The pistons of America’s economic engine are out of sync, and proof of that is piling up. Just look at the data on consumer and business spending in the third-quarter GDP report released on Friday.

The economy grew at an annual rate of 2 percent from July through September, according to the Commerce Department’s first estimate, but the elements driving that sluggish advance – businesses, consumers and government – diverged considerably. Personal consumption grew 2 percent from the second quarter, including a nearly 9 percent rise in purchases of durable goods like cars. The housing sector in particular helped fuel the still-modest growth, with residential investment increasing 14.4 percent. Surprisingly, government spending also grew, as a 13 percent increase in defense outlays drove overall government consumption up 3.7 percent.

Businesses, on the other hand, cut spending by 1.3 percent.

“The report highlights the fact that businesses have already begun to react to the fiscal cliff while consumers march steadily ahead,” Bank of America Merrill Lynch economists Joshua Dennerlein and Ethan Harris wrote in a note to clients on Friday.

If the American economy has been developing a “split personality,” as economist Paul Ashworth of Capital Economics wrote recently, then the latest figures essentially confirm the diagnosis. Corporations and consumers continue to exhibit sharply different moods and behavior.

In the wake of the Great Recession, corporate profits rebounded to record levels even as companies waited for demand to return to pre-recession levels. Consumers, on the other hand, often sought to ramp up savings and pay down their debt.

Now the trends have turned. With the housing market showing clear signs of improvement after years of painful losses, consumer confidence is as high as it’s been since before the financial crisis – despite stagnant incomes and an unemployment rate that’s still high at 7.8 percent. The final reading of the Thomson Reuters/University of Michigan consumer sentiment index for October came in at 82.6, and though that was down from a preliminary 83.1 it was still the highest final reading since September 2007.

Also for the first time since 2007, the percentage of Americans who told Gallup pollsters that they feel better off financially than they did a year ago was higher than the percentage who said they feel worse. And the optimism about the coming year was notable, with 66 percent saying they expect to be doing better still in a year’s time.

The increased optimism is further shoring up the housing market, where sales of new homes surged to a two-year high last month, partly because of exceptionally low interest rates on mortgages. And it is being felt in stores, where Americans have loosened their purse strings just a bit (and, perhaps driven by the Fed’s efforts to keep interest rates low, cut back on their savings rate). Retail sales have risen for three straight months, according to the Census Bureau. Sales for the months of July, August and September increased 4.8 percent from the same period in 2011.

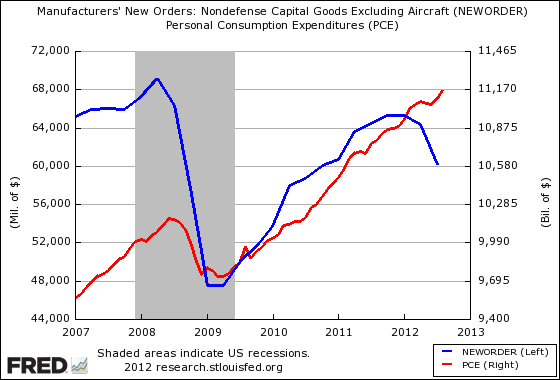

Typically, when consumers display optimism and a willingness to open their wallets, businesses ramp up spending and hiring in order to be ready for the increased activity. But this time, as consumers step up their activity, businesses have been hunkering down. Orders for non-defense capital goods have plunged by nearly 18 percent over the last three months, as companies anticipate further global economic weakness and the potential dangers of the fiscal cliff. That combination of tax hikes and spending cuts, set to kick in next year unless Congress and the president act, would pull some $500 billion out of the economy and send the U.S. into another recession, according to projections from the nonpartisan Congressional Budget Office.

For a group that’s sitting on a couple of trillion dollars in cash and not long ago steered their businesses to record profits, the CEOs of many American companies are now extremely cautious if not decidedly gloomy. Simply put, business confidence is sliding even as consumer confidence is rising.

As expected, the third quarter appears likely to break a streak of 11 straight quarters of earnings gains. But while analysts still expect earnings to grow in the fourth quarter, a host of companies like FedEx, UPS and Caterpillar have been lowering their full-year forecasts. A Business Roundtable survey of CEOs published late last month found that expectations for the next six months of sales fell to its lowest point since 2009.

A number of factors explain the divergent views. Businesses are more sensitive to global economic conditions than consumers, and they must adjust for slowing growth in China and a Eurozone still mired in uncertainty and, in many countries, recession. Exports, as Friday’s GDP report showed, fell 1.6 percent in the third quarter, the first drop since early 2009.

And while consumers tend to base their financial behavior on how things are going today and their outlook for tomorrow, companies must plan far further into the future. Concerns about the fiscal cliff have been mounting for months, but these days, as business leaders look to plan for the coming quarters, they find it’s hard to see clearly what lies beyond the approaching cliff.

Morgan Stanley’s Business Conditions Index plunged to 41 percent from 55 percent in September. "Optimism surrounding supportive monetary policy has faded while fiscal cliff and election uncertainty have steadily risen," Morgan Stanley economist Dane Vrabac wrote on October 16.

Or listen to the CEOs themselves: “Closing out the year, we're all mindful of the potential financial cliff, consumer sentiment and global economy driving uncertainty in the marketplace,” Union Pacific CFO Robert Knight told analysts this month, even as the company announced its best quarterly results ever. In a recent interview on CNBC, Goldman Sachs CEO Lloyd Blankfein warned that the fiscal cliff could derail the slow recovery. “We just met with a dozen of the largest high-tech company CEOs in the country,” Blankfein said. “Not only are they hoarding cash – all their customers, all their suppliers are. They’re scared to death we’re going to go over this cliff and it could be a catastrophe.”

Others have been beating the drum about the dangers of the fiscal cliff as well. On the heels of a Federal Reserve regional survey released Tuesday that found weakness in the domestic manufacturing sector, the National Association of Manufacturers (NAM) on Friday warned that the economy is already feeling the effects of the cliff, even with two months to go before we reach it. The cliff has cut 0.6 percentage points from GDP growth this year, according to the report prepared for NAM by Jeff Werling, executive director of the Interindustry Forecasting Project at the University of Maryland. Going over the cliff could wipe out almost 6 million jobs.Corporate pessimism is also reflected in the way companies are managing their share repurchase programs now that the S&P 500 has gained better than 12 percent on the year. “Corporate actions have been more bearish this fall than at any time since late 2010,” write Charles Biderman and David Santschi of investment research firm TrimTabs. Since the beginning of September, companies and corporate insiders have been selling significantly more stock than they’ve been buying.

“With the presidential election and the ‘fiscal cliff’ approaching and the global financial system on life support from central banks, corporate insiders seem to be battening down the hatches,” the TrimTabs report says.

As they look to 2013, economists say that businesses and consumers could still get in sync – but whether that's good or bad for the economy remains to be seen. If businesses pull back sharply enough they could wipe away consumers’ newfound enthusiasm. Newell Rubbermaid on Friday said it plans to cut 2,000 jobs – more than 10 percent of its workforce. And the Dow Chemical Company last week announced that it will close some 20 plants and cut 2,400 jobs, or 5 percent of its global workforce, to reduce costs by about $500 million over two years. The company will also save another $500 million by cutting its capital spending and investments. The moves, Chairman and CEO Andrew Liveris said, were being made to position the company for a “slow-growth and volatile world.”

More announcements along those lines could easily lead consumers to retrench, especially given that some recent spending appears to be at the cost of personal savings, which fell to 3.7 percent in August from 4.1 percent in July.

Whether consumer sentiment rubs off on business or corporate caution trickles down to average Americans may depend in large part on what happens with the fiscal cliff, economists say. Consumers who have been oblivious to the fiscal cliff might face an unpleasant surprise once Election Day has passed. And the increased attention paid to the lingering tax and spending uncertainties could sour consumer sentiment, much like the debt-ceiling debate in the summer of 2011 did. “The irony is that consumers could ultimately face a bigger potential shock from the fiscal cliff,” the Bank of America Merrill Lynch economists suggest.

The realization that breaks like the payroll tax holiday are set to go away could dampen consumers’ spirits too. “If there’s not deal then all of our paychecks at the beginning of January will get a hit,” says Harm Bandholz, chief U.S. economist at UniCredit. “And if you see that then you automatically cut back on spending.”

But a timely fiscal cliff deal might still spur an uptick in business investment as companies restart the projects they’ve put on hold. “Most of these projects are not abandoned. They’re just postponed,” says Bandholz. “Businesses want some clarity on what’s going on and once they have this clarity they will start investing again.”