Just when the battered housing market looked like it couldn’t get any worse, it did.

Home values fell three percent in the first quarter from the previous quarter, the largest decline since late 2008, according to Zillow.com, a Seattle-based real-estate listing website. Nearly 75 percent of all homes in the U.S. lost value during the first quarter. The hardest hit metro areas were Ocala, Fla.; Puebos, Co., Detroit, and Atlanta. Only one market — Honolulu — showed improvement.

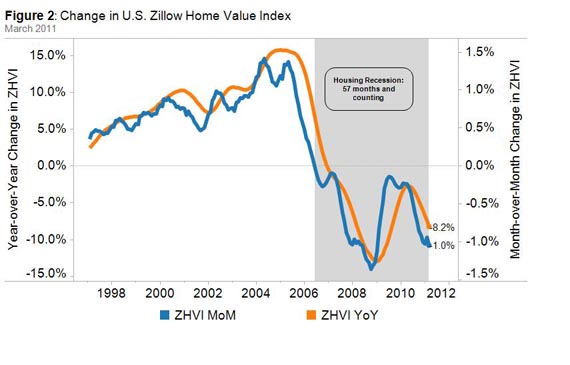

Home prices have fallen for 57 consecutive months, and Zillow is forecasting that pricedeclines will continue for the rest of 2011. Home values are falling by about 1 percent per month so far this year, said Stan Humphries, economist with Zillow. “We now believe a bottom will come in 2012, at the earliest,” he said. He predicts home prices will drop by as much as 9 percent due to stubbornly high unemployment and large quantities of foreclosures.

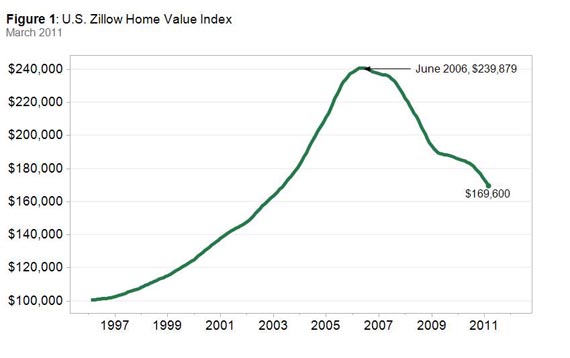

Home values have fallen 8.2 percent from March 2010, Zillow said, and are down nearly 30 percent since the market peek in June 2006.

Anika Khan, economist with Wells Fargo, warns that Zillow’s year-over-year home value estimates may be slightly skewed because first time home buyers who used the tax credit in 2010 artificially increased the housing numbers. Nonetheless, she says, prices are heading downward.

The rapidly falling home prices have forced home owners to owe more on their properties than they are worth. Negative equity or those single-family homes with “underwater mortgages” reached a new high in the first quarter with 28.4 percent, up from 27 percent at the end of 2010.

Even though housing demand remains weak, Zillow expects to see modest improvement for the remainder of 2011 due to improving job market and increasing rates of household formation. However, demand will be offset by excess property supply on the market. There are approximately 2 million homes in the foreclosure process and another 1.5 million homes seriously delinquent.

Other housing experts also expect to see housing values continue to decline this year. Paul Dales, economist with Capital Economics, predicts single-family homes prices will fall by at least 5 percent this year.

Experts say in order for the housing market recovery to get a jumpstart, job creation needs to accelerate to encourage more home buying activity. Weak demand reflects consumer uncertainty about high unemployment, which currently stands at 9 percent.

Related Links:

‘Underwater’ Homeowners Rise to 28 Percent (Bloomberg)

Home Market Takes a Tumble (Wall Street Journal)

Housing Market Double Dip Surprises Economists (Wall Street Pit)