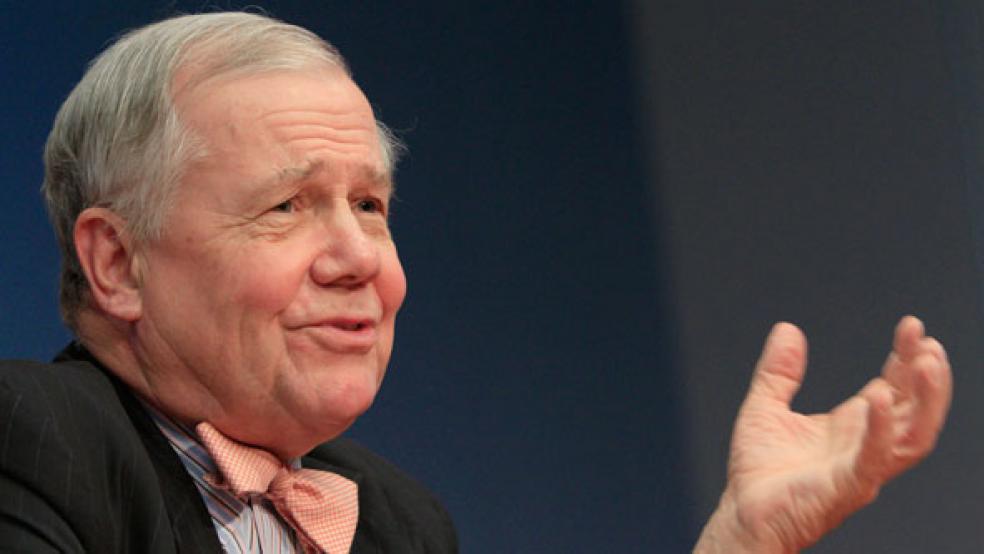

Renowned investor Jim Rogers is still worried. As the U.S. heads for the fiscal cliff at the end of the year, the chairman of Rogers Holdings has been outspoken about the consequences of the country’s growing national debt. From his perch in Singapore, he still doesn’t see much reason for real optimism. Rogers rose to investing prominence after starting the Quantum Fund with George Soros in the 1970s, generating an eye-popping and oft-cited return of 4,200 percent over a 10-year span that saw the S&P 500 climb less than 50 percent. Rogers “retired” as a multi-millionaire at age 37.

But he’s remained an active investor, world traveler, author and ubiquitous media presence. The self-styled “Adventure Capitalist,” who rode a motorcycle across China in the early 1990s – and biked more than 100,000 miles across six continents – moved from New York to Singapore in 2007. He created the Rogers International Commodities Index (RICI) in the late 1990s. His name has become synonymous with investing in commodities and China.

While some big-time money managers prefer to keep mum about their market views, Rogers has unabashedly offered his perspective – including to The Fiscal Times, which spoke with him this week about the fiscal problems in the U.S. and Europe, the fears about a slowdown in China, why the long bull market in commodities isn’t over yet and why the world needs more farmers.

The Fiscal Times (TFT): You’ve we’re heading for financial “Armageddon.” Why that dire?

Jim Rogers (JR): The United States is the largest debtor nation in the history of the world. Our debts are skyrocketing every year and nobody’s doing anything about it. Every country in history that’s gotten into this situation has had a crisis or a semi-crisis, or both. In 2002 we had an economic slowdown, which was fairly serious, and then in 2007 and 2008 we had another one, which was worse because the debt was so, so, so much higher. The next time around the debt is going to be that much more catastrophic.

TFT: We are still hearing calls for another round of quantitative easing by the Fed. Bad idea?

JR: It’s an absurd idea. Printing money has never solved anyone’s problems. Maybe sometimes in the short term printing money has alleviated the situation, but anybody who has studied history or economics knows that printing money in the longer term doesn’t work. Maybe this time it’s different, but I doubt it.

TFT: What’s your assessment of the market? Are you still bullish on commodities long term?

JR: Yes. My view is if the world economy gets better, I’m going to make money in commodities because of the shortages that are developing and getting worse. And if the world economy doesn’t get better, then they’re going to print money. It’s the wrong thing to do but that’s all they know. They’re not very smart people. So they’re going to print more money, and when they [do], historically you’ve always protected yourself – and made money – by owning real assets.

TFT: Are there some real assets that you prefer to others?

JR: On a historic basis, agriculture is still cheaper than others. But I own them all. I own more agriculture than I own of the others, but I own them all.

TFT: Have you been putting more money to work in commodities or in other areas?

JR: Not recently. I’ve been watching. I’ve got my positions. I’ve bought a few more Myanmar shares recently, but other than that I haven’t done anything.

TFT: What about China? You’re still bullish despite the concerns about how the economy there is doing – concerns that were reinforced last week with the weaker trade data that came out. Do you think those concerns about China and a potential hard landing have been overblown?

JR: I’m a little surprised anybody says anything about China. China has publicly announced for three years they’ve been trying to slow their economy down. They’ve announced almost every month or every quarter they were trying to slow things down, so anybody who isn’t aware of this either hasn’t been paying attention or doesn’t know what they’re doing. China is slowing down, by design, properly, if you ask me. Some parts of [that] economy are going to have problems, such as property and real estate. Other parts are going to continue to do well. But anybody who deals with the West in China is certainly going to know something’s wrong. Anybody who deals with property in China is going to know something’s wrong. But part of that was by design – and proper design.

TFT: You say there are broader structural problems with our agriculture industry and that the U.S. may have a shortage of farmers. Are we going to have problems producing crops beyond the weather-related issues we’re seeing this year?

JR: Nearly every year, the world always has a problem somewhere with weather or something, since the beginning of time, and I suspect we will continue to. The problem now is it’s going to be more and more difficult to recover because of two things. One, we’ve consumed more than we’ve produced nearly every year over the last decade, so inventories are very low. But more importantly, we’re running out of farmers. The average age of farmers in America is 58. More people study public relations than study agriculture. We don’t have anybody going into agriculture. Something’s got to happen, such as much higher prices, or we’re not going to have any food at any price… We’ve got to do something to get farmers back into the field.We produce 200,000 MBAs in the U.S. every year. Some human being has to go into the field. Yeah, things are more automated, but still, somebody has got to get his hands dirty.

TFT: Will the presidential election change the investing picture at all? And what are your thoughts about Mitt Romney’s choice of Paul Ryan as his running mate?

JR: As far as I’m concerned, the election is irrelevant. One [candidate] happens to be from Boston and one from Chicago, and whoever wins, their friends are going to do well, but other than that America is not going to do well. There’s very little difference in any of these guys. None of them understands the problem. These are the guys that got us into trouble. You expect them to get us out?

TFT: You’ve given money to Ron Paul’s campaign. Would he have done a better job?

JR: I suspect he would have. He would have had the problem of dealing with a Congress that is not in sync with his views, but he certainly would have pushed us in a better direction than these guys will.

TFT: Average investors see what’s going on in the U.S. and hear about what’s happening in Europe, China and other areas in the emerging world. How should they position themselves ?

JR: Investors should be investing in and owning things they know about. If you don’t know what you’re doing or don’t have something you think is going to be a good investment, you should do nothing. The problem these days is even if you put your money in cash, what kind of cash? Some cash is better than others. But even if you don’t know any better, just put your money in U.S. dollars in the bank and wait until you find something you know a lot about. I happen to be invested in commodities and especially agriculture – and I own currencies and I’ve sold short stocks. But people – if they can’t spell commodities, they shouldn’t be listening to me. They should be doing what they know about.