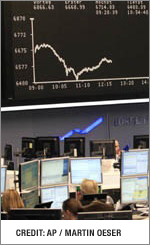

The economic effects of the ongoing disaster in Japan are just beginning to ripple globally, as the country’s nuclear crisis deepens after last week’s devastating earthquake and tsunami. Concerns about the stability of the world’s third largest economy led to a global market sell-off early in the week, though Tokyo stocks rebounded on Wednesday. Experts say prolonged power outages and the destruction of transportation routes are likely to interrupt worldwide supplies of cars, consumer electronics and manufactured goods such as steel.

Already saddled with massive public debt, Japan faces a reconstruction bill of at least $180 billion, or 3 percent of its annual economic output, according to Reuters. How the country chooses to pay for its reconstruction could have long-term consequences for U.S. treasuries.

To assess the continuing fiscal and economic impact of the crisis, The Fiscal Times reached out to top economists, academics, investors and other experts, who shared a wide range of views:

ANOTHER BLOW TO A WEAKENED JAPAN

‘Devastating Event to Key Ally’

The top U.S. priority in Japan has got to be humanitarian aid at the moment. This is a devastating event to a key ally. Anything we can offer them in securities and nuclear facilities is important, and after that, by and large I think Japan has the capacity to rebuild. They’re the third largest economy in the world which has for a long time done unproductive public works. It can now do some productive ones.

With the markets, what we’re seeing right now is classic fear-selling. Then people will evaluate known losses — like if you are holding a lot of nuclear power stocks, you probably realize the foreseeable future will not be the same. And as we seek the extent of the radiation spread, then that fear either dissipates or doesn’t. If it turns out that we don’t have a big radiation event, and power is restored, and Japan rebuilds, then implications to the U.S. are pretty de minimus. However, if there is a major radiation event, that would be very bad for Tokyo and would mean big financial market shocks, which would then harm the U.S. recovery.

— George Magnus, senior economic advisor, UBS Investment Bank in London

‘Could Seal Japan’s Decline’

This may be the signal moment that seals the decline of the Japanese economy. The country already has an enormous debt burden and has shown that it cannot keep up with the growth of the United States, let alone China. The recovery from the earthquake will suck up trillions of yen in public and private resources, with little scope to 'build back better' and improve the competitiveness of the country's industries. So far, Japan has avoided a fiscal crisis because of its people's saving. Now a chunk of that saving will need to be spent, and foreign investors won't rush to pick up the slack in Japanese credit markets. If interest rates rise as a result, Japanese growth will face yet another obstacle, perhaps an insurmountable one.

— Daniel Altman, economist, Dalberg Global Development Advisers; author, Outrageous Fortunes: The Twelve Surprising Trends that Will Reshape the Global Economy

‘Sharp Drop in Retail Sales in Japan’

Over the next few months there will be a sharp decline in retail sales, industrial production and exports from the region. We can expect retail sales to drop by about 75 percent over the next few months in the four most affected prefectures in Japan, which make up about 6.2 percent of Japan's total GDP. This economic shock should be sufficiently large to push Japan's total GDP growth down close to zero in the second quarter of this year, before large injections of monetary and fiscal stimulus help to restart the building process in the third quarter of this year. For the year as a whole we expect Japan's GDP to increase 1.0 percent from the 2010 average, before rebounding toward 2.0 percent in 2012. This forecast assumes a continued injection of monetary stimulus from the Bank of Japan and a significant government rebuilding package worth about 3 to 5 trillion yen.

There are likely to be temporary supply disruptions as manufacturers try and source new suppliers and work around the damaged infrastructure, including roads, bridges, ports, railways and electrical grid. This outlook could be reduced further if we get a full meltdown of the nuclear plant that spreads radiation toward the Tokyo metro area. Supply disruptions could impact trade flows with South Korea, Taiwan, China, the United States and Europe. A financial contagion is also a growing concern should global stock markets continue to plunge, impacting consumer spending and threatening the vitality of the global economic recovery.

Treasury yield will be held down by the flight to safety trade and the U.S. dollar could rally temporarily. The impact on inflation should be neutral as reduced demand offsets any price increases due to shortages of supply. For now the impacts on the global economic recovery appear to be limited.

-Scott Anderson, senior economist, Wells Fargo Securities, LLC

ROILING WORLD MARKETS

‘Negative Ramifications for Commodities’

Our highly interconnected global economy means that the natural disaster in Japan has the potential to snowball into economic and financial issues in other countries. Might the slowdown in global trade (even if only temporary) caused by the earthquake expose the overcapacity that has been building in China and the greater Chinese industrial complex? Such an event would have massive negative ramifications for commodities and the emerging markets in general.

—Vikram Mansharamani, global equity investor; author, Boombustology: Spotting Financial Bubbles Before

They Burst

‘Interest Rates May Rise’

The Japanese auto industry and its related electronics suppliers provide components to every major automaker in North America from production bases in Japan. This may result in production shortfalls for all automakers in North American, not just the Japanese owned facilities. The effect on oil prices and exchange rates as a result of the Japanese tsunami that are major macro-determinants of auto prices and consumer demand in the U.S. market are harder to gauge. Oil and fuel prices may rise as existing supplies are rushed to Japan to make up for shortfalls, but energy demand may fall if economic growth decreases in many regions due to the disasters in Japan. Changes in the value of the yen may also be subject to great uncertainties as Japanese capital returns to Japan. Interest rates, especially in the U.S., may rise as well because of the disaster and the need for reconstruction funding by the Japanese government. Higher interest rates will also affect auto sales in the U.S. market.

—Sean P. McAlinden, chief economist, Center for Automotive Research

‘Stocks Will Fall and Then Level Off’

In the short run, it could reduce demand for oil and certain other commodities. This would be deflationary, which could prompt the Fed to continue with its easy monetary policy. As for stocks, I have been of the mind that the recent rally was not justified and that a selloff was likely. While the crisis in Japan has created some buying opportunities, I expect stocks to fall further before leveling off.

- Vahan Janjigian, chief investment officer, Greenwich Wealth Management LLC; contributor, The Fiscal Times

EFFECT ON U.S.: NOT AS BAD AS YOU THINK

‘More Sales of American Cars’

We’re not changing our U.S. forecast, which was 3.5 percent real GDP growth for 2011 and 4.1 percent for 2012, because we expect the impact to be small. In the near term, the U.S. may receive a slight benefit from some production moving from Japan to the U.S. For example, the Japanese automakers have temporarily stopped production, which will mean more sales of U.S.-made cars, either U.S.-produced Japanese models or U.S. brands. Also, there may be stronger exports of U.S.-made materials used for reconstruction, such as building materials, steel and heavy equipment. The disaster has made the dollar stronger, however, which may weigh on exports a bit. Also, U.S. interest rates have fallen as a result of flight to quality; this may provide a little boost to growth.

The biggest long-run impact would come if (and it’s a big if) there is a shift away from nuclear power toward fossil fuels, which would raise long-run energy costs, weighing on growth. However, it’s too early to say if this will actually happen.

—Gus Faucher, director of macroeconomics, Moody’s Analytic

‘Global Impact Will Be Small’

I started off more optimistic about the situation than I am now. If you look at Japan’s quarterly GDP figures, after the Kobe earthquake in 1995, you don’t see much of an effect. In January, GDP was down 2 percent, it already was back near the pre-quake level. By the third month, growth was back on track.

The one thing that makes this different is the problem with electricity output, which is affecting Tokyo and other regions. Those areas suffered little damage from the actual quakes, but generating capacity was badly hurt, and not just the nuclear plants. So it’s cutting into the electrical supply. Tokyo Electric is saying it’s going to take until the end of April to fully restore power. In the Tokyo area, major companies are closing down until Wednesday, the end of the week. This is the thing that gives me concern — electricity powers railroad, delivers oil and brings people to work. This is a real issue.

Overall, the global impact will be small. There will be companies and products that will be hurt. Japan is the third largest manufacturer in the world, behind the U.S. and China. That will be affected, until production managers find substitutes. But almost everything has a substitute; it just takes time to find them. In a month or two, it will already take place. Japan will rebuild. That takes time and effort. But it will not grossly affect the U.S. economy.”

—Arthur Alexander, adjunct professor, Asian Studies, Georgetown University; expert on Japanese economy

‘Won’t Derail U.S. Economic Expansion’

With almost 10,000 megawatts of power generation currently offline and many roads and seaports severely damaged, concerns have spread about supply disruptions given that manufacturers like Sony Corp., Japan’s biggest exporter of consumer electronics, Nissan, Toyota and Honda have all temporarily halted production at some damaged facilities. Fears that the shutdowns could lead to inflationary pressures are overblown, as demand destruction from the world’s third largest economy is likely to be disinflationary.

In terms of scale, think of Japan’s economy as roughly the same size as China’s. Together a strong China and a weak Japan are roughly equivalent in GDP terms to a moderately strong U.S. economy. Thus, we do not expect that the near term weakness in Japan will be enough to derail the ongoing global and U.S. economic expansion.

-Stuart Hoffman, chief economist, The PNC Financial Services Group

‘Some Relief from Higher Gas Prices’

Japan is the second largest foreign holder of U.S. debt. It likely will need to liquidate some of its investments to finance rebuilding. That will have some negative impacts on expected growth in the U.S. Normal people, people who aren’t economists, don’t think this way, but it also may give us some relief from the recent run up in gasoline prices. Because Japan is likely to have a reduction for demand in petroleum products, the price of oil may come down. So we may see some temporary relief of gas prices. The domestic auto producers will certainly benefit from shut down of manufacturing facilities in Japan.

On net, the immediate impact is a reduction in total output, total demand for goods and services globally. We will see a little impact in the U.S.

-Patrick O’Keefe, director of Economic Research at J.H. Cohn; former deputy assistant secretary in the U.S. Department of Labor

BAD NEWS FOR NUKES, THOUGH

‘Dampening Effect on U.S. Nuclear Power’

This is a first-order catastrophe for Japan, but I’m not sure it’s a first-order catastrophe for the world. Japan is a very large economy but its impact on the world economy seems to be disproportionately low in relation to its size.

This is certainly going to have a substantial dampening effect on the resumption of nuclear power construction in the U.S. A lot of people are going to be more shy about investing in nuclear plants in light of what’s happened. It may not be rational, but it will probably have an appreciable effect for some time.

—Peter Kenen, Princeton University economist; expert on international finance

‘Consider Changing Your Mind’

Nuclear experts are rightly focused on the immediate challenges at the Fukushima power plants in Japan. Once the immediate crisis subsides, though, there will undoubtedly be a debate over the future of nuclear power. So far, most people are simply hammering their usual talking points, explaining that nuclear is perfectly safe in the United States, or that it must go. That does the public a disservice: When the facts change, people should at least consider changing their minds.

—Mike Levi, senior fellow for energy and environment, Council on Foreign Relations

-Michelle Hirsch, Georgette Jasen, John Greenwald and Sarah Stodola contributed reporting to this article

Related Links:

Japan Disaster Threatens Economic Recovery, Affects Economies Globally (The Huffington Post)

Economists React: If Worst Happens in Japan, All Bets Are Off. (Real Time Economics)