It’s hard not to chortle when reading a headline like this one atop a New York Times article from August: “Loeb Humbly Accepts Sony’s Rebuff of his Shake-Up Plan.”

It’s very, very hard to wrap my mind around a sentence that uses the words “humble” or any of its derivatives in connection with activist investors in general or Daniel Loeb – the subject of the piece – in particular. After all, this is the same guy who wound up as the subject of a New Yorker profile in large part because of his inability to self-edit, whether in cyberspace, print or in person. And while Loeb may be an extreme example, the same is true of many of his activist peers, to some degree.

To win attention from the management teams of companies they are trying to influence, these activists need an audience. And they’ve concluded that – in an era of reality television – the best way to do that is to be as publicly provocative as, say, Miley Cyrus was during her now-infamous VMA performance earlier this year. Anyone who is hoping that activist investors will disappear from the stage any time soon, though, is doomed to disappointment in the same way that Miley Cyrus’s critics remain disgruntled by her failure to apologize.

Related: 4 Investing Mistakes That Could Haunt Your Portfolio

Indeed, a recent report from Citigroup’s Citi Global Perspectives & Solutions team cautioned the bank’s clients that activist investors aren’t just “an occasional threat” any longer, but a “sweeping trend that has spread to companies in all sectors and of all sizes, and increasingly, across all geographic regions.”

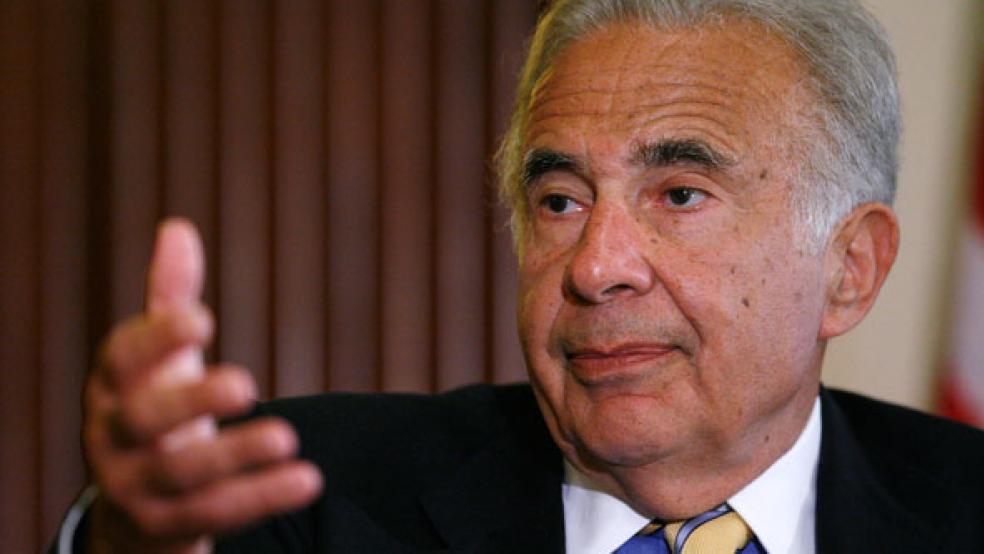

So far this year, 116 North American companies have been the target of a campaign – and that only counts those campaigns that have gone public, like Loeb’s recent engagement with FedEx (NYSE: FDX), Carl Icahn’s public push for Apple (NASDAQ: AAPL) to shrink its cash mountain or the suggestion by Barington Capital that Darden Restaurants (NYSE: DRI) should spin off underperforming chains like Red Lobster into a separate division. Add in the private campaigns, and the number rises. (The researchers conclude that in Europe, about 45 percent of all activist campaigns are private.)

Clearly, it’s not safe to simply ignore those folks. That’s what Yahoo (NYSE: YHOO) tried to do with Dan Loeb, when the investor’s Third Point Management first took a stake in the company back in 2011. Flash forward 18 months, and Loeb had managed to oust the company’s CEO and win himself a seat on the company’s board.

Nor can you assume that if your share price is doing well, you’re safe from the attentions of Loeb and his colleagues. Since 2006, the Citi report concludes, a third of the companies that activists targeted actually were beating their peers before those activists focused on them. If you’re invested in a company with sluggish revenue growth, multiple business divisions (especially in different industries) and lower insider ownership, the odds rise sharply that it will be targeted by an activist like Loeb.

So, should you invest in a company like American Eagle Outfitters (NYSE: AEO) or Corning Inc. (NYSE: GLW) that pundits consider to offer excellent "bait" for activists? After all, not every company in whose affairs an activist investor becomes involved goes on to do precisely what that investor expects, much less delivers great returns. Just consider Bill Ackman, under whose leadership the state of affairs at J.C. Penney (NYSE: JCP) went from slightly gloomy to nearly apocalyptic. Ackman also is still waiting for his prediction of Herbalife’s (NYSE: HLF) collapse to materialize; meanwhile, a host of other high-profile activists have all chimed in with their own views on that business model.

Still, there is evidence, both anecdotal and documented, that keeping track of what activist investors are up to can help boost returns. Citigroup reports that activists’ targets tend to outperform the broad market indexes by about 15 percent in the first year following a campaign and a total of 33.8 percent in the two years that follow that activist crusade.

Related: A Warning for Wannabe Twitter IPO Investors

Even if it’s hard to argue that Apple’s recent share price recovery is due to Carl Icahn's push to get the company’s board to pay out big dividends (it’s more likely due to the fact that its iPhone 5s and the iPad Air are selling well), it’s certainly arguable that the campaign he waged against the management-led buyout of Dell forced the bidders to sweeten their offer. (It also has helped Icahn win more followers for his Twitter account, where he brags, “I make money studying natural stupidity.”)

If you plan to track what corporate gadflies like Loeb, Ackman and Icahn are up to, you may want to stock up on motion sickness remedies. The common characteristic of stocks that become enmeshed in activist tussles is volatility. Even if you believe that your favorite activist has a better-than-average chance of nominating a slate of alternate directors who will be able to guide management to strategic decisions that will boost revenues and profits, that won’t happen overnight.

On the way, the kind of public tug-of-war that can follow the announcement by Icahn, Loeb and their lesser-known peers that they’ve got a particular company in their sights is going to trigger uncertainty. Will the targeted company spend time and cash to hire costly investment bankers now developing an expertise in fending off unwanted input from activists? Have the activists identified something about which investors already were anxious (like Apple’s cash mountain) or are they seen as simply adding uncertainty to the mix?

Ultimately, for most of us the antics of the activists may offer more entertainment value than investment returns, once that kind of volatility and uncertainty are factored into the equation. But if you’re hoping for a reality show – “The Real Activist Hedge Fund Managers of Manhattan,” say – don’t hold your breath. After all, George Clooney wouldn't approve.

Top Reads From The Fiscal Times: