especially important role in job growth. However, the formation and growth of small businesses depends on access to credit, which remains very hard to get. He said the task of getting credit flowing to small companies is neither simple nor straightforward, because each firm faces a unique combination of local economic conditions and complex relationships with customers, suppliers and creditors.

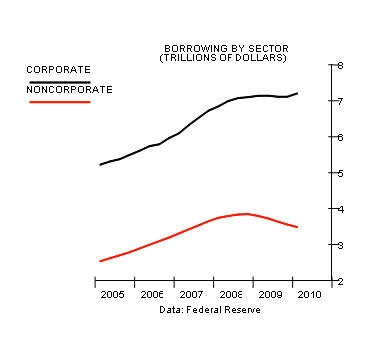

Borrowing is not an issue at big companies. Over the past year, borrowing by large corporations has grown 1 percent, but non-corporate lending, primarily to partnerships and sole proprietorships, has plunged 8 percent, according to Fed data.

Big firms can float bond issues in the capital markets, where credit flows have improved greatly. Small businesses typically depend on banks, often small community banks, for their borrowing needs. Banks this year began to ease terms and conditions on loans to large and midsize companies, but while they are no longer tightening standards for small businesses, they have not yet begun to relax them, according to Federal Reserve surveys.

Small Businesses Suffer Even as Global Businesses Thrive

Poor demand is perhaps even more important in explaining the divergence in sentiment between large and small businesses. Small companies told the NFIB in June that “poor sales” was their single-most important problem. Morgan Stanley economist Richard Berner says that makes sense because small-business sales are less oriented toward global markets, whose strong growth has boosted U.S. exports and profits at larger firms. Based on an analysis of NFIB data, he concludes that only about 4 percent of small businesses have more than 5 percent of total sales outside the U.S.

Small companies thus are much more dependent on domestic demand, especially consumer spending and construction. NFIB data show that retailing and construction make up about 40 percent of NFIB members. Based on a Morgan Stanley analysis, consumer and construction spending have, respectively, 10 and four times more influence on the NFIB’s measure of small business sentiment than exports, which helps to explain why both confidence and activity in the small business sector have been laggards in this recovery.

Finally, the drab mood of small business owners may also reflect generalized anxiety about policy uncertainties. According to economists at UBS, small business optimism is far below what would be expected by the current pace of overall economic growth. One reason: the $30-billion proposal by the Obama administration to support lending by small banks to small companies remains stuck in Congress. Small businesses also may be disproportionately worried about future taxation and regulation. NFIB members named those two issues as their second and third most important problems.

Recent data suggesting the economy is slowing down a notch, including the latest reports on retail sales, construction, and factory output, aren’t helping matters. Those areas are especially important to small businesses, and until they feel more confident about expanding operations, the economy will not be firing on all cylinders.