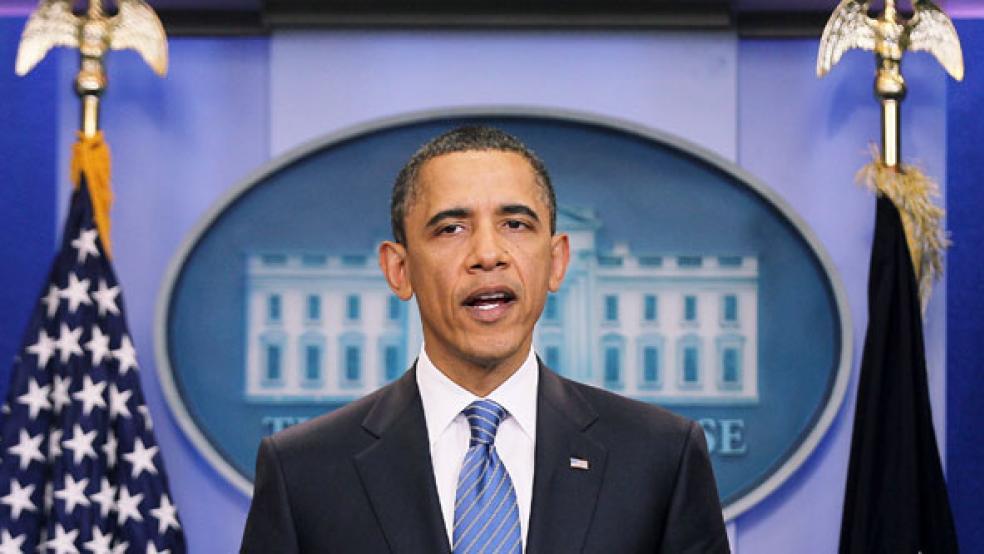

Unless he surprises us all with a curve ball, President Obama’s nationally televised address before a joint session of Congress tonight will outline a far-ranging but largely familiar-sounding $300 billion plan to revive the flat-lining economy.

The high-stakes strategy calls for new highway, bridge, and mass-transit spending; housing aid, including an expanded program for refinancing properties; and new programs to help retrain the unemployed and assist them in finding work. Obama will urge Congress to extend a payroll tax cut and unemployment benefits for the long-term jobless, as well as approve other tax cuts and incentives to put extra cash in Americans’ pockets and spur businesses to hire more workers. And he will advocate direct cash infusions to state and local governments to help avert the layoff of teachers, police and other public employees.

But with the unemployment rate firmly stuck at 9.1 percent, economic growth virtually stagnant, the stock market wildly gyrating, and most Republicans more interested in reducing the $1.3 trillion budget deficit than another round of stimulus spending, budget and political experts are highly skeptical that the president’s speech and proposals will do much to increase jobs in the near term.

“We're long past the time when impressive rhetoric can substitute for depressing reality,” says Larry J. Sabato, a University of Virginia political scientist. “Until the sights and sounds about jobs on the evening news show change, Obama's stuck.”

Since the vast majority of what Obama will propose--whether far-reaching or bite-size--won't be passed by Congress, Sabato and other political experts say Obama might as well “go big” with his rhetoric and ideas to try to energize his political base. And when his grand ideas are killed, he can play Harry Truman and run against the “do-nothing Republican Congress.”

Others believe that Obama, ever the pragmatist and consensus seeker despite his frequent disappointments in negotiating with Republicans, will try to straddle the center with his proposals – and by doing so will limit the impact of his economic recovery plan.

“There are certain realities that keep him from going much bolder or dramatic than he already has in the past,” says Harry Holzer, a visiting fellow at the Urban Institute and former Labor Department chief economist. “He has to keep his eye on the overall price tag this time.” Holzer was alluding to the $825 billion stimulus law he shepherded through in 2009, which Republicans have since maligned as Democrat-inspired wasteful spending. “So given that, I don’t think the scope for big surprises is very available to him.”

Indeed, with new federal funds hard to come by and Republicans and Tea Party conservatives adamantly opposed to raising taxes, Obama can hardly afford to propose another round of major stimulus spending or tax incentives and benefits beyond a renewal of existing tax breaks already embedded in the nation’s financial framework.

Moreover, new or expanded tax incentives for hiring or payroll tax holidays won’t substantially boost the economy in the long term and will detract from larger-ticket economic engines like tax and entitlement reform, Doug Holtz-Eakin, a former Congressional Budget Office director, noted recently.

Mark Zandi, chief economist at Moody’s Analytics, told The Fiscal Times that the President’s main responsibility in advancing his economic package is to prevent a double-dip recession and use stimulus spending to negate some of the contractionary impact that the billions in spending cuts being sought by Congress and the administration will have on the economy. For example, the payroll tax cut for employers and workers is a logical way to ensure the economy doesn’t lose additional jobs, he said.

“It would be nice to do things that would create jobs but when you’re talking about being additive to jobs, that means you’re going to raise the price tag [for a stimulus package] significantly above $300 billion, Zandi said. “And the odds of the President or Congress proposing that in this political and fiscal environment are low. “

Of the $300 billion to $400 billion the president reportedly wants to devote to economic recovery, up to $200 billion will be needed to finance an extension of the current two-percentage point payroll tax cut for workers and unemployment insurance benefits, according to Holzer. Obama reportedly is planning to propose $100 billion or more in spending on infrastructure, state and local aid, and programs for workers who have been unemployed for more than six months.

The payroll tax cut extension for employers won’t necessarily result in major hiring, Holzer says. “You may get a few hundred thousand workers hired, perhaps, but for a lot of companies this is just going to be a windfall that will provide them extra money for stuff they would have done anyway.”

Harvard economist Jeffrey Miron has similarly low expectations for the program, but for different reasons.

“It’s a kind of distraction that I just don’t think will add up to much and I, frankly, can’t get myself to care about it one way or the other,” says Miron, a libertarian. According to Miron, employers’ low expectations for what they can realistically sell in a weak economy is preventing them from hiring additional workers, not concern about the cost of hiring workers.

Miron is also doubtful that funneling cash transfers to states and localities is the most sensible way to help states pay their bills.

“It’s sort of robbing Peter to pay Paul in the form of higher federal taxes, without really making a fundamental change. It allows states to put off the tough choices and cost-benefit analyses they need to undertake,” he says.

One potential bright spot in Obama’s plan, that some groups on the Right and the Left are interested in pursuing, is creation of an infrastructure bank to fund highway, bridge, railroad, and airport projects through a mix of low-interest private and public loans and investments. “There, the short-term implications are positive because you’re putting people back to work in construction, but the long-term effect on productivity is there, too, since installing effective roads, bridges, and airports will help sustained growth,” Holzer says.

A rare coalition of business and labor is trumpeting the infrastructure bank idea, with the ultimate “odd couple” of U.S. Chamber of Commerce President Tom Donohue and AFL-CIO President Richard Trumka. teaming up last spring to give the idea a push.

However, the Republican leadership intends to shoot down any stimulus spending proposal the President lays out.

On Tuesday, House and Senate Republican leaders said they would oppose any major new spending plan to try to boost economic growth, citing Obama’s 2009 stimulus package as evidence that added spending won’t shore up the economy this time, either.

“We argued at the time that a large, deficit-financed government spending bill was not the best way to improve our economic situation or create sustainable growth in unemployment,” House Speaker John Boehner and House Majority Leader Eric Cantor wrote in a letter to Obama. “Given the current unemployment and deficit numbers, we believe our concerns have been validated.”

Senate Republican Leader Mitch McConnell said in the floor speech earlier today: “What is surprising is the President’s apparent determination to apply the same government-driven policies that have already been tried and failed.”