A bipartisan group of Senators has resurrected the idea of creating a government owned and independently run infrastructure bank amid growing concerns about the country’s crumbling infrastructure.

Sen. John Kerry, D-Ma., sponsor of the proposal, said it would help “bridge the infrastructure deficit that has been plaguing our nation for decades.” He said legislation will be introduced to create a way to invest in infrastructure projects and woo private investors to help finance them. But their proposal, like previous ones, is likely to be an uphill political battle given the ongoing battle over the federal budget.

Sen. Kay Bailey Hutchison, R-Tx., co-sponsor, and Sen. Mark Warner, R-Va., joined Kerry at a press conference on Capitol Hill Tuesday afternoon along with one of Washington’s oddest couples, Richard Trumka, President of the AFL-CIO and Thomas Donahue, President of the U.S. Chamber of Commerce appeared with the lawmakers to endorse the plan. They made their first appearance together a month ago when they urged Congress to invest in infrastructure in order to rebuild a strong economy and create jobs. The business and labor leaders joked about joining forces on this effort.

“We’re finding a number of places where we have common interest,” Donahue said. “We testified the other day before Senator Boxer and we both got out alive. We will take our show on the road as the new odd couple and see how that works.”

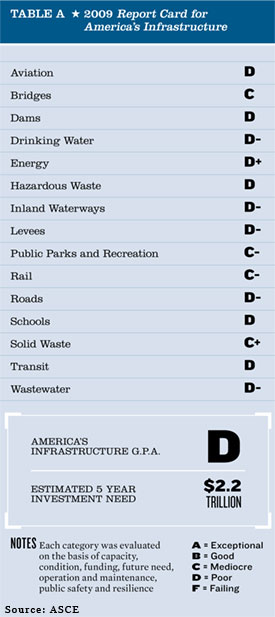

In 2009, the American Society of Civil Engineers graded the country’s infrastructure with a “D” and said a five-year investment plan of $2.2 trillion was needed to fix crumbling infrastructure. The nation’s transportation infrastructure system has an annual output of $120 billion in construction work and contributes $244 billion in total economic activity to the nation’s gross domestic product, according to the ASCE.

The government would provide $10 billion in start-up funds to the bank, which would eventually be supported by private investments. The goal is to eventually be self-sustaining. The bank would provide loans and loan guarantees for projects thatcost$100 million or more and that met certain criteria including the ability to generate revenue. The bank will primarily invest in areas of transportation, water and energy infrastructure. Kerry said the bank could leverage as much as $640 billion in the first 10 years of its existence, if matched by other funding sources.

Investment banker and former governor of the New York Stock Exchange, Felix Rohatyn, has been a long-time champion of such an idea, but he says $10 billion is not enough to start the bank. “I think additional capital from foreign and private investors would want to join up with this,” he told The Fiscal Times. He said somewhere in the range of $50 to $60 billion would be a better starting point.

Initially the Treasury Inspector General would have oversight of the American Infrastructure Financing Authority (AIFA) and after five years an AIFA Inspector General would oversee all of the operations. It would be run by professionals with banking and finance expertise.

Bernard Schwartz, another long time supporter of the idea, believes the infrastructure push could be a solution to the nation's unemployment problem, which stands at 8.9 percent. “For every billion dollars of transportation infrastructure that's invested, it's estimated that about 46,000 people are put back to work,” he told American Public Media.

Some critics fear the bank would become another government-sponsored enterprise (GSE) like Fannie Mae and Freddie Mac. Kerry defended the proposal and said there is no similarity between the two. He said unlike the ailing mortgage giants, the bank would not be for profit, would be independently operated and not issue stock.

The White House says improving roads, pipelines and even broadband networks is a priority in order to compete in a global economy and spur job growth —what President Obama calls a “Sputnik moment” to “win the future.” In February, the president proposed a six-year, $53 billion investment in a national high-speed rail network.

The idea for a national infrastructure bank is hardly new. Former Senate Banking Committee Chairman Chris Dodd, D-Conn., and Sen. Chuck Schumer, D-NY., proposed legislation in 2007 that gained little traction.

Kerry announced plans to propose the infrastructure bank last fall. Rohatyn says that while he applauds Senators Kerry and Hutchison for taking a strong role on the issue, he believes their proposal will likely face some of the same obstacles as the last proposal—mainly how it would be funded and who would run it. “The obstacles could possibly be worse because now you have the Tea Party being very aggressive in terms of investment and expenditure,” he said.

Hutchison and Kerry said they were extremely sensitive to today’s budgetary restraints when crafting the proposal. “We know we have a fiscal crisis and we’ve got to be creative to meet the needs of our country to have economic development to create jobs but in a way that doesn’t diminish our taxpayer funds,” Hutchison said.

Kerry hopes to see the proposal included with the president’s 2012 budget and potentially up and running by next year. He emphasized the need for urgency to act on the plan in the age of global competition. “If we don't act, we won't just stand still, and we won't just fall temporarily behind, we'll stay behind,” he said.

Trumka said the country spends less than 40 percent of what is required to meet infrastructure needs. "That's simply unacceptable and simply unsustainable," he said.

Related Links:

New Move to Woo Private Capital for Public Works (American Public Media)

Private Investment Key to U.S. Infrastructure Plan (Reuters)

Senators Back New Bank to Finance Infrastructure (Boston Globe)