Liberal groups are gearing up to fight a potential change in the Social Security cost-of-living adjustment, which deficit hawks are pushing to include in the budget and debt-ceiling deal currently being negotiated between the White House and Republican and Democratic congressional leaders. A recent report from the successor organization to the president’s deficit reduction panel says the move, if applied to all beneficiaries, could save the system $300 billion over the next decade.

While the nation’s senior citizen retirement income program has taken a back seat to Medicare in the entitlements debate, virtually every conservative plan and even a liberal one for closing the long-term Social Security funding gap included a call to tinker with the benefit plan’s COLA. The proposal would shift the basis for the annual inflation adjustment for the retirement benefit from the consumer price index (CPI) for urban consumers, the standard measure of inflation reported each month by the Bureau of Labor Statistics, to an alternative measure from BLS, known as the chained CPI. Chained CPI adjusts reported inflation by assuming consumers will substitute less expensive goods when the price of a particular item increases significantly, such as substituting chicken for steak.

“That will come out of the beneficiaries of the future and there’s no justification for it,” said Eric Kingston, co-director of Social Security Works, a labor-backed coalition of 270 national and local organizations representing 50 million people. “To sell this as a technical adjustment to the American people would be a lie. If you [project] out 20 years, you’re looking at a 7.7 percent cut in benefit levels.”

Opposition to changing the COLA isn’t only going to come from the left. Conservatives are likely to see it as a tax increase, since moving to chained CPI would affect a number of preferences in the tax code, leading to about $70 billion a year in increased income taxes.

“Fact-Based Conversation”

The proposal could get aired this Friday at a hearing of the House Ways and Means Social Security subcommittee, which will consider the latest trustees report. The annual update of Social Security finances released last month showed the retirement system will exhaust its trust fund by 2036, a year earlier than previously thought. Unless other measures are taken, benefits that year would have to be cut by about one-fourth, since payroll tax-financed Social Security is self-funded and is not allowed to borrow money.

“This year’s annual report again sounds the alarm that Social Security will be unable to keep its promises to the hard-working Americans who pay into the system,” said Rep. Sam Johnson, R-Tex., who chairs the subcommittee. “Americans want, need and deserve a Social Security program they can count on and a fact-based conversation about how to get there.”

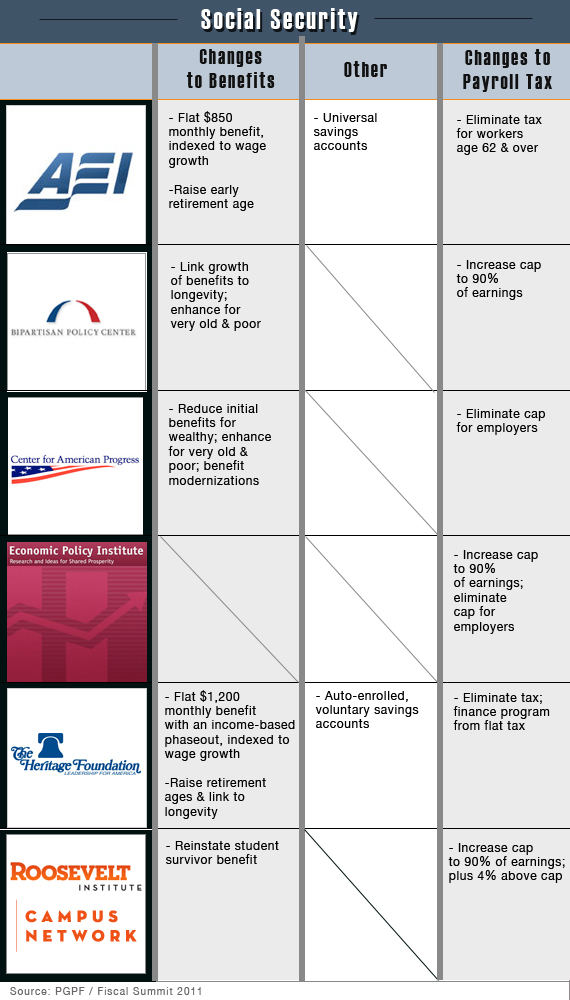

A number of the deficit reduction plans unveiled at last week’s Peter G. Peterson Foundation fiscal summit (the foundation’s funder, Pete Peterson, also provides financial backing for The Fiscal Times) called for changing the way Social Security benefits increase over time to reflect rising prices. Both the Center for American Progress (CAP) and Bipartisan Policy Center plans, left of center and right of center, respectively, called for making the change.

“It’s a gradual change,” said Christian Weller, a senior fellow at CAP and a professor at the University of Massachusetts at Boston. Coupled with other changes in the CAP plan – which increases benefits for lower wage workers, slows the rate of benefit increase for the top third of earners, and gives a special bump for those over 85 who are most likely to have exhausted other savings – “it makes the system more progressive,” he said. The CAP plan also raises additional revenue by levying the payroll tax on more of the wages of higher income workers.

The groups fighting any change in the COLA point to another alternative measure that is used by BLS – the senior citizen goods basket, also known as CPI-E. They claim that in most years, CPI-E, which gives extra weight to items like prescription drugs, rises faster than the regular CPI.

“Actual Substantive Change”

But that isn’t always the case, said BLS economist Malik Crawford. Last year, for instance, CPI-E rose at just 1.4 percent compared to 2.1 percent for regular CPI. It was also slightly lower in 2008, and slightly higher in 2007 and 2009. “The presumption that CPI-E will always be higher is not correct,” he said. “In fact, there shouldn’t be a presumption.”

But he added there’s no doubt that chained CPI would almost always be lower, sometimes significantly so. “That’s an actual substantive change in the market basket,” he said, cautioning that he was not speaking for the agency in rendering that analysis.

Adjusting the COLA – a longshot – is the only Social Security issue likely to be raised on Capitol Hill before next year’s presidential and congressional elections. Conservative plans to overhaul Social Security, which were authored by the American Enterprise Institute and the Heritage Foundation, would institute a flat benefit that’s lower for nearly half of beneficiaries, divert payroll taxes to individual accounts (Heritage would institute a new voluntary payroll tax on top of Social Security), raise the retirement age, and leave tax rates unchanged. Those plans are not much different than what President George W. Bush offered in 2005.

That plan went nowhere when negative public reaction contributed to the Democratic takeover of Congress in 2006. With most polls showing strong public support for leaving Social Security alone and raising taxes on the rich to make up for any shortfalls, most Republicans, already skittish about the public thumping GOP Rep. Paul Ryan’s Medicare plan took in upstate New York, are not likely to grab on to a political third rail twice in one election cycle.

Greater Piece of Income Pie

The other Social Security plans offered last week, both centrist plans and those on the left, rely on raising taxes, with most new revenue coming from raising the level of income subject to the payroll tax. Currently capped at $106,800, the tax today only hits about 83 percent of earned income instead of the 90 percent goal set in 1983. That’s because higher income workers (those earning above the cap) are grabbing a greater share of the national income pie than they did in the 1980s, when the last Social Security reforms – a deal struck between President Ronald Reagan and House Speaker Tip O’Neill – combined raising the retirement age to 67 with higher taxes.

Plans for shoring up Social Security rather than cutting benefits are taking on new urgency in the wake of a recession that has further eroded the three-legged stool that makes up American retirement security. The other two legs – defined benefit and defined contribution pension plans plus personal savings – have been severely eroded by changes in the U.S. economy, exacerbated by the Great Recession.

Defined benefit pension plans, which once covered 45 percent of the American workforce, now cover less than half that number, according to Dallas Salisbury, president of the Employee Benefit Research Institute. Between 1988 and 2008, the number of those participating in pension plans fell by a third, from 28 million to 19 million.

Defined contribution plans such as employer-matched 401(k) or 403(b) plans have grown, but savings are falling far short of what was previously guaranteed by pensions. Though the number of participants doubled to 66 million in the past two decades, the average plan had just $58,351 in 2009, which was $7,000 less than the pre-recession peak. The median plan – half the plans were smaller in size – had just $18,000 in assets. The wide gulf between the average and median level of assets in individuals’ plans suggest savings are heavily tilted toward higher income workers.

“Upwards of 60 percent of retirees will get a majority of their income from Social Security,” Salisbury said. “Average benefits are now in the neighborhood of $14,000 a year – a little more than what a minimum wage worker would earn, but not a lot.

“The U.S. does not have a particularly lucrative or generous public retirement system,” he added. “Across the developed world, there’s only one program that pays lower benefits than U.S. Social Security, and that’s the United Kingdom. This country has been very conservative in the level of commitments that it has made on the retirement income side.”

Related Links:

Solving Social Security with Cheap Money (Fox Business Network)

Defend Medicare, Social Security (Huffington Post)