Sharp declines in both stock prices and longer-term interest rates and a string of weak economic reports have raised new fears the economy could slip back into recession – if it hasn’t already. Despite the glimmer of good employment news Friday, all of this is putting enormous pressure on Ben Bernanke and other Federal Reserve officials to take new steps to boost the economy when they meet in a policy-making session on Tuesday.

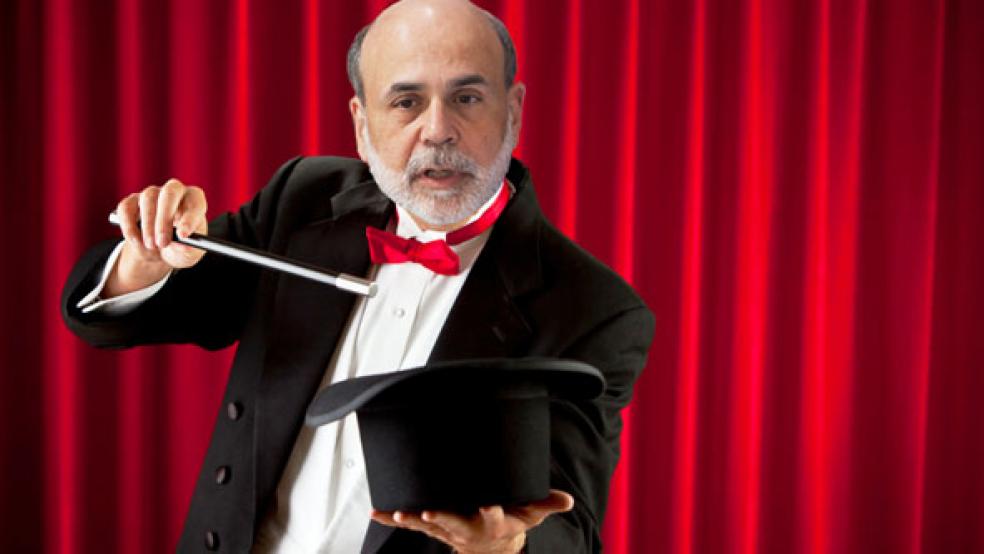

There’s been plenty of talk that the Fed has exhausted its bag of tricks to help bolster the anemic economy, including two rounds of quantitative easing, in which the central bank made massive bond purchases. Now Bernanke is under the gun to dig back into that bag and consider a third round of bond purchases or other more arcane maneuvers.

Economic growth in the first half of the year turned out to be quite weak, partly because of a wave of spending cuts by federal, state and local governments. Meanwhile, the contentious debate over increasing the debt limit and the deal that settled the immediate crisis made it clear there is virtually no prospect of any new fiscal moves to stimulate growth. Instead, more spending is to be slashed; more layoffs are likely.

The Fed’s traditional tool for stimulating economic growth — lowering its target for overnight interest rates — isn’t available because it already is virtually at zero. Instead, as Bernanke explained at a June 22 press conference following the last meeting of the policymaking Federal Open Market Committee (FOMC), only extraordinary measures are left. “We do have a number of ways of acting; none of them are without risks or costs,” Bernanke said.

One would be to resume purchases of longer-term Treasury securities. Beginning last fall, the Fed added $600 billion worth to its balance sheet before that program ended in June. Estimates by Fed economists indicate that program may have reduced long-term interest rates by as much as half a percentage point.

Bernanke said the Fed also could “structure them in different ways,” presumably a reference to buying those with longer maturities, such as seven-year notes instead of three-year notes, which could add liquidity to the bond market. He also mentioned cutting the one-quarter percent interest rate the Fed pays on cash that banks have on deposit at regional Federal Reserve banks.

And then there is “communication” to provide a little reassurance to the financial community. The FOMC has said it expects to maintain its overnight rate target for “an extended period.” The chairman said the committee could provide a “fixed date,” so there would be some added certainty about how long rates would stay super low — a strategy followed not long ago by the Bank of Canada.

“But, of course, all of these things are somewhat untested,” he cautioned. “They have their own costs. But we’d be prepared to take additional action, obviously, if conditions warranted.”

F. Ward McCarthy, chief financial economist for Jeffries Group, urged the Fed to take several of these steps next week. “They should change the communication on the target and reassure markets it will be low for longer than an extended period. They should also buy more longer-term Treasuries, or reinvest the maturing issues they now hold in longer-term stuff,” McCarthy said.

The “most powerful move” the Fed could take, he continued, would be to sell off the shorter-term securities they now hold and roll them into long-term stuff. That would add a great deal of liquidity to the shorter-term market, “which is starved for collateral,” McCarthy said. “That would make a stronger statement.”

‘Some Stimulus Essential’ for Stabilization

Economist Asraf Laidi said that some sort of Fed stimulus was also essential to help stabilize threats to the euro currency market. That market has its own crisis because of excessive debts in several member countries, including Greece, Ireland, Portugal and now Italy and Spain. A break up of the euro countries could pose a critical new threat to the U.S. economy.

Such Fed moves toward new stimulus would represent a sharp departure from what the FOMC planned when it met June 21 and 22. At that point, Bernanke said he and his central bank colleagues expected growth to pick up and that no new Fed efforts were needed to boost growth. But since then, the Standard & Poor’s 500 index has plunged 11 percent and longer-term interest rates are down sharply.

Minutes of the June meeting say that FOMC participants were divided over what to do if growth remained too slow to reduce unemployment. The Labor Department reported today that the jobless rate ticked down to 9.1 percent in July from 9.2 percent the month before. In addition, 117,000 payroll jobs were added. Both numbers were a bit stronger than analysts had expected, but were not enough to offset all the other recent bad news

Some officials said additional monetary stimulus should be provided if inflation returned to relatively low levels and joblessness doesn’t come down. Others felt there may be less slack in the economy than the unemployment rate suggests, and that to prevent inflation from rising, it might be necessary to begin to tighten policy sooner than investors expect.

But the economic news has been so poor that inflation expectations have dropped and the price surge fueled by soaring oil prices from December through April has subsided. Consumer prices rose only 0.2 percent in May and fell by that amount in June.

That same dose of bad news has driven yields on 10-year U.S. Treasury notes to just 2.4 percent, as investors sought the safety of the government securities now that the federal debt limit has been raised by Congress and the president. But in the depth of the financial crisis in late 2008, 10-year notes yielded 2.1 percent, so the current level is a sign investors believe the economy is in real trouble.

The latest developments have caused Macroeconomic Advisers, a prominent forecasting firm, to predict that the Fed won’t raise its current near-zero target for overnight interest rates until the middle of 2013. Previously the company expected that to happen in the middle of next year. In June, the FOMC spent considerable time discussing details about how best to go about “normalizing” its policies when the economy improved sufficiently. That is, when and how it should begin to shrink it nearly $3 trillion balance sheet and start to raise its target for overnight rates.

It’s not at all clear whether the Fed will do the array of things Jeffries economist McCarthy urges – but it’s certain the discussion in the one-day meeting next week will be very different from what was expected.