As the country crawls out of the Great Recession, America remains rife with entrepreneurial spirit. The Fiscal Times’ Launch Pad series looks at innovative small-businesses to see how they got started, how their founders dealt with mistakes, and what advice they have for other aspiring entrepreneurs.

InContext's Specs:

Year Founded: 2009

Business: virtual market research

Number of Employees: 35

First Round Funding: $200,000

Location: Chicago

Website:www.yipit.com

Competition: Red Dot Square Solutions, Fifth Dimension

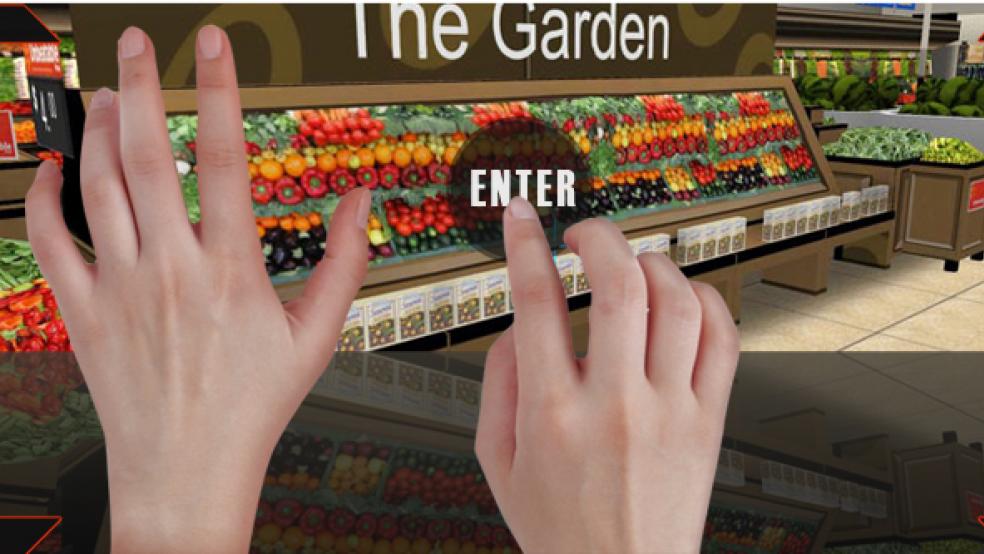

Imagine a shopping environment that looks like a well-known retailer – but it’s completely virtual. Customers can browse aisles, examine products, and compare prices with just a few clicks on their laptop. Better yet, the answers they give to a few highly targeted questions from manufacturers and retailers can significantly drive down market research costs for their firms – and help companies sell their products more effectively.

That’s the premise behind Chicago-based InContext Solutions, a tech startup that makes savvy use of three-dimensional replicas of the floor plans of major retail chains. The technology, offered over the Internet, expands the ability of manufacturers to query more consumers about pricing, packaging and shelf location without incurring significant expense. Retailers provide access, allowing InContext to collect images and study exact store dimensions required to build the simulations.

“They can much more effectively talk with their customers in a live environment and show them what it might look like,” said Bob Gillespie, CEO and one of the company’s three co-founders. “It’s much more efficient.”

Gillespie, 43, contends that his venture, now two and half years old, helps manufacturers bring goo ds to market faster because of the fresh insight gained from his company’s service. Virtual stores are also discrete, unlike traditional methods, such as polling customers in actual stores – an approach that retailers find disruptive and time consuming -- or creating focus groups in malls, where respondents view hypothetical product scenarios in screening rooms.

“Our process takes about a quarter of the time and runs a third the cost of doing traditional research,” said Gillespie, an entrepreneur with a background in software startups.

Projected Sales This Year: $6 Million

A lot of variables affect research pricing, including the scope of the research and complexity of the shopping environment but an initial study typically costs $60,000 to $125,000, with completion in about 10 weeks. Gillespie doesn’t name customers , but he said InContext has inked agreements with some of the best-known brands in packaged goods.

A glance at their website shows products ranging from Tropicana orange juice to Frito-Lay potato chips.

Are the research results truly as reliable as polling consumers in live settings? InContext says its findings have been proven to be as accurate as traditional methods, according to Rick Hanzelin, 43, the firm’s chief strategy officer.

“Statistically speaking, if they do [research] in the real world, they do it in our world,” he said. Competitors who offer two-dimensional research environments, such as Decision Insight and Vision Critical, are less sophisticated, said Hanzelin, while 3D rivals Red Dot Square Solutions and Fifth Dimension rely on simulations that don’t run on the Internet, but on local computers.

Hanzelin joined InContext in 2010 to help accelerate sales, which this year are projected to reach close to $6 million, a three-fold increase from 2010, the first full year of operation. He and Gillespie had worked together previously, at Navigant Consulting in Chicago, where they worked on systems for the insurance industry and later on software startups serving the insurance and mortgage sectors.

“The common thread is that each of [those previous stints] involved churning massive amounts of data really quickly,” Hanzelin said, adding that market research in a virtual world has similar demands.

Don Scheibenreif, an analyst with Gartner Research who studies how technology affects relationships between manufacturers and customers, said he found InContext’s technology promising.“They’re able to scale and get many more people to interact with an environment and increase the sample size,” said Scheibenreif. He cautions that big companies can be slow ships to turn, though.

“They’re going to come up against some very established research methodologies,” he said. “That’s one of [InContext’s] challenges.”

Conceiving the Business

To build their early prototype in 2009, InContext founders relied on investment from friends and family, eventually raising over $1 million through three rounds of fundraising.

Scamehorn, a boyhood friend of Gillespie, knew a thing or two about consumer insights, having led virtual research at cereal maker General Mills “If you can do this on the Web, I can sell it,” Wiedmeyer recalls of the conversation after Scamehorn described his need for the technology. “We can [poll] a lot of people as opposed to a handful.”

Development wasn’t without glitches. Wiedmeyer, who relies on a combination of off-the-shelf and proprietary 3-D software to create faux stores, recalled early on prepping for one presentation when the software crashed the demo laptop. The team scrambled for a solution, eventually reducing the size of the images to free up memory.

“We were literally thinking we’d have to chuck it and start over,” he said, noting there were also rumors that competitors were working on prototypes with similar technology. “That just didn’t come to fruition.”

Since then, InContext has grown to 35 employees, most working from an open, loft-style office in downtown Chicago, complete with foosball games and no shortage of antics during the long days.

We’ve got a lot of ego and pride in what we do,” Gillespie said, “but not a lot of ego with each other.”

One of his biggest worries is managing cash flow – preserving enough capital to keep things running, while anticipating when to accelerate hiring ahead of expected contracts. Toward that end, InContext is pushing to bring on more retailers as customers, a group that historically hasn’t relied on research. Gillespie also envisions uses beyond research, such as the creation of hypothetical scenarios that let manufacturers and retailers collaborate.

“What kinds of things are going to lift sales?” he said. “You can be in Arkansas and I can be in Omaha and we can have that discussion.”

He added, “I think we’re going to see exponential growth. I think we’ve just started to scratch the surface of the kinds of things our clients can use this for.”